By Steve Huntoon

If you peruse my columns (and thank you if you do), you may have noticed chronic heartburn over all manner of subsidies.

To be sure, I think everyone should have the right to buy a Tesla. But I don’t think anyone should have to contribute toward someone else’s Tesla.

Ditto someone’s microgrid, rooftop solar, home battery, grid battery, new nuclear plant, old coal plant, etc.

Which brings me to today’s topic: Offshore wind. Coming soon to a beach near you if the ambitions of just about every state north of Virginia pan out.

Now, please don’t get me wrong, I think wind energy is wonderful. If you’ve been to Atlantic City in the last 12 years, you may have noticed five wind turbines in the back bay. Yours truly did the resource analysis, the financials, the permitting and the contracting for that project. I drove the stakes in the ground to mark where the turbines were placed. Back then, wind project development was a jack-of-all-trades business. I was the jack.

Offshore Wind in Reality Is Anti-wind

My objection to offshore wind is that in reality it’s anti-wind. Here’s why: Whatever value you want to assign to wind (and other renewables), it is critical that we make the most of our collective money.

Offshore wind squanders that money.

How do we know that? Because onshore wind is a fraction of the cost.

For a given amount of subsidy dollars, to get 1 million MWhs of offshore wind, we could get 11 million MWhs of onshore wind.

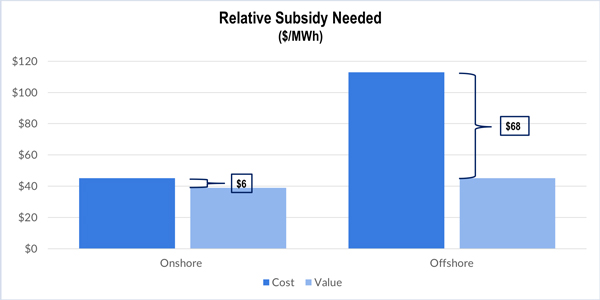

Here are the numbers, using a recent study by analysts who support offshore wind (seeking to show that offshore wind is more valuable than onshore wind). They define value as the market revenues in $/MWh. So in PJM, for example, onshore wind has a value of $39/MWh, and offshore wind has a value of $45/MWh.[1]

But here’s the thing. Onshore wind costs in the range of $30 to $60/MWh per Lazard’s most recent Levelized Cost of Energy analysis.[2] Offshore wind is estimated by Lazard to have a mid-point cost of $113/MWh – which I would suggest is way too low,[3] but let’s go with it.

Using the midpoint of the Lazard cost range for onshore wind of $45/MWh, and subtracting the onshore value of $39/MWh, means onshore wind on average needs a subsidy of $6/MWh.

Using the Lazard cost midpoint for offshore wind of $113/MWh, and subtracting the offshore value of $45/MWh, means offshore wind on average needs a subsidy of $68/MWh.

See the difference? Offshore wind sucks up $68/MWh, when onshore wind needs only $6/MWh. We can get on average 11 times more onshore wind from a given dollar of subsidy. Wow.

Lots of Onshore Wind Out There

It’s important to point out the enormous subsidy of offshore wind cannot be based on a claim that we’re running out of onshore wind. In PJM, for example, only some 8,200 MW of onshore wind have been installed, while the potential onshore wind resource is a staggering 365,000 MW.[4]

Yes, you read that right. Installed wind in PJM is only 2% of the potential wind resource. And the PJM onshore potential is 43 times the total offshore wind currently planned for the entire East Coast (8,500 MW).

The undeveloped onshore resource is out there, waiting. Why sacrifice so much to subsidize offshore wind when that same subsidy dollar could create 11 times more onshore wind? With 11 times more environmental benefits?

Offshore Apologia Doesn’t Hold Up

I raised these concerns at the summer meeting of Mid-Atlantic regulators, to a panel of offshore wind proponents (no skeptics allowed on the panel). I received answers something like these (answers in quotes with my comments following):

- “There’s not enough onshore wind in places like New Jersey.” If you care about global warming, why should you care if the wind is built in your state? And even if that mattered, offshore wind isn’t going to be located in New Jersey – or any other East Coast state for that matter. By federal law, each state’s offshore boundary extends only 3.5 miles from the coastline (with the notable exception of, where else, Texas). So this must be about political bragging rights instead of responsible use of taxpayer and consumer dollars.

- “Offshore wind is a better resource than onshore wind.” This misses the point that offshore wind, being a better resource, is already reflected in the value-cost comparison above.

- “Offshore wind costs are declining, as shown in Europe.” True enough, but as the current numbers reflecting the most recent decline show, offshore wind is nowhere close to making sense. When and if it ever is, that would be the time to spend scarce taxpayer and consumer dollars on it, instead of on onshore wind.

