By Michael Kuser

Eversource Energy last week said it has the levers to keep earnings growing — with or without its troubled Northern Pass transmission project in New Hampshire.

The company on Feb. 22 reported full-year 2017 earnings of $988 million, up 4.8% from the previous year on a strong rate base and good results from its transmission business, which earned $391.9 million. The electric distribution and generation segment earned $497.4 million for the year.

Fourth-quarter earnings rang in at $237.4 million, up 3.6% from $229.2 million in the same period a year ago.

Humble Pie

During a Feb. 23 earnings call, CEO Jim Judge told analysts the company was surprised and “humbled” by the New Hampshire Site Evaluation Committee’s (SEC) Feb. 1 rejection of its Northern Pass transmission line, just one week after Massachusetts awarded the project its solicitation for 9.45 TWh/year of hydro and Class I (wind, solar or energy storage) renewables. (See New Hampshire Rejects Permit for Northern Pass.)

Eversource partnered with Hydro-Quebec on the 1,090-MW line to bring up to 9.4 TWh of Canadian hydropower to New England each year for 20 years, starting in December 2020.

Massachusetts this month selected a transmission project proposed by Avangrid subsidiary Central Maine Power as an alternative if New Hampshire regulators fail to approve Northern Pass by March 27. (See Mass. Picks Avangrid Project as Northern Pass Backup.)

Lee Olivier, Eversource executive vice president for business development, said the company is confident that it can make a good case for Northern Pass if the SEC grants a rehearing.

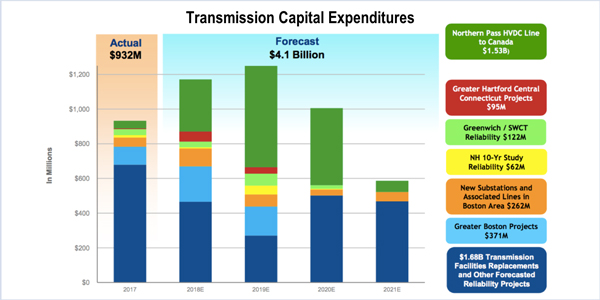

CFO Phil Lembo said the company can sustain earnings growth of 5 to 7% a year with or without Northern Pass, and that the project was not dependent on any request for proposals.

Olivier said that Eversource partnered with Orsted to form Bay State Wind for the offshore wind solicitation in Massachusetts but was not yet disclosing the specific amount of investment involved. In December, the joint venture proposed a 400-MW or 800-MW wind farm 25 miles off New Bedford to be paired with a 55-MW battery storage facility. (See Mass. Receives Three OSW Proposals, Including Storage, Tx.)

Regulatory and Operational Highlights

Lembo said Eversource in January closed a $258 million sale for 1,200 MW of the remaining generation assets belonging to its Public Service Company of New Hampshire subsidiary.

The company in December merged its Western Massachusetts Electric Co. and NSTAR Electric subsidiaries and will no longer report the former as a separate unit, Lembo said. Massachusetts regulators also approved spending on grid modernization and energy storage, and a performance-based rate design effective Feb. 1, 2018. Eversource so far has invested $100 million in solar projects in the state.

Subsidiary Connecticut Light & Power last month filed a settlement with state regulators on a rate plan that proposes $154.5 million in increases over the next three years and a 9.25% return on equity, with the final figures to reflect a decline in the federal income tax rate to 21%. The company expects a decision on April 18.

FERC and ROE

The federal regulatory situation “remains unclear” as Eversource and “the other New England transmission owners continue to litigate the fourth transmission ROE complaint before FERC,” Lembo said.

Hearings were held in December and an administrative law judge decision is due next month, he said.

“Meanwhile, we’re awaiting a ruling from the commission on how they will address the court-ordered remand of their decision in the first complaint, as well as initial rulings in the second and third complaints,” Lembo said, adding that the earnings results reflect the current 10.57% base ROE the commission approved four years ago.

FERC last October rejected a bid by New England transmission owners, including Eversource, to increase their ROE to the levels in place before being reduced by a 2014 commission order that was vacated by an appellate court early last year. The commission said it would address the actual rate in a later remand order, but has yet to do so (ER15-414, EL11-66.)

The D.C. Circuit Court of Appeals ruled last April that FERC had “failed to provide any reasoned basis” for setting the base ROE at 10.57%, adding that the commission failed to meet its burden of proof in declaring the existing 11.14% rate unjust and unreasonable. (See FERC Rejects New England Tx Owners on ROE.)