By Amanda Durish Cook

MISO’s sixth annual Planning Resource Auction cleared at $10/MW-day in all but one zone, a nearly seven-fold jump over last year’s single clearing price of $1.50/MW-day.

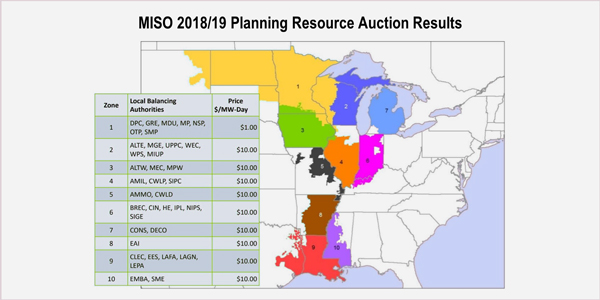

The RTO reported clearing 135 GW of capacity on Thursday, with nine of its 10 local resource zones clearing at $10/MW-day. The lone outlier was Zone 1 — covering parts of Wisconsin, Minnesota and the Dakotas — which cleared at $1/MW-day. MISO’s Independent Market Monitor has reviewed and certified the results.

“This year’s auction results reflect an adequate availability of resources for the planning window and the grid’s capability to effectively and efficiently transfer resources among local resource zones,” MISO Executive Director of Market Operations Shawn McFarlane said in a press release.

MISO said this year’s price increase was driven by “an increase in the planning reserve margin requirement, a decrease in supply and changes in market participant offer behavior.” Come June, the RTO will have a 17.1% planning reserve margin, based on limiting the likelihood of shedding load to no more than one day in 10 years.

MISO Manager of Resource Adequacy John Harmon on Friday said zero-price offers declined compared to last year’s auction.

“It does seem that participants had a greater appetite for risk,” Harmon said.

MISO maintained a 15.8% planning reserve margin for the 2017/18 planning year, when all zones cleared at $1.50/MW-day. Last spring, CEO John Bear said that the 2017/18 price resulted from high supply and low demand. (See All Zones at $1.50/MW-day in 5th MISO Capacity Auction.)

The last two auctions were a departure from three years ago, when almost all of MISO Midwest cleared at $72/MW-day for 2016/17, and four years ago, when Illinois’ Zone 4 cleared at $150/MW-day for 2015/16.

The RTO also said auction results were in line with the results of last year’s Organization of MISO States-MISO resource adequacy survey, which predicted sufficient capacity to meet near-term planning requirements through 2022. (See Capacity Survey Shows MISO in the Black.) McFarlane said the results demonstrate the “grid’s capability to transport those megawatts across the zones.”

MISO said this year’s auction continued the increase in non-traditional resources. About 1,600 MW of additional demand response, energy efficiency and behind-the-meter generation cleared, bringing the total to 11,000 MW, 8% of all resources. McFarlane said the increasing use of load-modifying resources to meet capacity needs underscores the need for MISO to continue its discussions on resource availability and need. (See MISO Looks to Address Changing Resource Availability.) The RTO said it will “continue to focus on the importance of long-term resource adequacy as the industry and generating fleet continues to evolve. MISO will also continue to support state processes around resource adequacy planning.”

During a Market Subcommittee meeting Thursday ahead of the auction results, Independent Market Monitor David Patton said he expected low auction capacity prices to continue “indefinitely.” In late February, FERC rejected the Monitor’s latest request to order MISO to apply a sloped demand curve, which he said would result in more efficient pricing. The commission said the RTO’s vertical curve was just and reasonable, noting that 90% of load is served by vertically integrated utilities. FERC also said pricing takes a backseat to the auction’s main objective to maintain reliability. (See FERC Vacates, Upholds MISO Resource Adequacy Rules.)

Zone 1

Harmon said 142 GW was offered in this year’s auction, 4 GW above the reserve margin requirement even when factoring in capacity stranded by transmission constraints, which would’ve accounted for another 2 GW in excess capacity.

“Zone 1 did bind on its capacity export limit this year. This binding did occur on the same transmission facility as last year,” Harmon said during an April 13 conference call with stakeholders.

WPPI Energy’s Steve Leovy expressed concerns over improper binding and price separation in Zone 1. In stakeholder meetings, Leovy has repeatedly called attention to MISO’s capacity export limit, which does not distinguish imports sourced outside the RTO from those sourced inside, making available transmission capacity appear scarcer than it really is, according to Leovy.

“I wouldn’t expect that line to bind. I would expect that line to have a lot of slack,” Leovy said. He said MISO must change the calculation behind its capacity import limits.

MISO staff on the conference call promised more information on capacity export limits and the RTO’s simultaneous feasibility test at the May 9 Resource Adequacy Subcommittee meeting.

Consumers Energy’s Jeff Beattie said it would be helpful for MISO develop a presentation showing how transmission capacity might increase around Zone 1 when the RTO’s multi-value transmission projects come online.