- “It’s a long-term investment.” A bad idea is a bad idea. It doesn’t become a good idea by calling it an investment and thereby taking money from people who could productively use it. Whenever offshore wind comes to make sense, then, and only then, would it be a good idea.

The Economic Development and Jobs Scam

As a final note, let me address a couple other leading arguments for offshore wind subsidies: economic development and jobs. The economic development claim typically comes from the wind developer’s consultant and is not only fanciful but also still pales in comparison to the negative impact of the subsidy cost (which somehow doesn’t appear in the press release).

As for jobs, let me give as an example the U.S. Wind project of 248 MW in Maryland, which the Maryland Commission claimed would create 4,540 new jobs in the operating phase of the project,[5] a claim that was cranked into the press release.[6]

This is a ridiculous number of new jobs for a relatively small (yet expensive) wind project. The project sponsor, U.S. Wind, claimed only 250 new jobs during the operating phase.[7]

So how could the Maryland Commission come up with 4,540 new jobs? The Commission’s consultant took its estimate of 226 new jobs and multiplied it by 20 years of project operation.[8] So every year, the same 226 jobs got counted again and again and again, for a total of 20 times. Is “scam” too strong of a word?

Oh, and as the Maryland People’s Counsel pointed out, the economic development claims completely ignored the negative effects on Maryland businesses (and jobs) from having to pay the enormous subsidies.[9] This is the free-lunch fallacy.

Bottom Line: All Ashore Please!

Subsidies are costly, especially when they sacrifice many times better options and can’t possibly produce the claimed benefits.

Politicians and regulators should suppress their Edifice Complex and support the wind resources that makes sense.

- http://eta-publications.lbl.gov/sites/default/files/offshore_erl_lbnl_format_final.pdf (subtracting the $6/MWh of additional energy and capacity revenue on pdf page 15 from the offshore value on pdf page 11 to get the net onshore value). 2016 data are used from the study, rather than 2007-2016 data, because the latter do not fully reflect the fundamental change in natural gas prices over time. ↑

- https://www.lazard.com/media/450337/lazard-levelized-cost-of-energy-version-110.pdf, pdf page 3. ↑

- Pegging the cost of offshore wind is difficult because numbers bandied about in the trade press and in press releases can be deceptive. Some reported numbers are north of $200/MWh, and then there is a surprise like Maryland’s claim of Offshore RECs at $131.93/MWh. Now, with RECs, the developer is assuming some level of energy revenue that needs to be added to get total cost. But more importantly about the Maryland report is that the actual REC cost is $163/MWh in year one, escalating at 1% per year. Now, you might wonder how a REC cost starting at $163/MWh can actually cost $131.93/MWh. It can’t. The Maryland Commission converts the actual cost into a present value in 2012 dollars by an assumed discount factor. https://webapp.psc.state.md.us/newIntranet/Casenum/NewIndex3_VOpenFile.cfm?FilePath=C:Casenum9400-94999431\121.pdf, pdf page 78. Of course, there’s no end to such nonsense – the Maryland Commission could have converted to 1912 dollars and said the cost was $6.50/MWh. ↑

- Installed wind in PJM is available here: https://www.pjm.com/planning/services-requests/interconnection-queues.aspx (sort by generation interconnection, in-service status and wind fuel type). Total wind resource in PJM is estimated from total resource by state, developed by AWS Truepower for NREL, which is available here: https://openei.org/doe-opendata/dataset/acf29328-756e-4d14-bd3e-f2088876e0e6/resource/337aca6a-c8f1-4813-b0e6-670beb47a900/download/windpotential80m30percent1.xls (estimates exclude areas unlikely to be developed such as urban areas). And from prorating each state’s total potential resource by the PJM installed portion of the total state installed capacity, as provided by AWEA, which is available here: https://www.awea.org/statefactsheets. Spreadsheets available by request from the author. ↑

- https://webapp.psc.state.md.us/newIntranet/Casenum/NewIndex3_VOpenFile.cfm?FilePath=C:Casenum9400-94999431\121.pdf, pdf page 11. ↑

- https://www.psc.state.md.us/wp-content/uploads/PSC-Awards-ORECs-to-US-Wind-Skipjack.pdf. ↑

- https://webapp.psc.state.md.us/newIntranet/Casenum/NewIndex3_VOpenFile.cfm?FilePath=C:Casenum9400-94999431\3.pdf, pdf page 54. ↑

- https://webapp.psc.state.md.us/newIntranet/Casenum/NewIndex3_VOpenFile.cfm?FilePath=C:Casenum9400-94999431\85.pdf, compare Tables 20 and 21 on pdf pages 130 and 131. ↑

- https://webapp.psc.state.md.us/newIntranet/Casenum/NewIndex3_VOpenFile.cfm?FilePath=C:Casenum9400-94999431\113.pdf. ↑