PJM‘s Independent Market Monitor released a report Wednesday concluding that New Jersey ratepayers would likely see costs increase if the state left the RTO’s capacity market and instituted a fixed resource requirement (FRR).

The New Jersey Board of Public Utilities opened a docket March 27 to investigate whether remaining in PJM’s capacity market under the expanded minimum offer price rule (MOPR) will impede Gov. Phil Murphy’s goals of 100% clean energy sources in the state by 2050 (Docket No. EO20030203). Comments are due May 20.

The BPU acted in response to FERC’s Dec. 19 order that expanded the MOPR to new and existing state-subsidized resources. The order granted exceptions for some existing resources: demand response, energy efficiency, self-supply and resources receiving payments under renewable portfolio standards.

The order could prevent New Jersey nuclear plants receiving zero-emission credits (ZECs) and future offshore wind generators from clearing the capacity market, leaving ratepayers paying twice for some capacity. Unless the order is overturned on appeal, New Jersey’s only alternative to the PJM capacity market is to provide its own capacity under the FRR.

Monitoring Analytics’ report concluded that a statewide FRR would increase costs by almost 30% if prices were at the PJM offer cap of $235.42/MW-day but only 2.4% if prices equaled the $186.16/MW-day weighted average price for the state in the 2021/22 Base Residual Auction held in 2018, the most recent auction.

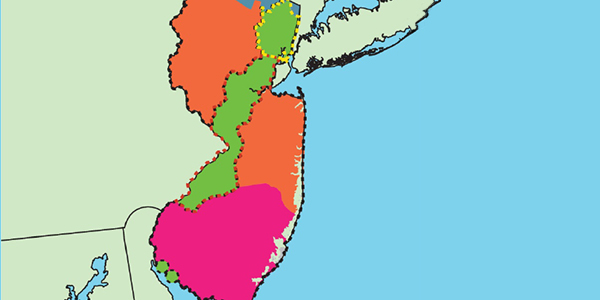

Using similar assumptions, the Monitor found that ratepayers in an FRR for the PSEG locational deliverability area (LDA) would pay 6.4 to 27% more. Those in an FRR for the JCPL zone could save 2.1% or see prices rise by 28%. (The Monitor did not provide separate analyses for the AECO or RECO areas, which represent only 15% of the state’s load.)

“Based on the analysis, the creation of a New Jersey FRR, a PSEG FRR or a JCPL FRR is likely to increase payments for capacity by customers in New Jersey,” the Monitor said.

The IMM’s analysis was requested by Stefanie Brand, director of the N.J. Division of Rate Counsel.

The BPU said Wednesday “it is premature to comment on the IMM’s report or anticipate what the results of the investigation may be.

“Staff has an obligation to review the comments filed in the docket and take any necessary action to continue the investigation (through further requests for comment, technical conferences, or hearings) before making recommendations for the board’s consideration,” the BPU said.

The Monitor said an FRR creates market power for the few local generation owners from whom generation must be purchased to meet reliability requirements. New Jersey has 15,005 MW of unforced capacity within its borders, 4,711 MW less than the 19,716 MW needed to meet its FRR reliability requirement.

“All participants in the New Jersey, JCPL and PSEG FRRs fail the one- and three-pivotal-supplier test, which reinforces the conclusion that there is structural market power in each case,” it said.

Because of the impact of market power, “even the higher estimates of the cost impact to the customers of New Jersey from the creation of an FRR are likely to be conservatively low,” the Monitor said. “If New Jersey were to subsidize any generating units, the subsidy costs would be in addition to the direct FRR costs.”

“Our basic overall point is that FRRs are not a panacea,” Monitoring Analytics President Joe Bowring said Wednesday during an RTO Insider webinar on the MOPR.

“FRR is a term that is really not very well defined, and the exact ratemaking process will be the result of negotiation. … There are, at the moment, no rules governing it; every state will do it their own way. But there is simply no reason to believe that this nonmarket approach … will provide the least-cost option for customers or provide incentives for renewables or for any form of energy you favor.”

The Monitor’s findings were similar to those of its previous analysis on the impact of Exelon’s Commonwealth Edison in Northern Illinois leaving the capacity market for an FRR and one on Maryland’s options.

Others have disputed those findings. Rob Gramlich, president of Grid Strategies, said FRRs won’t necessarily raise costs because they can use a lower reserve margin than PJM. (See PJM Monitor Defends FRR Analyses in MOPR Debate.)

Exelon is pushing legislation in the Illinois General Assembly to switch to the FRR. (See PSEG Turns Bullish on NJ FRR Option.)

Both Exelon and PSEG are trying to protect their nuclear units receiving state ZEC subsidies.