The economic fallout from the COVID-19 pandemic will weigh most heavily on utilities most dependent on commercial and industrial load, two power industry researchers told the Northeast Energy and Commerce Association (NECA) on Thursday.

About 60 participants tuned into NECA’s “Pandemic, Power Demand and Profits” webinar to learn how the stay-at-home orders and the contraction in U.S. second-quarter GDP are impacting the utility industry.

The U.S. has only 4% of global population but accounts for a third of the world’s COVID-19 cases. The webinar examined where a recession will hit hardest in the U.S. electricity industry — and who could ride through the storm relatively unscathed.

The panel also looked at how the pandemic will affect the level and shape of load in future, and whether commercial load will become lower and flatter than before the shutdown.

Load Composition Determines/ Downturn Fate

Panelists Hugh Wynne and Eric Selmon, both longtime international power project developers, together founded Power Research Group and head up utilities and renewable energy research at investment consultancy SSR.

The pandemic shutdown finds Selmon holed up with his wife and children in Tel Aviv, Israel, while Wynne is doing the same on the coast of Maine.

Wynne said the pair’s research indicates the recession will impact power sales most severely in those regions — and among those utilities — with the highest share of C&I load.

“Over the last couple of decades, changes in GDP can explain about 40% of the annual variation in commercial and industrial electricity revenues,” Wynne said. “In the residential sector, there is not a very strong correlation between GDP and revenues from residential demand, and that has important consequences.

“Conversely, regions that have high levels of residential demand will be cushioned from that impact. And importantly, because this recession was triggered by and coincides with the state lockdowns, a second development will alleviate the financial burden on these utilities, and that is the increase in residential demand during the lockdowns,” he said.

Residential demand is up about 10 to 15% nationally over the past month, which will have a material mitigating effect on the downturn in C&I revenues from the utilities’ perspective — it won’t offset it completely, but it will reduce the reduction in revenues, Wynne said.

At the retail level, rates for electricity vary dramatically by customer segment.

“Residential rates are by far the highest, commercial rates perhaps two-thirds on average nationally, in terms of the residential rate, and industrial revenues per megawatt-hour are perhaps a half of the residential rate,” Wynne said.

As a consequence, the downturn in C&I demand will have a less-than-proportional impact on utility revenues while the increase in residential demand as the lockdowns persist will have a greater-than-proportional impact, he said.

New York vs. New England

In terms of individual utilities and regions, Selmon and Wynne concentrated on the Northeast and found some utilities better positioned because of their high levels of residential demand.

National Grid and Emera, for example, have very high levels of residential demand in their electricity sales profiles at 70% and 52%, respectively. The pair categorized Avangrid and Eversource Energy as moderately well situated to absorb the impacts from the downturn, at 45% and 40%, respectively, and others such as Consolidated Edison, at 32% residential demand, not well positioned.

“In Con Ed’s case, almost two-thirds of demand comes from the commercial segment, and that renders them particularly vulnerable to the economic contraction,” Wynne said.

He pointed to peak load having fallen markedly in NYISO Management Committee Briefs: April 29, 2020.)

Selmon noted that “the country experienced a fairly mild winter, but particularly in the Northeast and parts of the Midwest, it was significantly colder than average in March and April, so when you weather-adjust, you would see a greater impact: a greater decline in peak loads from before the lockdown.”

In contrast to New York City and its concentration of commercial demand, New England as a whole is much more heavily weighted to residential demand, Selmon said.

“New England is different from other parts of the country in being more gas generation, so here there’s less of a stack to shift around,” Selmon said. “When demand declines you will see more of an impact on heat rates. In other parts of the country the heat rates have held up fairly well … in Texas demand is actually up.” The Midwest was already seeing a decline in industrial demand before the lockdown because an industrial recession appeared to be starting, but now the region is seeing declines in commercial load as well, he said.

Gross Margins and the Long View

Industrial demand is about a quarter of total demand nationally, yet the contribution of the industrial segment to utility gross margins nationally is only about an eighth of the total.

On the other hand, residential demand is about a third of total demand nationally, but the contribution of those residential customers to utilities’ gross margins is slightly over half.

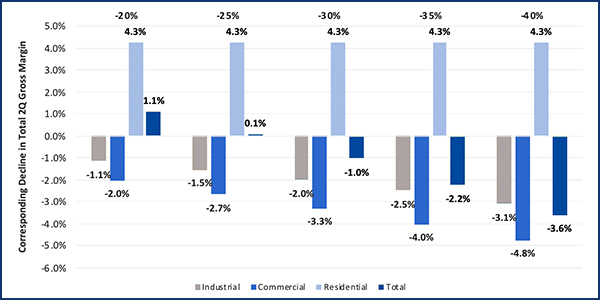

“What we’ve done here is to translate our estimate of the decline in C&I revenue, and our estimate of the increase in residential revenue, to show their impact on the total gross margin of utilities in the second quarter,” Wynne said.

In Wynne and Selmon’s central case of a 30% decline in second-quarter GDP, the decrease in industrial revenues will probably erode the total gross margin of the utilities by about 2%. Combining the industrial profile with a 3.3% decline in commercial revenues and an offsetting 4.3% increase in residential revenues would result in a 1% decline in utility gross margins during such a quarter.

Over the second half of the year, “we’re concerned that the experience of Asia may portend a recurrence of COVID-19 in the future,” Wynne said. “In Asia there’s a group of island nations — Singapore, Hong Kong and Taiwan — that noted considerable initial success in combatting the spread of COVID. But in each of those countries, there have been renewed outbreaks of the disease and authorities have been forced to reintroduce social distancing measures, and in some cases, particularly Singapore, those new measures are stricter than the ones initially imposed.

“With such a recurrence likely in the U.S., particularly in the fall flu season, we foresee a re-imposition of social distancing by state health authorities, and possibly, in extreme cases, a re-imposition of lockdown.”

Such an eventuality would mean that the typical V-shaped economic recovery chart would instead be a sawtooth pattern resulting from a slower return to normal with alternating quarters of expanding and contracting GDP, he said.

As a result, wholesale electricity markets may see persistent reduced power demand and prices, and regulators will look less favorably on revenue increases and rate base growth, Wynne said. In turn, lower and flatter load profiles may limit opportunities for investment in generation and transmission.