By Ryan Hledik

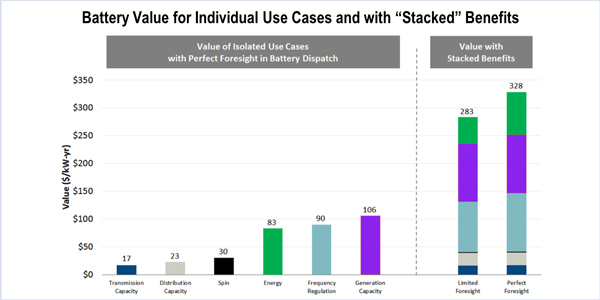

Batteries have the unique potential to provide a broad range of valuable services to the grid. If operators are able to control the battery in a way that simultaneously captures multiple value streams, the resulting “stacked benefits” can amount to significantly more revenue than pursuing any individual stream in isolation. In some cases, those benefits can justify battery investment at today’s costs.

Huntoon’s article makes four basic points when arguing against the feasibility of stacked benefits. However, there are nuanced conceptual problems with each of those four points.

Combined Energy and Capacity Value

First, the Huntoon article argues that energy price arbitrage value cannot be added to capacity value, because “a battery cycled daily for energy arbitrage is going to be partially or totally discharged most of the time” and therefore unavailable to provide capacity. This assumes that all reliability events occur instantaneously, with no warning. In fact, system operators commonly provide notice prior to a reliability event and can often anticipate events in advance by tracking and forecasting supply and demand. Such notification would allow the battery operator to charge the battery and fulfill its commitment. Further, in the event that the timing of battery dispatch for energy value is not coincident with reliability needs, the modeling behind our study has accounted for that impact.

Capacity Value

The Huntoon article suggests that batteries cannot provide capacity value because reliability events often last longer than four hours (which was the assumed battery capacity in our study). However, system operators typically establish a performance duration that resources must satisfy in order to qualify as a capacity resource. The required performance duration is only three hours for “peak ramping” and “super peak ramping” resources in CAISO’s “flexibility capacity” products, for instance.

In fact, a battery with even less availability would still have capacity value. For example, the dispatch of two batteries each with two-hour capacity could be staggered in order to provide four hours of discharge. In the U.K., the government recently proposed a novel approach in which batteries are given capacity credit that is a function of their duration. Batteries with four-hour duration would receive the full allowed capacity credit. Batteries with less duration would receive a prorated credit.

To the extent that any individual day would have resource needs that are greater than four consecutive hours, that is accounted for in our study, and the capacity value of the battery was derated accordingly.

Energy Value

Huntoon’s article questions the extent to which battery operators could predict the highest priced hours of each day and discharge the battery during those hours. It is certainly true that battery operators will not have perfect foresight into market prices. However, system operators will schedule batteries in energy markets to minimize system costs. Our modeling is based on a realistic assumption that this dispatch will align reasonably well with high priced hours. Additionally, self-scheduling resources could use day-ahead prices as a guide for bidding into the real-time energy market, and potentially benefit from the higher price volatility in that market.

Frequency Regulation

The Huntoon article points out that frequency regulation is a shallow market with limited need. This is true, and is explicitly acknowledged in our report.[2] At the same time, early movers in many markets have provided significant value by using fast-responding batteries to provide this service. Frequency regulation (and other ancillary services) could become increasingly important in the future as more intermittent renewable resources must be integrated into the power system.

Additionally, in recognition of the current limited need for frequency regulation, we included a sensitivity case that assumed no incremental value from the frequency regulation market. In that case, the stacked value of the battery still exceeded $200/kW-year.

A point that is not raised in the Huntoon article, but which is important to consider when assessing the value of energy storage, is the impact that large quantities of energy storage deployment could have on energy and capacity market prices, thus impacting the incremental value of additional storage resources. Our California study was focused only on the incremental value of 1 MW of storage. However, a study by my Brattle colleagues in the ERCOT market included detailed modeling that accounts for the effect of these market impacts on the stacked value.[3] The study identified a significant amount of economic energy storage potential, as well as a number of barriers to achieving that potential.

Capturing the Potential

Our study in California was intended to illustrate the potential system value of stacked benefit streams from battery storage in the absence of existing barriers. There certainly will be challenges to capturing this potential. To fully tap into this value, market rules may need to change, regulatory constructs may need to be revised, retail rates may need to be redesigned and technical challenges will need to be addressed.

But to paraphrase Theodore Roosevelt, “Nothing worth having comes easy.” In the power industry, initial skepticism about emerging technologies is regularly overcome through technological improvements and market and regulatory adjustments; just ask demand response providers, which have developed significant and valuable wholesale market resources over the past decade. In this case, the potential stacked value of battery storage is real and too significant to simply ignore.

Ryan Hledik is a Principal in The Brattle Group’s London office. He specializes in the economics of policies and technologies that are focused on the energy consumer. Mr. Hledik holds a Master’s Degree in Management Science and Engineering from Stanford University, and a Bachelor’s Degree in Applied Science from the University of Pennsylvania, with minors in Economics and Mathematics.

- Ryan Hledik, Roger Lueken, Colin McIntyre and Heidi Bishop, “Stacked Benefits: Comprehensively Valuing Battery Storage in California,” prepared for Eos Energy Storage, August 2017. http://www.brattle.com/system/publications/pdfs/000/005/494/original/Stacked_Benefits_-_Final_Report.pdf. ↑

- From page 11 of the report: “… it is important to note that the frequency regulation market is ‘shallow’ and can quickly saturate.” ↑

- Judy Chang, et al., “The Value of Distributed Electricity Storage in Texas,” prepared for Oncor by The Brattle Group, November 2014. http://www.brattle.com/system/news/pdfs/000/000/749/original/The_Value_of_Distributed_Electricity_Storage_in_Texas.pdf. ↑