By Rich Heidorn Jr.

FERC failed to adequately explain how it relied on natural gas exports in approving the Nexus Gas Transmission pipeline in Ohio and Michigan, the D.C. Circuit Court of Appeals ruled Friday (18-1248).

The court said it agreed with the city of Oberlin, Ohio, and the Coalition to Reroute Nexus, a landowners’ organization, that the “commission failed to adequately justify its determination that it is lawful to credit Nexus’ contracts with foreign shippers serving foreign customers as evidence of market demand for the interstate pipeline.”

The court, however, declined to vacate FERC’s approval of the 256-mile pipeline, saying, “We find it plausible that the commission will be able to supply the explanations required, and vacatur of the commission’s orders would be quite disruptive, as the Nexus pipeline is currently operational.”

At issue is the commission’s August 2017 order granting Nexus a certificate of public convenience and necessity under Section 7 of the Natural Gas Act and its July 2018 order rejecting rehearing (CP16-102, et. al.).

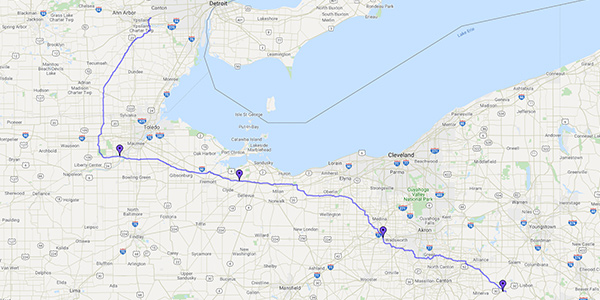

The 36-inch pipeline runs from receipt points in eastern Ohio to pipeline connections in southeastern Michigan, allowing delivery to customers in northern Ohio, southeastern Michigan and the Dawn Hub in Ontario. Nexus Gas Transmission is a 50/50 partnership between DTE Energy and Enbridge.

FERC found that Nexus’ precedent agreements were “the best evidence” that the pipeline would serve unmet market demand. Although the precedent agreements represented only 59% of Nexus’ capacity, the commission concluded that existing pipelines could not absorb that amount of gas.

The petitioners claimed Nexus’ precedent agreements should be ignored because half of them are with affiliates. The court backed the commission’s explanation that it fully credited Nexus’ agreements with affiliates because it found no evidence of self-dealing.

But the court agreed with the petitioners’ claim that the precedent agreements are not strong evidence of market demand because two of the agreements, totaling of 260,000 dth/day, are intended for export to Canada. If the commission excluded the exports, Nexus would have precedent agreements for only 625,000 dth/day, about 42% of its 1.5 million dth/day capacity.

“The commission never explained why it is lawful to credit demand for export capacity in issuing a Section 7 certificate to an interstate pipeline,” the court said.

“Section 7 states that the commission may issue a certificate of public convenience and necessity for ‘the transportation in interstate commerce,’ and we have explicitly refused to interpret ‘interstate commerce’ within the context of the act so as to include foreign commerce.

“Accordingly, we remand to the commission for further explanation of why — under the act, the Takings Clause [of the Fifth Amendment], and the precedent of this court and the Supreme Court — it is lawful to credit precedent agreements with foreign shippers serving foreign customers toward a finding that an interstate pipeline is required by the public convenience and necessity under Section 7 of the act.”

The court rejected challenges to FERC’s approval of Nexus’ proposed 14% return on equity and its finding that the pipeline does not “represent a significant safety risk to the public.”

The case was decided by Judges Judith W. Rogers, Sri Srinivasan and Robert L. Wilkins, and the opinion filed by Wilkins.