By Amanda Durish Cook

After prodding by stakeholders, MISO now says it will boost renewable generation estimates in each of the four 15-year future scenarios that guide its annual transmission planning process.

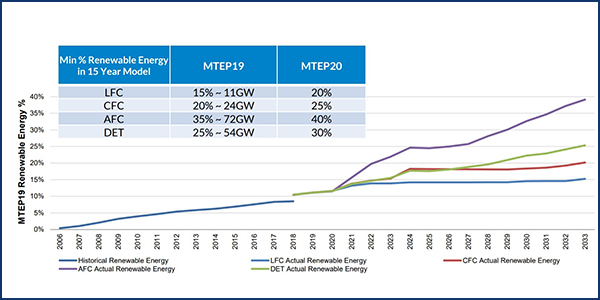

MISO had previously proposed relying on an older set of futures to inform the 2020 Transmission Expansion Plan (MTEP 20). But stakeholder pushback prompted the RTO to increase the minimum renewable penetration levels for each future by 5%, bumping projections from 15-35% of the generation mix to 20-40%.

Speaking at a Planning Advisory Committee meeting Wednesday, MISO Planning Manager Tony Hunziker noted the high degree of consensus among stakeholders to increase renewable estimates.

The MTEP will also assume the solar investment tax credit — which allows a 30% federal tax deduction of installation costs — will continue into 2023. The RTO will also rely on the National Renewable Energy Laboratory’s Annual Technology Baseline capital cost projections for renewable generation instead of using a 30% variance on those projections.

However, some stakeholders said they’d like to see a more nuanced approach to projecting renewable growth based on subregional characteristics to avoid blindly increasing renewable projections. For instance, MISO shouldn’t expect significant wind generation growth in sunny MISO South, some noted.

“MISO is not a resource planner. We don’t dictate renewable resource additions,” Hunziker responded.

Entergy’s Yarrow Etheredge said MISO didn’t adequately support the case for a blanket increase of every type of renewable generation everywhere in its footprint.

“This is basically just an adder,” Etheredge said, asking MISO to defend the change using data.

Hunziker promised a complete rework of MTEP 21 futures with stakeholders and reminded PAC members that MISO was up against a June deadline to finalize MTEP 20 futures definitions and assumptions.

The RTO last month said it would rely on the same set of 15-year futures for the third straight year to evaluate transmission projects in MTEP 20, though some stakeholders criticized the RTO’s limited fleet change future as no longer a likely scenario. (See MISO Going Back to the Futures for MTEP 20.) The futures scenarios include a limited fleet change, continued fleet change, accelerated fleet change, and a distributed and emerging technologies future.

Hunziker said the renewable increase should alleviate specific concerns about MISO’s limited fleet change future, which has been criticized as improbable because it projects only an 11-GW growth in renewable generation through 2033. MISO’s interconnection queue currently includes about 420 projects worth a combined 70 GW; renewable resources account for about 90% of the queue. Historically, about 18% of proposed projects clear the queue.

Last month, members of MISO’s Board of Directors also questioned whether the limited fleet change future was still plausible.

“It seems like the rate of adoption is increasing,” Director Thomas Rainwater said, while also acknowledging that MISO is “no California” in terms of appetite for renewables. He asked if the RTO will consider “a more radical adoption” of renewables and distributed resources in a new set of futures for MTEP 21.

MISO Vice President of System Planning Jennifer Curran said the accelerated fleet change and distributed and emerging technologies scenario are fast becoming the most probable futures and noted the RTO will soon revisit how futures are developed. But she also cautioned that MTEP futures represent possible trends and are not meant to be forecasts.

At the April PAC meeting, Minnesota Public Utilities Commission staff member Hwikwom Ham said he remained concerned that the limited fleet change and continued fleet change scenarios still risk obsolescence because they don’t account for the zero-carbon pledges of multiple utilities and increasing electrification of the economy. He also pointed out that equity investors are now contemplating a company’s carbon footprint as a risk factor before making investments decisions.

“Who is going to be in the White House next year? It’s going to be a different business model,” Ham added, referencing President Trump’s rollbacks of environmental regulations.

Hunziker said MISO will raise those topics in the redevelopment of futures in time for MTEP 21.

Meanwhile, MTEP 20 marks the first time MISO will work with Purdue University’s State Utility Forecasting Group and Applied Energy Group to create separate load forecasts that reflect each of the four futures. The RTO this month reported that entities representing 77% of its load responded to its request for load, demand and energy data.