By Rich Heidorn Jr.

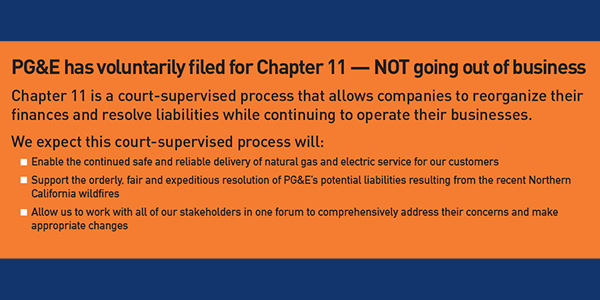

As expected, PG&E Corp. and its primary operating unit, Pacific Gas and Electric, filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code this morning.

The company said the filing in the U.S. Bankruptcy Court for the Northern District of California is an effort to provide “the orderly, fair and expeditious resolution of its liabilities resulting from the 2017 and 2018 wildfires.”

It said it made the filing after taking into account California officials’ statements last week clearing it of liability for the 2017 Tubbs Fire. (See related story, PG&E Cleared in Fire that Burned Santa Rosa.)

The parent company listed total assets of $71.4 billion and debts of $51.7 billion. But those debts do not include all the expected wildfire claims. Its list of its 50 biggest creditors is dominated by banks, led by the Bank of New York Mellon and Citibank.

PG&E also filed a complaint asking the court to issue an injunction confirming its exclusive jurisdiction over the debtors’ rights to reject power purchase agreements and other FERC Claims Authority over PG&E Contracts in Bankruptcy.)

“Our most important responsibility is and must be safety, and that remains our focus. Throughout this process, we are fully committed to enhancing our wildfire safety efforts, as well as helping restoration and rebuilding efforts across the communities impacted by the devastating Northern California wildfires,” interim PG&E Corp. CEO John R. Simon said in a statement released shortly after midnight. “We also intend to work together with our customers, employees and other stakeholders to create a more sustainable foundation for the delivery of safe, reliable and affordable service in the years ahead. To be clear, we have heard the calls for change, and we are determined to take action throughout this process to build the energy system our customers want and deserve.”

PG&E asked the court’s approval to sign a $5.5 billion in debtor-in-possession financing agreement to allow the company to continue maintenance and investments in safety and reliability during the bankruptcy proceedings. JPMorgan Chase, Bank of America, Barclays, Citi, BNP Paribas, Credit Suisse, Goldman Sachs, MUFG Union Bank and Wells Fargo will act as joint lead arrangers.

“We believe that this process will make sure that we have sufficient liquidity to serve our customers and support our operations and obligations,” Simon said.

PG&E also filed motions seeking court approval to pay employees’ wages and benefits and continue its support of existing customer programs for energy efficiency and low-income ratepayers. The company said it will pay suppliers in full for goods and services provided going forward.

The company named James Mesterharm and John Boken, managing directors at AlixPartners, as chief and deputy chief restructuring officers, respectively.

PG&E shares, which closed Monday at $12.01, were up slightly in pre-market trading today.