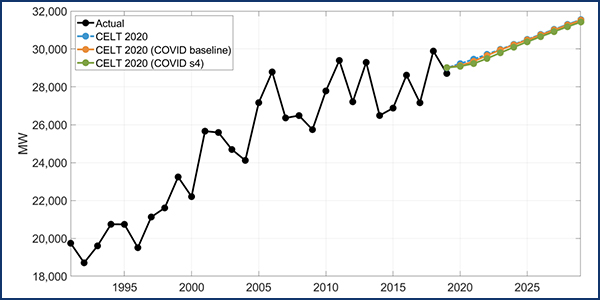

ISO-NE‘s preliminary analysis suggests that summer demand from June 1 to July 11 was consistent with the 2020 Capacity, Energy, Loads and Transmission (CELT) forecast despite the economic impact of the COVID-19 pandemic on New England.

The RTO ran this year’s CELT models with numbers from Moody’s Investors Service’s June economic forecast in order to estimate how much the pandemic-related economic disruption might affect preparation for the upcoming 2021 CELT forecast, Load Forecasting Manager Jon Black told the New England Power Pool’s Power Supply Planning Committee on Tuesday.

“The main takeaway here, based on the first 41 days of the summer: I don’t see any real, systematic issues with the CELT 2020 peak forecast models, even at 183 MW of mean error for the highest peak demand days,” Black said.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

The error represents less than 1% of the 2020 CELT 50/50 gross peak load forecast and does not indicate the forecast deviating from actuals in a systematic way, he said.

“We’ve seen a strong rebound in summer demand,” Black said. “Early on in the April-May time frame, when weather was mild, we did see relatively significant reductions in demand and energy, but from a summer peak perspective, we’re not seeing that throughout the first 41 days of summer.”

The results also align with those of ISO-NE’s recent weekly analyses of COVID-19 demand impacts, performed by the System Operations Department, Black said.

The RTO used the October 2019 (i.e., pre-COVID) Moody’s macroeconomic forecast in the development of CELT 2020 and expects to use the Moody’s October 2020 macroeconomic outlook to develop CELT 2021.

Graphing the Data

ISO-NE’s June baseline scenario assumed a 50% probability of worsening U.S. economic performance, no second wave of infections that would cause states to shut down again and nationwide confirmed cases of 2.4 million — with new infections peaking in April, a 6% confirmed case fatality rate and 10% hospitalization rate.

The downside scenario assumed a much higher-than-expected incidence of new infections and deaths in the latter part of 2020 causing businesses to reopen much more slowly than anticipated, with consumer spending not rebounding, especially in air travel, retail and hotel stays. It also assumed 4.1 million confirmed cases, new COVID-19 infections peaking in May, with 12% confirmed case fatality rate and 17.5% hospitalization rate.

Compared to the CELT 2020, the new expected (i.e., baseline) macroeconomic outlook results in a summer demand forecast that is approximately 113 MW lower in 2021 and 26 MW lower in 2025. However, consideration of a lower probability, greater downside economic risk scenario suggests greater summer demand impacts in 2021 (-232 MW) and 2025 (-127 MW).

When compared to the October 2019 macroeconomic forecast used in the CELT 2020, the June 2020 forecast for regional gross state product (RGSP) is approximately 7% lower in the near term (2021) and recovers to 1.4% lower in 2024.

Black also noted the connection between how these assumptions are modeled and what the economic fallout of that is, saying it’s not just the COVID-19 stats that are important.

“We’ll be getting the October vintage of this forecast for CELT 2021, just like we always do, so it will be interesting to see how different that outlook is three months from now,” Black said.

The deltas of both the baseline scenario and the greater downside potential scenario are within the realm of confidence bands for a long-term load forecaster, he said.

“The load forecast is the result of what we’ve been seeing year over year as time has marched on: that economics are driving demand lower, especially summer demand, from one CELT forecast vintage to the next,” Black said. “We have a much smaller margin of downside potential here, even with changes in the macroeconomic expectations.”