By Christen Smith

FERC denied Vitol’s request for rehearing of PJM’s mark-to-auction provision, a new rule that gives the RTO leverage to secure collateral for declining portfolios in its financial transmission rights market (ER19-945).

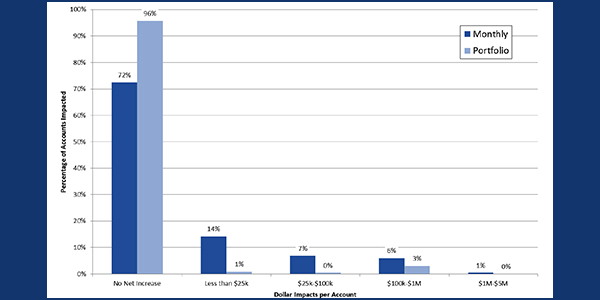

The commission approved PJM’s proposal in April after 91% of stakeholders endorsed it at the Market Implementation Committee late last year. (See “FTR Collateral,” PJM MIC Briefs: Dec. 12, 2018.) The RTO can now restrict a market participant from buying more FTR positions until it satisfies the additional collateral needed to secure its portfolio.

In its protest of the initial filing, Vitol said, “PJM market participants would be better protected if the proposal addressed when PJM should take action if an FTR portfolio loses value and when PJM should make a collateral call.” Specifically, the company wanted the RTO to add the word “promptly” in several sections of the Tariff’s Attachment Q and include language that specified it would not delay recalculation of auction revenue rights credits “when it is in possession of information indicating that the applicable market participant may be unable to satisfy the FTR credit requirement.”

The company had also called the proposal a “suboptimal solution … unless and until the pricing PJM uses for the market is updated on a more frequent, market-driven basis.”

FERC rejected Vitol’s arguments, saying the revisions provide enough specificity around how and when PJM will make and collect additional collateral calls, recalculate ARR credits and declare a market participant in default. There was also no need for PJM to prove its proposal was the “optimal solution,” the commission said.

Vitol filed a rehearing and clarification request in May, noting that specific points from the independent probe into the GreenHat Energy default underscored the company’s position that the amended Tariff language didn’t provide “reasonable, specific timelines” for PJM to act on undercollateralized portfolios. (See Report: ‘Naive’ PJM Underestimated GreenHat Risks.) The company urged the commission to deem the Tariff revisions unjust and unreasonable without language that obligates PJM to act within a specified time frame.

FERC disagreed again and pointed to provisions that state PJM will update long-term FTR requirement calculations on an annual basis; that the mark-to-auction price will be based on the most recently available cleared FTR auction price; and that these mark-to-auction values will occur on a regular basis after each monthly FTR auction. The commission said that its job is not to determine whether PJM’s Tariff revisions “are more or less reasonable than Vitol’s alternative.”

FERC said the GreenHat report doesn’t change its judgment either.

“The new mark-to-auction tariff provisions were intended to address the historical flaws in PJM’s credit and risk-management practices,” the commission wrote. “Indeed, the new Tariff provisions force PJM to confront warning signs through an affirmative obligation to calculate mark-to-auction valuations after each FTR auction and to issue a collateral call whenever the mark-to-auction valuation exceeds the FTR credit available for auction bidding.”

The commission did clarify that Vitol’s request for a monthly rolling auction in its initial protest was out of scope for the proceeding.