By Mark J. Volpe

Volpe | © RTO Insider

MISO recently announced that its Value Proposition provided annual quantitative benefits of $3.3 billion to its members during 2017. In the past, MISO has announced similar levels of overall monetary benefits attributable to its Value Proposition; however, over the years, based on the business decisions of numerous merchant-owned generation companies in MISO, including the non-regulated generation arm of several utilities, the overall value MISO membership provides the independent power producers is undoubtedly questionable at best.

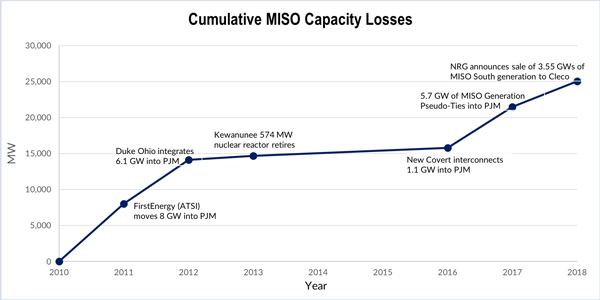

The gradual exodus of merchant generation out of MISO began in 2009 when FirstEnergy announced it would leave MISO and consolidate all its assets from their wholly owned subsidiaries American Transmission Systems Inc. and the non-regulated generation fleet of FirstEnergy Solutions into PJM. Anthony J. Alexander, president and CEO of FirstEnergy at the time, stated, “Aligning all of our transmission assets with PJM will provide customers with the benefits of a more fully developed retail choice market and enhanced long-term planning that supports construction of new generation when and where it is needed.” Quickly following suit, Duke Energy announced in May 2010 that its Ohio and Kentucky utility subsidiaries would quit MISO and join PJM. An industry analyst observed that “Duke’s motives were clear, and the move was widely ascribed as a bid to cash in on the substantial revenues available in PJM’s capacity market, the Reliability Pricing Model (RPM), which had proven much more lucrative than MISO’s much less formal monthly voluntary capacity auction. FirstEnergy already had sought the same advantages.”

| Coalition of Midwest Power Producers

After the Ohio companies left MISO, in a surprising turn of events during 2012, unable to find a buyer after a long-term power purchase agreement had expired, Dominion Resources announced it would shut down their 574-MW Kewaunee nuclear reactor located in Wisconsin. What made this decision somewhat puzzling at the time was EPA’s focus on clean air regulations; however, Dominion had made the decision to forge ahead with decommissioning its environmentally friendly nuclear facility. The following year, St. Louis-based Ameren announced the sale of its entire non-regulated generation portfolio located in downstate Illinois to Dynegy (recently merged with Vistra Energy) to focus on its rate-regulated electric, natural gas and transmission operations and remove $825 million in debt from its balance sheet. Dynegy paid no cash in acquiring all of Ameren Energy Resources coal units totaling 4,119 MW — only assuming the debt.

In 2014, Tenaska Capital Management, owner of a highly efficient, natural gas-fueled combined cycle facility New Covert merchant power plant in Michigan, announced plans to directly interconnect the 1,100-MW plant with PJM in June 2016. Tenaska invested millions in the construction of a new substation, a 345-kV transmission line and significant transmission system upgrades to literally build their way out of MISO. New Covert had cleared capacity in PJM’s RPM auction in May 2013 and May 2014. Tenaska Senior Vice President Brad Heisey stated, “PJM is a good fit for merchant wholesale generators such as New Covert. It has a balanced, forward-looking capacity market that should provide certainty for covering the facility’s fixed costs.” The same year, Calpine sold their Mankato Power Plant, a 375-MW natural gas-fired, combined cycle power plant located in Minnesota, to Southern Co. subsidiary Southern Power for $395.5 million plus working capital. Calpine President and CEO Thad Hill said, “Mankato is a modern, efficient and well-performing plant under long-term contract to the local utility with an expansion in advanced development. This sale is another step in our capital allocation plan to divest plants in non-core regions when we see an attractive value opportunity.” Another major MISO merchant player, NRG Energy, recently announced its intention to sell its entire 3,555-MW South Central business to Cleco Corporate Holdings for $1 billion.

The slow death of merchant generation in MISO has been pervasive with more than 25,000 MW exiting MISO over the last decade. The strategic motivation behind several of these companies’ business decisions is very clear: monetize assets in MISO to optimize their generation portfolios for participation in the better designed eastern U.S. capacity markets. None of the companies have folded their tents and gone out of business! They can operate successfully and turn a profit in markets other than MISO. These companies decided better opportunities could be found by deploying their capital resources elsewhere. This chain of events is not a coincidence, and in our next column, we will analyze the underlying circumstances behind these business decisions forcing the independent power producers to leave MISO.

Mark J. Volpe is the President & CEO of the Coalition of Midwest Power Producers (COMPP), a newly formed non-profit trade association focused on the continued evolution of fully robust wholesale energy and capacity markets in MISO. He is the former Senior Director of Regulatory Affairs for Dynegy Inc. and continues to serve as chairman of the Independent Power Producer sector on MISO’s Advisory Committee working actively within the stakeholder process at MISO and PJM advocating on energy and capacity market design issues.