By Michael Brooks

More than half of the $24.3 billion in transmission projects in PJM since 2012 were unneeded to comply with RTO or federal reliability requirements and were not subject to rigorous review, according to a report commissioned by American Municipal Power.

At a teleconference Friday, AMP used the findings to call for more transparency into transmission owner-proposed supplemental projects, which represented $12.7 billion of the total spending since 2012.

Supplemental projects are proposed by a TO and fully paid for by its customers. They are not required to fulfill any reliability obligations from NERC, FERC or PJM, which reviews the projects only to make sure they do not negatively impact the grid. This is in contrast to network upgrades and regionally funded baseline projects proposed by PJM to address violations of RTO, NERC, ReliabilityFirst or TO planning criteria. Supplemental projects also are exempt from the competitive transmission requirements of Order 1000.

Of the $28.1 billion in planned or in-service transmission projects from 2005 to 2012, only 24% ($6.8 billion) were supplemental, according to the report by Ken Rose, an independent consultant and senior fellow at Michigan State University’s Institute of Public Utilities. After 2012, supplemental projects made up 52% of total spending, compared to 48% ($11.6 billion) in baseline projects and network upgrades.

“There is a shift from baseline projects to supplemental projects as revenue requirements and transmission rates have gone up, a lot — way beyond the levels of inflation,” Rose said. “Basically, if you continue to have a process where it is fairly easy for the regulated entity to pass project costs through, there is going to be an incentive to continue pursuing supplemental projects.”

PSEG, AEP, PPL Cited

Three TOs — the “overachievers,” as Rose called them — were particularly aggressive in such spending. Between May 9, 2005, and September 2017, supplemental projects represented more than 44% of the transmission spending within the PSEG zone, 40% of spending in the AEP zone and almost 59% of that in the PPL zone.

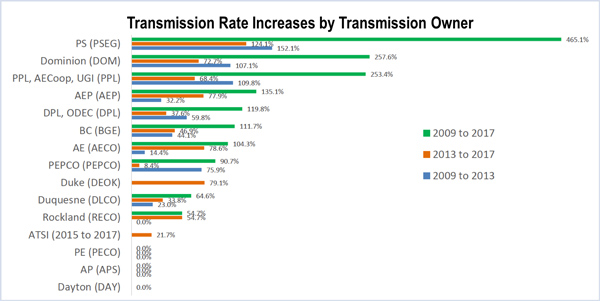

The three TOs also saw their transmission revenue requirements and rates more than double since 2009, with PSEG’s requirements jumping 420% and its rates increasing 465% since 2009, far more than any other TO.

“Those transmission costs that we’ve seen increasing are being passed along to our members,” said Jolene Thompson, executive vice president of member relations for AMP, which provides generation, transmission and distribution to 135 members in Delaware, Indiana, Kentucky, Maryland, Michigan, Ohio, Pennsylvania, Virginia and West Virginia. AMP has “prioritized trying to find ways to mitigate the impact of the increasing transmission costs” on its members, she said, and chief among those is shedding light on the RTO’s supplemental projects.

“Our members are seeing their transmission rates skyrocket,” AMP President Marc Gerken said in a statement. “We need to able to tell them why this is happening.”

Aging Infrastructure

At a 2015 FERC technical conference, PJM Vice President of Planning Steve Herling told commission staff that supplemental projects are often proposed to replace aging infrastructure. “If you went down the list in our database, I guess half of them start with the word ‘replace,’” he said. (See PJM TOs Defend Jurisdiction at FERC Conference.)

The conference led FERC last year to issue a show cause order finding that PJM’s TOs were not complying with Order 890’s requirements that stakeholders have “early and meaningful input and participation” in the planning process for supplemental projects (EL16-71). The commission said some TOs “appear to be identifying — and even taking steps toward developing — supplemental projects before providing any opportunity” for stakeholders’ input through the Regional Transmission Expansion Plan. (See FERC Orders PJM TOs to Change Rules on Supplemental Projects.)

While insisting they already comply with Order 890, the TOs in October proposed a Tariff amendment they said would increase transparency. FERC, which had no quorum between February and August, has yet to act on their response.

“PSE&G works closely with PJM and its stakeholders to review and respond to questions about its transmission projects, including supplemental projects,” said Karen Johnson, PSE&G director of communications. “Projects also obtain state and local permits and approvals from state agencies, municipalities, environmental permitting agencies and other local stakeholders. We work closely with all of them to ensure that transmission is built in a cost-effective manner that mitigates environmental impacts and is consistent with customer needs.”

Johnson also said that investment in transmission “puts downward pressure on energy and capacity prices by alleviating congestion on the system” and that ”PSE&G’s electric bills have remained flat to slightly lower over the past nine years.”

AEP and PPL did not respond to requests for comment.

Task Force

In the interim, the TOs and stakeholders have resumed meetings of the Transmission Replacement Processes Senior Task Force, which had gone on hiatus awaiting a FERC ruling. (See related story, Softer Rhetoric as TOs, Customers Seek Accord on Replacement Rules.)

AMP wants to “proceed as aggressively as we can in the current PJM stakeholder process in trying to get the transmission owners to provide a similar amount of information and transparency of data for the supplemental projects as they do for the baseline and Regional Transmission Expansion Plan projects,” Ed Tatum, AMP’s vice president of transmission, said at the teleconference. FERC’s show cause order gives the organization “a good opportunity to get the transparency that we need. But it’s important that those orders be implemented in the spirit with which the commission intended them.”

Asked by RTO Insider why PSEG, PPL and AEP proposed so much supplemental spending, Tatum responded, “I think you make our point for us right there: We don’t know.”

He said PJM should be doing more to protect ratepayers.

“By virtue of being the regional transmission organization … they are in charge of the planning and operation of the system. We see [TO-proposed] projects that come in that talk about building new infrastructure or replacing infrastructure. We have this crazy idea that it’s planning. … There’s certainly an important role for the transmission owners, but at the end of the day we do believe it’s PJM’s process and I think the commission has been clear on that, saying that PJM is in charge of not only the regional but the local planning processes as well.”

“This is a complex issue and one we continue to work through with our stakeholders. It is important to note that there is an active FERC proceeding right now,” PJM spokesperson Paula DuPont said. “We believe in the importance of transparency in all aspects of the planning process and that’s why we’ve been working with stakeholders on it.” She pointed to Planning Community – an online communications platform – and the new Manual 14F: Competitive Planning Process, saying they “demonstrate the value we place on transparency.”

AMP acknowledged that PJM is not alone in seeing increasing transmission costs. But “this supplemental cost category is unique to PJM and those are the ones we really have an issue with because they lack the same rigorous oversight process,” said Lisa McAlister, AMP’s senior vice president and general counsel.

MISO ‘Out-of-cycle’ Controversy

TO-proposed projects also have generated controversy in MISO. In 2015, the RTO approved a $187 million “out-of-cycle” project by Entergy in Lake Charles, La. Transmission developers complained that they had been denied an opportunity to compete on the project, which Entergy had argued was an “immediate need” and thus could not wait for the RTO’s next Transmission Expansion Plan. The complaints led the RTO to change the rules for dealing with out-of-cycle proposals under a new “expedited review” procedure that was added to its transmission planning manual (Business Practices Manual 20) in May 2016. (See Ideas to Reform MISO Out-of-Cycle Process Emerge.)