Officials of East Coast states with ambitious offshore wind goals said Thursday they are trying to balance the urgency of getting turbines in the water with potential economies of networked transmission.

“States have initiated what I would say is a process of execution and planning simultaneously,” said Doreen Harris, acting CEO of the New York State Energy Research and Development Authority (NYSERDA) during a virtual panel discussion at the Business Network for Offshore Wind’s 2020 International Partnering Forum. “None of us are in a position to necessarily wait for the exact planning exercises to be concluded and installed before we move forward with our strong commitments to offshore wind.”

“We’re anxious to see that first turbine in the water … but you always have to think about the ratepayer,” said Joseph Fiordaliso, president of the New Jersey Board of Public Utilities. “Shared transmission can be very helpful and economical in comparison [to transmission for individual developers] for all those states on the coast. We have said to our neighbors more than once we think that there could be a very good collaborative effort as far as transmission is concerned.”

Speaking at the Business Network for Offshore Wind’s virtual International Partnering Forum were, clockwise from top left: Rob Gramlich, Grid Strategies; Ken Seiler, PJM; Joseph Fiordaliso, president of the New Jersey BPU; Stephen Pike, CEO of the Massachusetts Clean Energy Center; and Doreen Harris, acting CEO of NYSERDA. | Business Network for Offshore Wind

New Jersey Goals

New Jersey, which has a goal of 7,500 MW of OSW by 2035, has awarded an 1,100-MW solicitation and will award up to 2,400 MW more early next year.

“Everyone who comes into [my] office has a different idea about transmission: Should the developer do it along with setting up the wind turbines? Should you have … independent transmission?” Fiordaliso said.

The BPU hired consultant Levitan & Associates to help it evaluate its alternatives, he said. The board’s studies indicate that “anything beyond 3,500 MW may … need a shared network of transmission. … Solicitations 1 and 2 can successfully be handled with bundled generation and transmission. Once we get to procurements 3 to 6, we are pursuing really a shared-network approach.”

Although the current solicitation calls for bundled generation and transmission, it also required applicants to include plans for using a shared network and to allowing others to use the applicants’ facilities, he said.

New England Looks for ‘Break Point’

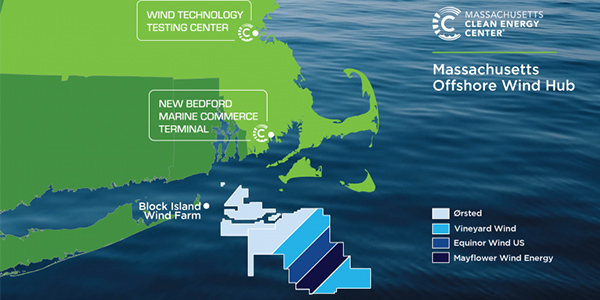

The New England States Committee on Electricity (NESCOE) asked ISO-NE to identify the “break point” between existing or near-term transmission opportunities and long-term needs, said Stephen Pike, CEO of the Massachusetts Clean Energy Center. “They found there is roughly 8 GW of interconnection capacity in Southern New England that can be used before you need significant onshore upgrades; it was broken out to roughly 6 GW on AC and then 2-plus GW on HVDC technology.”

Those thresholds are coming fast, Pike said. “You could see that capacity essentially accounted for in the relatively near term, and … should we want to go to some sort of independent/shared transmission system, we need to start planning now for that. I don’t think we have a whole heck of a lot of time to waste. … I do think that we need to start that process in earnest in the very near term in order to be prepared for some of these … market triggers. I see 8 GW or even 6 GW being a really critical trigger.”

New York Seeks to ‘Accelerate’

NYSERDA issued a solicitation in July for up to 2,500 MW of OSW to meet New York Gov. Andrew Cuomo’s goal of 9 GW by 2035. (See NY Announces 4 GW in Clean Energy RFPs.)

Harris said the state is planning for the future grid and executing its radial transmission procurements simultaneously “to maintain New York’s market momentum and to utilize the existing federal lease areas that are available.”

“Acceleration … is our mantra,” she said, citing the state’s streamlined siting process for transmission and generation. “We are looking to install transmission much more quickly than had been the case historically.” (See Cuomo Proposes Streamlining NY’s Renewable Siting.)

