By Rory D. Sweeney

While structural issues persist, PJM’s markets were competitive in 2017, the RTO’s Independent Market Monitor said Thursday, contradicting concerns from PJM and some stakeholders that prices are unsustainably low.

In his annual State of the Market Report, Monitor Joe Bowring noted that PJM’s energy, capacity, regulation, synchronized reserve, day-ahead reserve and financial transmission rights markets all produced competitive results with competitive participant behavior, although all showed either market structure or design issues. Bowring recommended improvements for each market.

But the results show that the generation fleet remains relatively diverse and that most plants are receiving enough revenue to be profitable. All diesel and pumped-storage resources, and nearly all gas-fired combustion turbines and hydro stations, received full recovery of their avoidable costs, as did 88% of oil- or gas-fired steam units and 86% of gas-fired combined cycle plants.

Among nuclear plants, 68% earned enough revenue to cover an industry-standard calculation of costs developed by the Nuclear Energy Institute.

Using capacity auction results going forward, the report found only four nuclear facilities are threatened with negative revenues: Oyster Creek (which is already slated for decommissioning), Davis-Besse, Three Mile Island (TMI) and Perry. Quad Cities and Byron, the beneficiaries of Illinois’ controversial zero-emissions credits legislation, had been unprofitable four of the past five years but are projected to turn a profit through 2020.

The Salem nuclear plant also is expected to remain profitable through 2020. Asked why Exelon and Public Service Enterprise Group, which jointly own the two-unit facility in southern New Jersey, decided to halt capital expenditures at the plant, Bowring said he was “not quite sure” the reasoning.

“Based on publicly available data, it is more than covering its costs,” he said. “Nuclear units are not making a lot of money, but generally … they are not receiving a retirement signal from the market.”

“It’s not surprising” that single-unit facilities are the ones that are getting that signal, Bowring said. Additionally, he argued that NEI’s number was “inappropriate” because it included additional costs that were incurred in the aftermath of the Fukushima disaster in 2011. Using two-thirds of those costs, all but TMI and Davis-Besse will be profitable.

Just 52% of coal-fired plants recovered their avoidable costs, the report showed. PJM’s plan to revise price formation would support large, inflexible units like coal plants, but Bowring said the reforms were not based on market flaws. Nearly 79% of the $24.7 million uplift costs from day-ahead operating reserve differences were paid to coal units in 2017, but not because of market design issues, he said.

“That actually has to do with some very specific circumstances about coal units that have nothing to do with convexity and non-convexity and would not be affected by PJM’s price-formation proposal,” Bowring said.

Coal units also received nearly 85% of $20.4 million in uplift paid for reactive services, but gas turbines gobbled up the vast majority of the remaining $83 million uplift payments for lost opportunity cost, black-start services, local constraints control and balancing operating reserves.

While new combined cycle facilities could turn a profit in some zones, the revenue available in 2017 didn’t cover the cost of entry for new combustion turbine generators, nuclear or other units.

“The PJM system is significantly long” on generation, Bowring said, in part because the RTO has been regularly over-forecasting demand. The average real-time demand was down 2.2% from 2016 to 86,618 MWh. Peak and average load were also down.

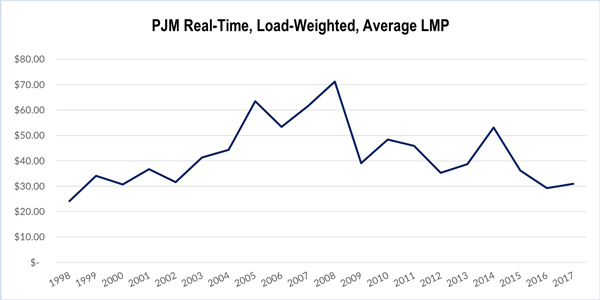

That factored into a $30.99 average LMP, which was up 6% from 2016 but lower than every other year since 2000. Much of that came from coal and gas prices, which combined to account for nearly 70% of the LMP.