By Robert Mullin

Pacific Northwest members reaped an unusually large chunk of the Western Energy Imbalance Market’s $85.38 million in first-quarter benefits, according to a report from market operator CAISO.

Necessity was likely the reason. Evidence suggests Northwest utilities were leaning more heavily on the EIM last quarter to keep up with demand.

Among Northwest participants, PacifiCorp secured the largest portion of benefits by far at $23.76 million, compared with $10.5 million a year earlier. (See CAISO, PacifiCorp Gain Most EIM Q1 Benefits.) The EIM defines benefits as cost savings and the use of surplus renewable energy.

Portland General Electric took in $11.74 million (compared with $3.64 million), while Puget Sound Energy earned $7.21 million (compared with $3.01 million).

Idaho Power and Powerex, which did not begin transacting in the market until the second quarter of 2018, brought home $8.45 million and $7.23 million in benefits, respectively.

Further south, CAISO realized $13.08 million in benefits, followed by Arizona Public Service at $8.20 million and NV Energy at $5.71 million.

The EIM’s total quarterly benefits were the second highest on record, up nearly 103% from a year earlier, in part “driven by increased transfers compounded with higher energy prices” in February and March, CAISO said in its report.

First quarter 2019 benefits in millions USD by month | CAISO

But the CAISO report only hints at how steeply prices rose during the quarter — and where those gains were concentrated.

According to a report released earlier this month by Northwest industry consultant Randy Hardy, a former head of the Bonneville Power Administration, bilateral March 1 day-ahead peak prices at the Mid-Columbia trading hub broke $900/MWh, driven by natural gas prices of $160/MMBtu. (By comparison, CAISO day-ahead prices that day ranged from about $38/MWh to $82/MWh, holding that high for only a one evening interval.)

“These prices were driven by a number of factors including cold temperatures, a prolonged cold period prior to March 1 resulting in depletion of hydro generation and natural gas in storage, a maintenance outage on the DC intertie [linking the Northwest with Southern California] and limitations in supplies of natural gas impacting the ability of some natural gas generation to operate,” Hardy said.

Hardy also noted the high prices occurred despite “all the soon-to-be-retired [Pacific Northwest] coal plants operating at maximum capacity.”

Higher prices and tight regional supplies drove Northwest load-serving entities into the short-term market, including the EIM. That development was a boon for power producers in CAISO, which saw net exports surge from 120,364 MWh in January to 449,417 MWh in March — a 38% jump over March 2018. First-quarter exports from CAISO totaled 724,239 MWh, up 19% from the same period a year ago.

The figures also suggest the deepening of a longer-term trend attending the arrival of spring: CAISO becomes a net exporter of energy as increasing solar output coincides with lower electricity demand stemming from mild weather in California.

CAISO said the first-quarter energy transfers allowed it to avoid the curtailment of 52,254 MWh of renewable energy, down more than 20% from last year but in line with the first-quarter 2017 figure. The avoided renewable curtailments translated into the displacement of 22,365 metric tons of carbon dioxide, based on an assumed default emissions rate of 0.428 metric tons CO2/MWh from other sources of generation. The ISO estimates, by avoiding curtailments, the EIM has helped displace 346,649 tons of CO2 since 2015.

The EIM has yielded $650.26 million in benefits for its members since being launched with PacifiCorp as its first member in November 2014, CAISO estimates.

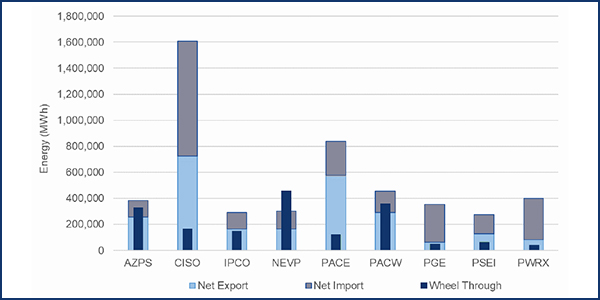

Estimated wheel through transfers in Q1 2019 | CAISO

EIM Wins New Member in Avista

The EIM is poised to spread into yet another corner of the Northwest, with the announcement last week that Spokane, Wash.-based Avista has signed up to join the market beginning in April 2022. The utility serves about 340,000 electric customers in western Washington and northern Idaho and operates about 2,750 miles of transmission.

Avista also owns 1,042 MW of hydroelectric generation and 1,875 MW of thermal capacity, 222 MW of which is generated by units of the coal-fired Colstrip plant in Montana, which could close as early as 2025 under pressure from Washington legislators.

“Joining the EIM is another milestone in our effort to efficiently use carbon-free renewable resources throughout the region while helping maintain reliability and keeping power affordable for our customers,” Jason Thackston, Avista senior vice president for energy resources, said in a statement.

The Sacramento Municipal Utility District began participating in the EIM in April, while the Los Angeles Department of Water and Power, Arizona’s Salt River Project and Seattle City Light are scheduled to begin participating in April 2020.

New Mexico’s PNM had anticipated joining in 2021 but may face a delayed entry as it works with state regulators to settle issues around recovering costs related to participation. (See PNM Bid to Join Western EIM Gets Approved in Part.)