By Michael Brooks

FERC on Thursday denied requests for rehearing and clarification of its acceptance of a settlement between PJM and its transmission owners over the cost allocation of major legacy transmission projects, the latest development in a nearly 13-year dispute that has reached the 7th U.S. Circuit Court of Appeals (EL05-121, ER18-2102).

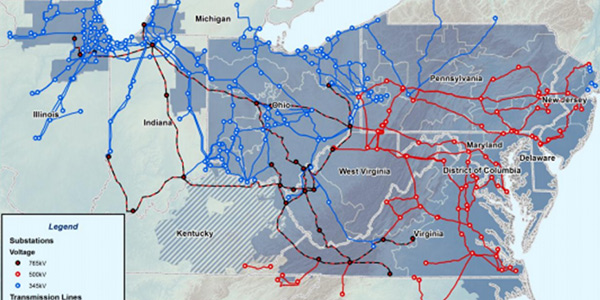

In May 2018, the commission approved an agreement over how PJM would allocate the costs of transmission projects above 500 kV approved between April 19, 2007 — when FERC found the RTO’s existing violation-based distribution factor (DFAX) method unjust and directed a new load-ratio share method — and Feb. 1, 2013, when FERC approved PJM’s new hybrid method, combining both the DFAX and load-ratio methods. (See “Response to FERC’s Cost Allocation Order,” PJM Market Implementation Committee Briefs: June 6, 2018.)

The commission approved the settlement under the second so-called “Trailblazer approach,” referring to the precedent set by a 1999 case involving Trailblazer Pipeline Co. Under the second Trailblazer approach, FERC may “approve a contested settlement as a package on the grounds that the overall result of the settlement is just and reasonable. The commission does not need to render a merits decision on whether each element of a settlement package is just and reasonable, so long as the overall package falls within a broad ambit of various rates which may be just and reasonable.”

Linden VFT challenged FERC’s approval under the approach, arguing that the commission needed “a detailed and independent cost-benefit analysis.”

“The commission largely bases its findings on the contested settlement’s general adoption of the cost allocation methodology currently contained in the PJM Tariff,” Linden said in its request for rehearing. “The settling parties did not present, and the commission did not base its decision on, any detailed or quantitative analysis comparing costs and benefits of any of the projects.”

The merchant transmission developer also said the commission’s order contained “oversimplified and fallacious data analyses” and “determinations contrary to circuit court and FERC precedent.”

“Any one of these flaws alone would constitute reversible error and would make the order unable to withstand an appeal,” Linden warned. “That would mean that this proceeding, which officially began over 13 years ago, would continue following yet another remand without the certainty of cost allocation that the settling parties and the commission have expressed the desire to obtain.”

Neptune Regional Transmission System and the Long Island Power Authority also alleged factual inaccuracies in their own requests for rehearing. Linden, along with Hudson Transmission Partners and the New York Power Authority, also requested clarification that they would not be subject to any of the current recovery charges or transmission enhancement charge adjustments provided for by the settlement.

The 7th Circuit twice remanded FERC’s approval of the load-ratio share method before PJM abandoned it in favor of the hybrid method. The Illinois Commerce Commission, which had filed the original complaint with the 7th Circuit on behalf of Commonwealth Edison, was among the parties to the settlement. (See Despite Lengthy Negotiations, PJM Cost Allocation Settlement Still Finds Detractors.)

“We continue to find that the commission’s reliance on the Order No. 1000 hybrid cost allocation method is consistent with the court’s decision, and that the settlement’s application of the Order No. 1000 hybrid cost allocation method achieves an overall just and reasonable result,” FERC said in denying rehearing. “While the court did discuss using a cost-benefit analysis, it did not require exact quantification of costs and benefits but rather required that the benefits be ‘roughly commensurate’ with costs.”

Regarding the requests for clarification, FERC noted that Linden, Hudson and NYPA based their argument that they should not be subject to any charges under the settlement on the fact that the commission did not approve it until May 31, 2018, when they had already converted their firm transmission withdrawal rights to non-firm transmission withdrawal rights effective Jan. 1, 2018. “In fact, Hudson and Linden sought to convert their firm transmission withdrawal rights to non-firm transmission withdrawal rights because they were subject to transmission enhancement charges,” it said.

“Cost responsibility under this provision does not depend on the date on which the commission approves the settlement or the date on which the transmission owners begin collection of these charges,” FERC said. “Because clarification parties held firm transmission withdrawal rights from the period from Jan. 1, 2016, to Jan. 1, 2018, we find that they are responsible for paying for the current recovery charges for that period.”