By Michael Brooks

Renewable resources will account for the largest proportion of new capacity this year, the U.S. Energy Information Administration predicted, though their growth will be tempered by the economic slowdown caused by the global COVID-19 pandemic.

Renewable capacity will increase by 11%, with the power sector adding 19.4 GW of wind and 12.6 GW of solar by the end of the year, EIA said in its monthly Short-Term Energy Outlook report released Tuesday. Those figures are 5% and 10%, respectively, lower than what the agency predicted in its previous report, which was published March 11, the same day the World Health Organization labeled the coronavirus outbreak a pandemic and just as the economic crisis was beginning.

| EIA

Throughout the report, EIA cautioned about the uncertainty of its projections because of the “rapidly changing economic conditions” resulting from state governors’ stay-at-home orders and the mass closures of nonessential businesses. “Although all market outlooks are subject to many risks, the April edition of EIA’s Short-Term Energy Outlook is subject to heightened levels of uncertainty because the impacts of the” virus, it said.

The agency predicted total electricity consumption to fall by 3% this year. The decline will mostly be driven by a 4.7% cut in commercial consumption. The industrial sector is expected to consume 4.2% less “as many factories cut back production.” Even residential consumption is expected to fall 0.8%, “as reduced power usage resulting from milder winter and summer weather is offset by increased household electricity consumption as much of the population stays at home.”

C&I prices are expected to dip this year before rebounding and surpassing those of 2019 in 2021. Residential prices will stay flat this year before following the C&I trend in 2021.

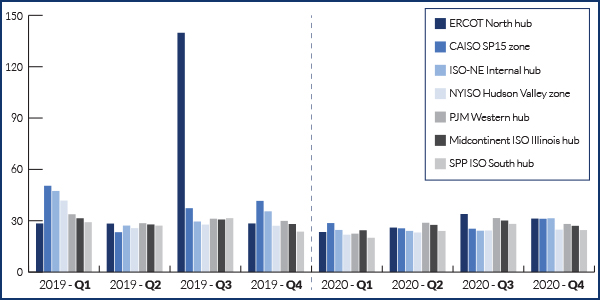

All U.S. grid operators will see a decrease in energy prices, according to EIA, but ERCOT will see the largest dip, with the North Hub average price falling 49.1% from $56.24/MWh in 2019 to $28.65, though its prices last year were inflated by an unusually hot summer. CAISO is second with a 27.5% drop, followed by ISO-NE (25.3%), NYISO (23.1%), SPP (13.2%), PJM (10.1%) and MISO (7.6%).

EIA predicts that RTO/ISO wholesale energy prices, which were already lower in Q1 this year because of a mild winter, will remain lower for the rest of the year because of the economic slowdown. | EIA

Carbon emissions will follow a similar trend. After decreasing by 2.7% in 2019, EIA predicted CO2 emissions would further decrease by 7.6% this year “as the result of the slowing economy and restrictions on business and travel activity,” before they increase by 3.6% in 2021.

Coal generation will fall by 20%, according to the report, while natural gas generation will rise by 1% as a result of low fuel prices.

“Although EIA expects renewable energy to be the fastest growing source of electricity generation in 2020, the effects of COVID-19 and the resulting economic slowdown are likely to have an impact on new generating capacity builds over the next few months,” the agency said.