By Hudson Sangree

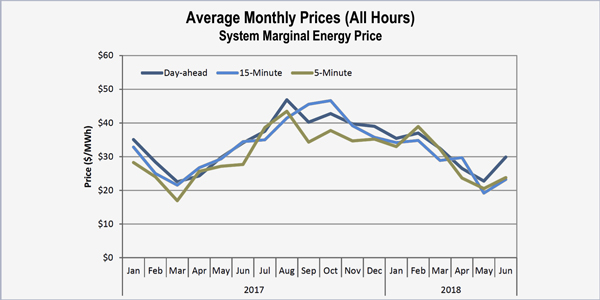

After an unusual surge in the first quarter, CAISO prices fell in the second quarter based on lower prices for natural gas and increased output from wind, hydroelectric and solar sources, the ISO’s Department of Market Monitoring told stakeholders Tuesday.

“Q1 prices were relatively high, while Q2 prices were relatively low,” said Amelia Blanke, CAISO’s manager of monitoring and reporting, during a call to discuss the department’s quarterly market report.

She noted prices are generally lower in the first two quarters and rise later in the year. This year was different, however. Q1 prices spiked because of the increased costs of natural gas, due to tight supply and high demand, and limited hydroelectric output, due to scarce precipitation.

Snowpack in the Sierra Nevada was only 54% of normal in early April, Blanke said.

Hydroelectric and renewable sources picked up in the second quarter, adding supply and helping to lower prices. Still, she said, hydroelectric is expected to remain below average this year.

“We are predicting relatively low hydro for this year, but not as low as we had at the peak of the drought in 2015,” Blanke said.

Also during Q2, north-to-south congestion in the day-ahead market continued to play a significant role, as it had in the first quarter, CAISO reported. It increased day-ahead prices in the San Diego Gas & Electric area by $3.54/MWh, Blanke noted.

Planned outages in Southern California were largely to blame for the congestion, she said.

“Outages in Southern California also caused congestion in the 15-minute market,” the CAISO report said. Congestion increased prices in the San Diego Gas & Electric area by about $4.95/MWh and in the Southern California Edison area by about $1.32/MWh, it said.

Another major development in Q2 was Idaho Power and Powerex joining the Western Energy Imbalance Market on April 4, Blanke said. The report noted prices in the Northwest region including the two companies are generally lower than those in the ISO and other EIM balancing areas because of their “abundant supply and limited transfer capability out of the region.”