By Amanda Durish Cook

CARMEL, Ind. — MISO’s Board of Directors on Thursday unanimously approved the RTO’s annual Transmission Expansion Plan, including 353 new transmission projects valued at $2.6 billion.

But a Texas project subject to shifting cost allocation was benched for at least two months before approval.

MTEP 17 contains $1.4 billion of projects driven by transmission owners’ local needs, including reliability, replacement of aging equipment and upgrades for environmental requirements. Almost $1 billion will be spent on baseline reliability projects, while nearly $240 million will go to generator interconnection projects. The proposed projects have expected in-service dates through 2024.

“The bulk of the dollars are being driven by local needs,” MISO Vice President of System Planning Jennifer Curran said.

Although nearly the same price as MTEP 16, this year’s plan has 29 fewer projects. An earlier version of MTEP 17 called for just 10 fewer projects. (See MTEP 17 Proposal: 343 New Transmission Projects at $2.6B.)

MISO South represents 41% of spending under the new plan, in keeping with a trend that increasingly allocates more spending to the southern portion of the RTO’s footprint, which is experiencing load growth — unlike the Midwest region.

Texas Project Delay

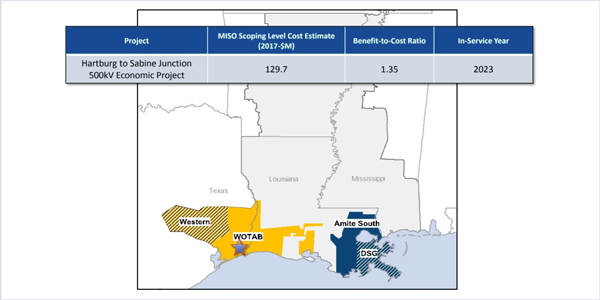

The board postponed approval of the $130 million Hartburg-Sabine 500-kV line market efficiency project (MEP) in eastern Texas for two months because of a late change to cost allocation for the projects. Last month, regulators from both Texas and Louisiana asked MISO to create separate zones for the two states to allow for a more specific cost allocation.

MISO has since filed with FERC to rename Local Resource Zones as “Cost Allocation Zones” for the purposes of allocating MEP costs only, with Louisiana becoming Zone 9 and Texas becoming Zone 11 (ER18-364). The proposal does not eliminate LRZs, which are used to determine resource adequacy needs, nor does it change their boundaries.

“Out of an abundance of caution, MISO does believe that a short delay would be prudent,” Curran said. A board vote on the project has been put off until Feb. 5, allowing FERC time to respond to MISO’s filing.

“The change to the zonal requirement makes sense,” Curran said. “Most of our other cost allocation zones are based on state lines.”

MISO policy requires that 80% of the costs for MEPs be allocated to local resource zones based on their relative share of adjusted benefits.

Curran said the delay would not affect MISO’s timeline for issuing a request for proposals for the project.

The Hartburg-Sabine project will be MISO’s second-ever competitively bid transmission project and the first such project to include a substation, and the RTO plans to add two new staff members to oversee the competitive process behind the project. The line is intended to alleviate constraints in MISO South’s West of the Atchafalaya Basin load pocket area straddling Texas and Louisiana.

“There’s a significant amount of aging infrastructure in this area,” MISO interregional adviser Adam Solomon said.

The Texas project has already frustrated some stakeholders, who last month considered requesting a longer delay over concerns about the project’s cost estimates. (See MTEP 17 Advances with Disputed Texas Project.)

MTEP 17 also includes five targeted market efficiency projects, smaller interregional projects meant to relieve historical congestion on seams shared with PJM, whose Board of Managers also approved the TMEP portfolio on Monday. (See related story, New Wave of PJM Transmission Upgrades Rankles AMP.)

All five TMEP projects this year are upgrades to existing systems. The projects, which have individual $20 million cost caps, will coincidentally cost $20 million combined.

TMEP project costs will on average be allocated 69% to PJM and 31% to MISO, based on projected benefits, which are expected to reach $100 million within four years of going into service.

TMEPs are designed to address cost-effective and congestion-relieving seams projects that might otherwise be overlooked because of their low cost and small size. To qualify, projects must cost less than $20 million, be in service within three years of approval and provide historical congestion relief that is equal to or greater than construction costs within the first four years of operation.