The New Jersey Board of Public Utilities on Wednesday agreed to ask PJM to approve a plan for the state to undertake a second solicitation process under FERC’s State Agreement Approach (SAA), this one for grid upgrades to handle the recent increase of 3.5 GW in planned offshore wind power.

The four-member board voted unanimously to ask PJM to incorporate into its planning process the state’s goal of developing 11 GW of capacity by 2040, which Gov. Phil Murphy increased from 7.5 GW in September. (See NJ Seeks Stakeholder Input for 3rd OSW Solicitation.)

The vote came six months after the board concluded the first SAA solicitation by awarding contracts totaling $1.07 billion for transmission upgrades to deliver 6,400 MW of offshore wind generation to the PJM grid. FERC backed New Jersey’s plan in April 2022. (See NJ BPU OKs $1.07B OSW Transmission Expansion.)

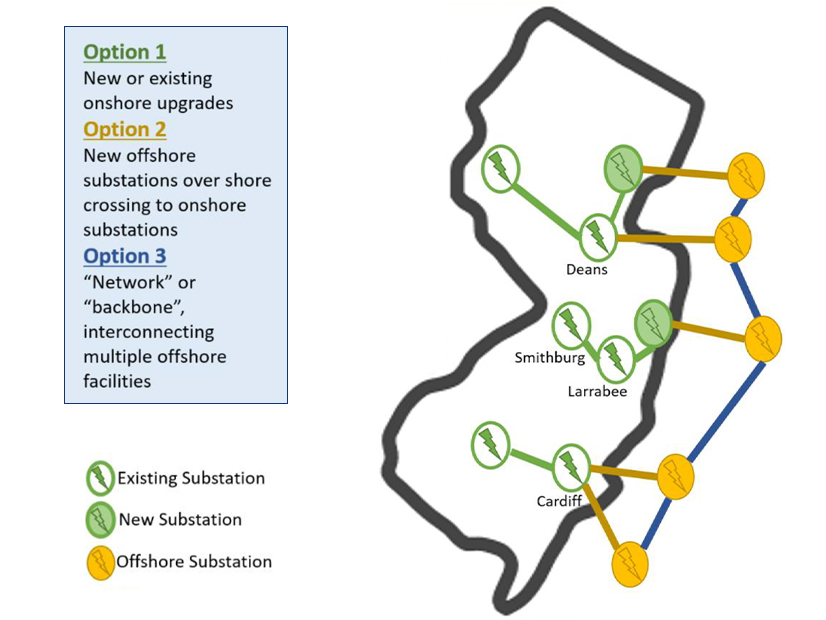

In its latest solicitation, which it calls SAA 2.0, the board is seeking solutions for three options, according to the order approved Wednesday:

-

-

- upgrading the onshore PJM regional transmission system to accommodate increased power flows from OSW facilities. This would leave OSW developers responsible for bringing power to the newly constructed onshore substations.

- connecting onshore substations to offshore substations.

- creating an offshore transmission “backbone” that would connect to the offshore substations.

-

The order recommends that the offshore cable system tie into the grid at the 500-kV Deans substation in Northern New Jersey, saying that it “is located near high electric load centers” and is accessible to the lease areas likely to service the state. In addition, PJM has in the past identified the Deans site as having the capability to handle the expected power injection.

“This process will examine whether an integrated array of open-access transmission facilities, both onshore and potentially offshore, can achieve New Jersey’s expanded offshore wind goals in an economical and timely manner,” PJM said in a statement.

The RTO said it will include New Jersey’s needs for offshore wind-related transmission improvements in a competitive proposal window tentatively set to open in 2024.

Complicated Initiatives

New Jersey officials, including BPU President Joseph Fiordaliso, have expressed concern that efforts to boost the use of electricity with wind and solar power will create a demand for interconnections that the grid can’t handle. Fiordaliso has repeatedly said he fears that the state will develop plenty of solar and OSW projects but have “no place to plug them in.”

