By Jason Fordney

CAISO last week issued its proposal to offer reliability coordinator (RC) services in the West, including a plan to charge rates that appear to dramatically undercut rival Peak Reliability.

But when asked about the figures Monday, Peak told RTO Insider that “a true and accurate side-by-side comparison is not possible.”

The ISO on Friday provided more details on the planned Tariff changes and rates it will charge after its planned departure from current RC service provider Peak Reliability in September 2019. It plans to become certified as its own RC provider. (See CAISO to Depart Peak Reliability, Become RC.)

CAISO will develop an RC funding requirement — which includes the operating budget and reserve, as well as an annual revenue adjustment — to determine what it will charge per megawatt-hour. The ISO estimates its annual funding requirement will range from $5 million for only the ISO area to $12 million for all potential balancing areas in the region. Dividing those amounts by projected volumes yields a rate of 2 to 3 cents/MWh. CAISO said the monthly service charge will be derived by multiplying the RC rate by the megawatt-hour volumes submitted, citing an example of $51,000 monthly and $614,000 annually based on a monthly customer with a volume of about 2 million MWh.

By comparison, Peak said it charged customers nearly $44.6 million for its RC function in both 2016 and 2017 and will maintain the same level of funding for 2018.

“Yes, we can do it that much cheaper,” CAISO spokesman Steven Greenlee confirmed.

But Peak spokeswoman Rachel Sherrard said a comparison is not possible, “as the depth and breadth of the services Peak RC provides for its current rate of around 5 cents per retail customer per MWh is significantly more than we believe will be offered by CAISO.” She said that price includes the core RC function and several enhanced tools and technologies such as the WECC Interchange Tool, the Enhanced Curtailment Calculator and the Peak Synchrophasor Project.

“These additional value-adding tools, requested by our funding parties over the past nine years, have been consistently modified and refined to meet the reliability challenges posed by the changing landscape,” Sherrard said. “Our understanding is that CAISO is going to offer the basic NERC-compliant RC services, which doesn’t directly correlate to what we provide.

“In addition to switching costs associated with a transfer from Peak to any other RC, there is risk in transitioning from an entity with a strong operational track record, exceptional talent with an immense knowledge of the Western Interconnection and skills to an entity that is not yet an established RC,” Sherrard said.

Next Steps

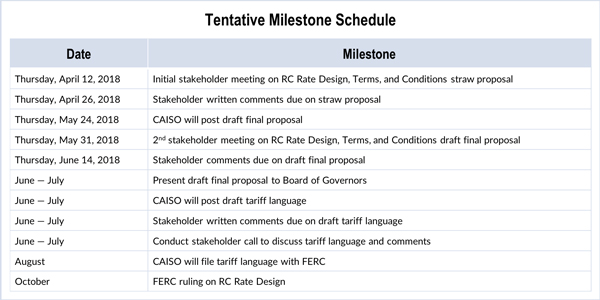

CAISO has scheduled an April 12 meeting at its headquarters to discuss its RC rate design straw proposal, which it will develop into a final plan submitted to the ISO Board of Governors and then FERC.

“All transmission operators within the CAISO balancing authority (BA) area will become reliability coordinator service customers of the CAISO at that time,” the ISO said. The RC services will also be offered to balancing authority areas outside of CAISO area and to transmission operators in those BAAs.

The RC is the highest level of reliability authority under the NERC model and has the widest view of the bulk electric system, with authority to prevent or mitigate reliability problems in both next-day analysis and in real-time.

The ISO said it also will be working with transmission operators in CAISO and others that have provided a letter of intent for RC services and signed non-disclosure agreements to develop operating procedures, technical requirements and other facets of the RC proposal.

CAISO’s model is based on seven ratemaking principles used to determine its other rates, including grid management charges and Energy Imbalance Market (EIM) administrative fees: cost causation, use of services, transparency, predictability, ability to forecast, flexibility and simplicity.

The ISO will require RC customers to initially commit to 18 months of services and will not penalize for withdrawals provided that six months of notice is given. The ISO estimates it will need 28 full-time employees that will work solely on the RC function.

CAISO in January initially announced its intent to depart Peak and offer its own RC services.

The ISO cited as the reasons for the move Peak’s decision to partner with PJM to provide market services and Mountain West Transmission Group’s likely departure from Peak after it joins SPP. (See Peak/PJM Enter Western Market ‘Commitment Phase’.)

CAISO is also developing a plan to extend its day-ahead market across the EIM, setting up competition for developing the market that could possibly develop into a new Western RTO. (See Multiple Entities, Markets Now Beckon in West.)