By Michael Kuser

The New York task force charged with determining how to price carbon emissions into NYISO’s markets on Monday tackled the complex issue of avoiding the pitfall of “carbon leakage.”

The term refers to when carbon market participants evade caps and prices by shifting electricity production to bordering areas outside the market.

The Integrating Public Policy Task Force (IPPTF) on April 9 heard two presentations on seams and leakage, part of issue “Track 2” in its five-track effort. The task force is jointly run by NYISO and the state’s Department of Public Service.

“It’s not an option at all to put a sizeable carbon charge on New York production and not do anything at the borders; that’s just not an option,” Brattle Group’s Sam Newell said during a presentation on applying carbon charge border adjustments to the ISO’s external transactions. “The reason you can’t is it creates a very unlevel playing field and would shift production to out of state in a very big way.”

Status Quo or Green Power

Newell presented two carbon pricing options to avoid market distortions. The “status quo” model would not consider carbon content in energy trades, while the second “green power” option would evaluate marginal emissions rates from out-of-state imports.

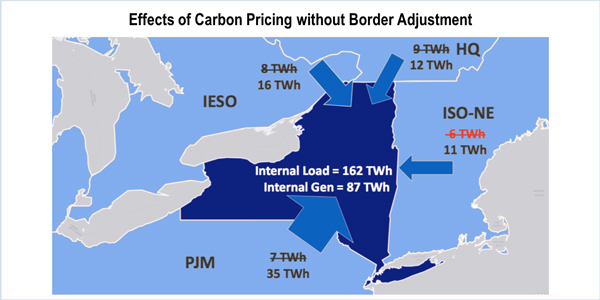

The status quo option could shift generation serving up to half New York’s load to out of state and also increase emissions regionally while only reducing them in state, Newell said.

“We’re talking about something that could be on the order of $50/ton, could be $20/MWh,” Newell said. “Imagine putting a $20 penalty on internal generation and not external. Again, you’ve really unleveled the playing field.”

The second option would factor into the prices for imported electricity the estimated difference in the carbon content of emissions based on the region (PJM versus Quebec, for example), “and it does think about carbon content in terms of exports and what are you displacing on the other side,” Newell said.

In response to questions from several stakeholders, Newell said the carbon charge on imports would not be unit-specific, noting that neighboring regions do not identify their exports by generating unit.

He contrasted New York’s situation with the Energy Imbalance Market (EIM) administered by CAISO.

“That’s an integrated market, and if you just said these units in California have to buy allowances and the others don’t, you’d have the same leakage problem,” Newell said. “They had to build into the [EIM] some sort of border treatment. … Unlike New York when it’s thinking about its neighbors, the EIM actually is dispatching the region on a unit-specific basis.”

Other stakeholders asked about charging imports from neighboring regions based on their average — rather than marginal — emissions rates.

“In economics, for price signals, marginal is what matters, not average,” Newell said. “This is a whole topic in ratemaking. If you charge based on average, you’ll have unintended consequences and inefficiencies.”

Marginal emissions rates differ from region to region, he said, but the types of marginal units may be more uniform across neighbors than assumed. For example, “energy limited resources” in Hydro-Quebec and Ontario (often limited to shorter run times because of local environmental restrictions) are more likely to produce and export at the margins of the market.

“If you get it right, you incentivize cost-effective abatement everywhere,” Newell said, noting that approach is consistent with New York’s objective to reduce global emissions.

Specifying Emissions and Costs

Julia Frayer and Gabriel Roumy of London Economics International (LEI) presented a study commissioned by Hydro-Quebec Energy Services (Hydro-Quebec’s U.S. subsidiary) on potential methodologies to address leakage of emissions to and from neighboring areas.

Like the Brattle report, LEI stated that improper implementation of a carbon charge mechanism could derail decarbonization objectives and distort underlying market signals.

LEI believes that a more granular approach to assessing carbon emissions rates for imports, based on resource- or area-specific emission rates, is superior in terms of economic efficiency, market impacts and reduction incentives.

“It’s all a matter of consistency, and it’s important when you look on the regional scale [that] you really need to look at unit-specific emission rates and what are these resources contributing to the overall Northeast markets,” Roumy said. “And the contribution is the lack of emissions that they are doing.”

Howard Fromer of PSEG Power New York said, “We want to know what the cost and price impacts are going to be to end-use consumers. If they’re a lot, then we’re probably not going to be very supportive. If they’re modest … then the next question we’re going to ask is: What are we getting for that extra cost? Are we getting significant carbon reductions, or are we just reshuffling the deck and making it look good?”

Warren Myers, DPS chief of regulatory economics, summed up the two political approaches represented in both the Brattle and LEI studies.

“One is keeping, as best as you can, interactions with other control areas on the same playing field that it’s currently on,” Myers said. “The other one is — do you want to take New York’s policy, or what the value of carbon is, and apply it beyond New York’s borders to address its consumption.”

In wrapping up the meeting, IPPTF co-chair Nicole Bouchez, NYISO principal economist, noted that the group will move a discussion on carbon charge implementation from May 7 to its next meeting on April 16 in response to stakeholder concerns.