At the same time, New Jersey is facing pushback against the rapid expansion of the OSW sector from commercial fishermen, local residents and the tourism industry, who fear a negative impact from turbines off the Jersey Shore, and from Republicans and business groups worried about the cost.

In a statement, Fiordaliso called the decision “extremely important for the future of our offshore wind program.”

During the BPU’s meeting Wednesday, he said that the approval “does not obligate the board to anything” but will initiate the kind of study necessary for such a large and complicated project.

“These are not easy decisions to make. Some of them are very complicated initiatives,” he said. “We just don’t go into these initiatives willy-nilly. There’s an awful lot of research that goes into it. How is it going to affect the ratepayer? That’s No. 1. How is it going to move us forward in achieving our goal? All of these things have to be evaluated before we say ‘yes, let’s pull the trigger.’”

PJM CEO Manu Asthana said in a statement that New Jersey has been “a pioneer in developing infrastructure needed to achieve its ambitious offshore wind policies.”

The BPU “recognized early on the value of PJM’s independent, competitive and proven transmission planning process, and we look forward to continuing to help New Jersey achieve its offshore goals reliably and as cost-effectively as possible,” Asthana said.

Jim Ferris, deputy director of the BPU’s Division of Clean Energy, said that the order only allows the board to embark on the SAA process, and any submissions would be evaluated “in concert” with PJM and not go ahead without the BPU’s approval. He added that the process includes “extensive protections for ratepayers, including cost-containment options.” Moreover, it does not preclude exploration of “opportunities for coordinating on regional offshore wind transmission up to and including a regional offshore wind backbone transmission system,” he said.

“While the second SAA is being initiated as a New Jersey-only effort, discussions with other states and federal stakeholders in this important area are continuing,” Ferris said.

Key among those discussions would likely be whether any of six successful bidders in the February 2022 auction for federal leases for OSW projects totaling 5.6 GW in New York and New Jersey would participate in a regional grid upgrade project. (See Fierce Bidding Pushes NY Bight Auction to $4.37 Billion.)

Commissioner Dianne Solomon, who has in the past expressed concern at the rising costs of New Jersey’s clean energy plans, backed the SAA proposal but encouraged BPU staff to continue looking for a regional approach to executing grid upgrades.

“We should be working as diligently in trying to get to that solution as the SAA solution,” she said. “I have no objection to doing them in tandem,” she added, urging staff to “put your pedal to metal” in pursuing a regional solution.

Reducing Costs, Risks

The board said staff “continues to believe” that the SAA process will result in “more efficient or cost-effective transmission solutions versus a non-coordinated transmission planning process.” The process also will “significantly reduce the risks of permitting and construction delays” and minimize environmental impact, it said.

The BPU picked its final contractors in the first SAA from among 80 proposals submitted by 13 developers who responded to the solicitation. At the time the board initiated the solicitation process, the state’s goal was to create 7.5 GW of capacity by 2035, and so it did not account for the extra 3.5 GW subsequently approved by Murphy.

The BPU picked only solutions to upgrade onshore transmission facilities and proposals for upgrades to resolve reliability criteria violations resulting from offshore generation injections. It did not pick any of the proposals for offshore transmission in large part because they did not result in a reduction in the number of cables, Andrea Hart, the BPU’s senior program manager for offshore wind, said at the time. The BPU instead has required applicants in the state’s third OSW solicitation to propose solutions.

BPU staff in the first solicitation selected a $504 million project that it called the Larrabee Tri-Collector Solution, which included parts of Jersey Central Power and Light’s proposal and pieces of Mid-Atlantic Offshore Development’s proposal. The BPU also approved $575 million in seven smaller projects to upgrade existing onshore transmission identified by PJM as necessary to support the OSW injections.

Ferris told the board Wednesday that the first SAA process would mean “New Jersey ratepayers will realize hundreds of millions of dollars in savings from the selection of these transmission projects, compared to the estimated cost of transmission facilities that would otherwise be necessary to achieve New Jersey’s 7,500-MW goal in the absence of the SAA solicitation.”