NYISO’s Business Issues Committee on Monday approved a proposed Tariff revision that redefines acceptable collateral for foreign market participants, largely to head off cumbersome bankruptcy proceedings in foreign jurisdictions.

Sheri Prevratil, the ISO’s manager of corporate credit, presented analysis on the proposal to allow only entities formed or incorporated in the U.S. or Canada to post cash collateral.

The changes modify Section 26.6.1 of the Services Tariff and affect only four market participants, she said.

NYISO currently allows market participants to post either unsecured or secured credit, with participants not meeting unsecured credit standards required to provide secured credit.

The ISO is seeking the change to avoid the potential costs required to secure and use collateral in the case of a foreign bankruptcy. Given the potential number of jurisdictions at issue worldwide, it is not feasible for the ISO to evaluate laws in all jurisdictions to ensure its interest in cash collateral would be adequately protected, Prevratil said.

State of the Market: Peak Load Up 7%

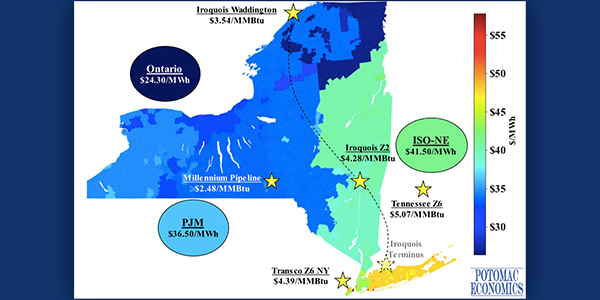

Rising natural gas costs and increased load levels were the two key factors that drove up NYISO electricity prices by 23% to 36% in 2018, Pallas LeeVanSchaick of the Market Monitor told the BIC while presenting a summary of the 2018 State of the Market Report.

The report showed peak load up 7% last year — “quite a large increase,” LeeVanSchaick said.

Average gas prices rose 21% to 47% across the state, with much of the increase caused by a cold spell in early January, while gas price spreads between western and eastern New York fell, leading to less west-to-east transmission congestion, LeeVanSchaick said.

The state’s electricity consumption rose from low levels seen in 2017, with average load up 3% and higher congestion occurring within New York City and Long Island.

“These factors also increased day-ahead congestion revenues, which we saw go up by 21% to just over $500 million in 2018,” LeeVanSchaick said.

LeeVanSchaick said the current capacity market produces prices for only the four modeled capacity regions and may produce incentives for excessive investment in some export-constrained areas and insufficient price signals for investment in import-constrained load pockets or in areas that improve reliability elsewhere, such as Long Island.

The four-zone model may not allow prices to change efficiently as units retire and enter, or transmission is built, and incentive issues become more acute with anticipated policy-induced retirements and new resource additions, as well as resource retention necessary to support local reliability in NYC load pockets, he said.

Based on those considerations, the Monitor recommends implementing a more granular locational capacity pricing mechanism, LeeVanSchaick said.

Included among the multiple policies aimed at removing capacity sources are the Indian Point nuclear plant retirement, coal plant retirements and the state’s Department of Environmental Conservation proposal to curb emissions from peaker plants. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

LeeVanSchaick said retirement of inflexible generation is needed to make room for state-sponsored resources and flexible resources that help integrate them, and that requires efficient market incentives.

“Even if those [public policy] resources are not justified based on economics and competitive entry, there is still an opportunity to get an exemption through a Part A test … which in New York City essentially allows for 6% excess capacity,” LeeVanSchaick said. The Monitor’s Part A test is intended to exempt from mitigation any resource deemed to be economic compared with a NYISO forecast, allowing that resource to bid into the capacity market on the same basis as other resources.

Updates to Economic Planning Process Manual

The BIC approved limited updates to the Economic Planning Process (EPP) Manual, the first since February 2016, modifying the description of historic congestion data reporting.

Timothy Duffy, the ISO’s manager of economic planning, delivered a summary of the changes, providing a brief overview of the separate generation deactivation process outlined in the overview section of the Comprehensive System Planning Process (CSPP).

The changes correct NYISO web links and make ministerial revisions for user readability, standardization of tariff references, inappropriate capitalizations and use of Tariff-defined terms, Duffy said.

NYISO-PJM JOA Revisions

The BIC approved NYISO-PJM joint operating agreement revisions, which the Management Committee will consider on May 20, and if approved, will go to the Board of Directors in June, ahead of a joint NYISO-PJM FERC filing.

Total redispatch settlement last year was “very small,” said Cameron McPherson, NYISO operations analysis and services analyst.

NYISO and PJM last September filed with FERC a joint request for waiver of their joint operating agreement to permit them to add the East Towanda-Hillside tie line as a market-to-market (M2M) flowgate. (See “NYISO, PJM Revising JOA for Tie Line Issues” in NYISO Business Issues Committee Briefs: March 13, 2019.)

Robert Pike, NYISO director for market design and product management, presented the monthly Broader Regional Markets report and highlighted the ongoing work to revise the JOA to address coordination on flowgates similar to the East Towanda-Hillside Tie Line.

Pike also highlighted continued stakeholder discussions regarding deliverability requirements for external capacity suppliers, including new rules such as those approved at the April BIC. (See “New External SRE Penalty” in NYISO Business Issues Committee Briefs: April 17, 2019.)

The requirements relate to New York capacity market eligibility, and the objective of the effort is to better understand any obstacles preventing external resources from delivering capacity-backed energy to the New York Control Area border.

Under the new proposal, any external resource that fails to meet the criteria will be subject to the penalty, which is equal to 1.5 times the applicable spot price multiplied by the number of megawatts of shortfall and the percentage of the SRE call hours to which a supplier fails to respond.

In a separate matter, the ISO is reviving its Metering Working Group, with meetings starting in July on technical issues around metering infrastructure for distributed energy resources and storage.

LBMPs Drop 25% in April

NYISO locational-based marginal prices averaged $28.01/MWh in April, down about 25% from March and the same month a year ago, Pike said in delivering the monthly operations report. Year-to-date monthly energy prices averaged $40.12/MWh, a 27% decrease from a year ago.

Day-ahead and real-time load-weighted LBMPs came in lower compared to March. Average daily sendout was 371 GWh/day in April, lower than 411 GWh/day in March and 390 GWh/day in the same month a year ago.

Transco Z6 hub natural gas prices averaged $2.37/MMBtu for the month, down 24% from March and 15.1% from a year ago.

Distillate prices were down 1.5% year over year and up slightly from the previous month, with Jet Kerosene Gulf Coast averaging $14.63/MMBtu, compared to $14.18/MMBtu in March, while Ultra-low Sulfur No. 2 Diesel NY Harbor rose to $14.72/MMBtu from $14.18/MMBtu in March.

April uplift increased to -$0.15/MWh from -$0.33/MWh in March, while total uplift costs, excluding the ISO’s cost of operations, came in higher than those of the previous month.

The ISO’s $0.20/MWh local reliability share in April was down from $0.31/MWh the previous month, while the statewide share climbed to -$0.35/MWh from -$0.64/MWh in March.

The Thunderstorm Alert cost was $0.01/MWh, unchanged from March.

— Michael Kuser