New York currently has three 345-kV transmission projects in the siting process that are intended to eliminate choke points preventing upstate renewables from serving downstate loads. The Long Island Power Authority is looking to increase the island’s export capability to deliver OSW to the rest of the state by expanding its 138-kV backbone, Harris said. (See NY PSC Gets Update on Tx Planning, Investment Efforts.)

The strategy for offshore transmission “is very contingent on the availability and conversion of additional wind energy areas for offshore wind development, which really needs to be resolved in advance for us to conclude our grid study on the wet side of the equation [offshore transmission] to get on with detailed planning and execution,” she said.

A study released in August by Wood Mackenzie for the American Wind Energy Association and the New York Offshore Wind Alliance said more leases in the New York Bight would create 30,000 construction jobs and deliver as much as $800 million in lease revenue for the federal government.

“For us, it’s a no-brainer from an economic development perspective,” she said.

She talked of the need to “balance” the economics, “which is to say that the most optimized wet offshore grid … may not ultimately result in the most optimized, cost-effective onshore grid. So, the balance of issues, particularly in spatially congested areas like New York, [is] critically important.”

Similarly, while running fewer cables would appear to be the most efficient and environmentally friendly approach, that would not be the case if those routes “run afoul of key maritime corridors or commercial fishing grounds or environmentally sensitive areas,” she said. “So, the question of financial efficiency needs to be balanced with the broad impacts as a whole.”

“We do sit in the middle. Although a single-state ISO, we are proximal to New England and PJM in a way that inevitably will bring these issues to bear. I would say it’s not the focus of our current power grid study, which is focused on the integration within New York. But these interties and cost allocation issues that President Fiordaliso mentioned are certainly paramount when we start to broaden our scope.”

Why not More Proactive?

Moderator Rob Gramlich of Grid Strategies asked why PJM had not taken a proactive view on planning, citing transmission built to serve wind generators in California’s Tehachapi Pass, Texas’ Competitive Renewable Energy Zones and MISO’s Multi-Value Projects. PJM has five coastal states that could develop OSW: New Jersey, Delaware, Maryland, Virginia and North Carolina. (See related story, Md. PSC Approves Larger OSW Turbines.)

“We don’t count on those megawatts being there until we have public policy,” responded Ken Seiler, PJM’s vice president of planning. He added, “If all the … five coastal states execute on some of the renewable portfolio standards they have in place right now, there will be [transmission] upgrades in other states that are not coastal.”

Seiler said OSW is just the latest development in PJM’s transformation. The RTO, which has interconnected 10 GW of wind so far, currently has 120 GW of proposed generation and storage in its interconnection queue, including more than 56 GW of solar, 13 GW of solar with storage, almost 13 GW of onshore wind and another 13.5 GW of OSW.

“We have traditionally [had] a West-East flow, with [coal] mine mouth units in the West feeding large load centers in the East,” and generation dominated by coal and nuclear, Seiler said. “Then we moved into the gas era with the Marcellus and Utica shale … which [resulted in the growth of gas-fired generators built] closer to the load centers. And now we’re talking about solar and offshore wind.”

Seiler said PJM planners are having ongoing discussions with their counterparts in Germany to learn about what Europe has done to accommodate its OSW.

One challenge will be determining who pays for the additional transmission, he said. “Cost allocation, obviously, is in the eye of the beholder. What may be fair to you may not be fair to me. … Either the cost causer pays, or the beneficiary pays. There’s two ways to do it, and there’s other ways [we could] come up with.

“We ideally would like to see federal policy around some of this that would help enable states and us to accomplish these goals. That doesn’t seem to be in the cards, at least in the near term. We’re going to have to collaborate, coordinate [and] communicate. This is all new to many of us. But it’s an exciting time, and I think we have the right people at the table to figure this all out.” (FERC has scheduled a technical conference for Oct. 27 on integrating OSW in RTOs and ISOs.)

Pike said meeting the states’ goals will require “multilevel coordination,” beginning with “engagement at the local level,” where the offshore transmission meets the land-based grid.

“You’re going to need that local layer; you’re going to need the state level, as well as states talking across regions; and you’re going to need it at the ISO level, working across ISOs,” he said. “I won’t try to convince folks that I know exactly what the process is moving forward, but I do feel as though we’ve taken a couple of good first steps.”