By Tom Kleckner

AUSTIN, Texas — Sempra Energy’s proposed $9.45 billion acquisition of Energy Future Holdings and its interest in Oncor took a major step toward reality Thursday before the Public Utility Commission of Texas.

The commission canceled a hearing on the merits of the deal scheduled for next week and directed staff to prepare a proposed order in the proceeding (Docket No. 47675). The PUC is expected to revisit the issue during its next open meeting on March 8.

EFH, which declared bankruptcy in 2014, holds an indirect 80% interest in Oncor, once its crown jewel but now the lone business remaining in its portfolio. Hunt Consolidated, NextEra Energy and Berkshire Hathaway Energy have all come up short in previous attempts to acquire Oncor, the largest electric utility in Texas.

“The fourth time’s the charm!” said an onlooker to a smiling Oncor CEO Bob Shapard, clapping him on the shoulder as he left the PUC’s hearing room.

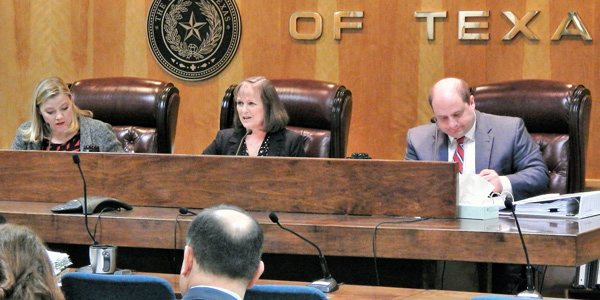

Shapard and General Counsel Allen Nye, who will both retain positions on the post-acquisition board of directors as chairman and CEO, respectively, were singled out for praise by PUC Chair DeAnn Walker. She thanked them for their work in what she said was a “very painful process” for them.

Walker also apologized to a large contingent of Sempra representatives, which included CEO Debra Reed, for making the long trip from California for a discussion that took less than two minutes. “Come back and see us anytime,” she said.

Walker acknowledged the work of both parties involved in the transaction. San Diego-based Sempra and Oncor have agreed to a list of commitments in settling with all 10 parties that have intervened in the case, rendering a hearing moot. (See Sempra, Oncor Reach Agreement with Texas Intervenors.)

“The unanimous settlement agreement is incredibly positive and demonstrates support for the proposed Sempra transaction from all parties,” Oncor spokesman Geoff Bailey said in an email to RTO Insider. “We look forward to reviewing the proposed order from the commission and answering any further questions that they may have.”

Sempra said it was pleased with Thursday’s developments. The company announced its intentions to acquire EFH last August and received approval from the U.S. Bankruptcy Court for the District of Delaware in September. FERC gave its approval for the acquisition in December, but the transaction remains subject to the PUC’s approval and that of the bankruptcy court.

“If approved by the commission, we will have the opportunity to potentially bring this long ordeal to a close, and Texas will get a terrific partner in Sempra,” Bailey said.