By Michael Kuser

GROTON, Conn. — The best strategy to deal with change in the energy sector is to embrace it. So said some of the more than 250 participants at the Northeast Energy and Commerce Association and Connecticut Power and Energy Society’s 24th New England Energy Conference last week.

Stahl | © RTO Insider

NECA President Tina Bennett, a principal consultant with Daymark Energy Advisors, said that the electric markets should “accept disruption” from new technologies by creating a new regulatory landscape.

Bennett | © RTO Insider

“The model today is not really conducive for where we want to go in the future,” Bennett said, citing the growing impact of distributed energy resources. “What are the things we can do today from a regulatory perspective and from a business model perspective that can open up possibilities for the disruption to happen?”

Former Massachusetts Undersecretary of Energy Barbara Kates-Garnick, now a professor of practice at Tufts University, agreed.

Kates-Garnick | © RTO Insider

“We are going to have to accept disruption, but that is something that we as the energy industry haven’t been easily able to accept,” she said. “The future is not linear, it’s not a straight line, and we’re going to have to design processes that have off ramps and that also enable rewards for those people and those entities that take risk.”

Angela M. O’Connor, chairman of the Massachusetts Department of Public Utilities, said her state is “at a crossroads. We’re number one in the nation in energy efficiency, but our programs are also the most expensive in the country. When lighting requirements change, what will the next programs and the benefits look like?”

NESCOE

DERs’ Impact

RTOs are trying to automate their grids, but high penetration of distributed energy resources means they have to operate their feeders with less flexibility at times depending on renewable penetration levels, or “hosting capacity,” said Scott Higgins, director of distributed energy and microgrids for Schneider Electric.

The job of managing the grid is complicated by different market participants — independent power producers, utilities and behind-the-meter “energy prosumers” — each having different goals, contracts and control systems.

To illustrate the challenge, Higgins mentioned the use of battery storage to shave a “prosumer’s” peak in the middle of the day. “But we also have a demand response event coming up later in the afternoon and the control system will need to recharge the battery for that. The DR event benefits the prosumer, but it is initiated by the utility, so at some point the control algorithm decides to stop peak shaving and to charge the battery. What if the prosumer has an economic interest in peak shaving longer and foregoing the demand response event that day? Contracts and control systems both have to draw the line at some point between serving one customer constituent and another.”

Roark | © RTO Insider

With the huge investments needed in upgrading transmission and developing renewables, “we can make use of that grid; we don’t need to be trying to escape the grid,” said Jeffrey Roark of the Electric Power Research Institute.

Trotta | © RTO Insider

Alan Trotta, director of wholesale power contracts for United Illuminating, offered some statistics illustrating the growth of DER. “In 2011 we had fewer than 100 requests for interconnection with distributed generation units,” he said. In 2016 “there were over 3,000 requests and over 2,300 new behind-the-meter generators interconnected.”

For maximum cost-effectiveness of decarbonization of the grid, go big, said Trotta, referring to the difference in customer costs between grid-scale renewables and DERs. “The economies of scale are real and we see it in actual procurement results.” Speaking about the evolving role of the grid, Trotta said, “The grid is changing because the needs of the users are changing, and by users, I mean customers, generators, potential storage developers [and] people in the transportation sector.”

Electric Vehicles

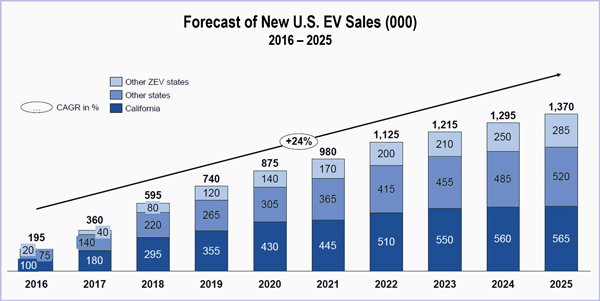

Many in the industry are confident that electric vehicles will cause an increase in loads after years of flat or declining power demand. Martin Stahl, managing director of Germany-based Stahl Automotive Consultants, forecast that EV sales in the U.S. will increase seven-fold to nearly 1.4 million by 2025. The main constraint on EVs, he said, is a lack of charging infrastructure.

Stahl Automotive Consulting

Stahl said utilities are committed to building an EV charging infrastructure in Germany, where the decision to give up nuclear power increased renewable commitments and added stress to the grid.

Well-placed chargers are essential to avoiding excessive spending on public and private charging infrastructure, Stahl said. “But more important is the demand response function, either regulated or behind-the-meter,” he said. Fast-charging equipment is expensive and needs to be connected to higher voltage lines, while at-home charging is almost invisible to utilities. “We are exploring with clients how to ensure that emerging load can be put to a good time of the day,” he said.

Stahl Automotive Consulting

For example, he estimated that with good location planning and optimization, EV charging could decrease the average residential ratepayer bill by nearly 10%, versus a 1.5% increase with no optimization.

Timing

Timing is crucial to those who seek to introduce change, Stahl said. “The ones who do that too early are also on the wrong side of the game. We saw that especially with electric vehicles, where the early players did not make it.”

ENGIE North America CEO Frank Demaille said his company and Axium Infrastructure US recently signed a $1.2 billion 50-year contract with Ohio State University to map and implement the school’s energy sustainability strategy. One initial goal is to reduce energy consumption at the 485-building campus by 25% within 10 years. A contract with such a long lifespan means “you can really build something with a strong partner,” Demaille said.

New Rate Designs

Decoupling revenues from sales is a good start to make utilities “indifferent to increasing energy efficiency on their system,” Trotta said. Referring to the expansion of net metering, however, Trotta said, “We may need to see new rate structures in the future that send the appropriate economic signals to all of the users of the grid.”

There’s no doubt that the market structure and the rate design need to change, O’Connor said. “We want utilities to do much more now under the same rate structure from 20 years ago.”

States, RTOs in Conflict?

On whether RTOs’ focus on reliability conflicts with the environmental goals of states, Macky McCleary of the Rhode Island Division of Public Utilities and Carriers said he preferred to acknowledge tension, rather than conflict. “It’s a shared concern, and the ISO can help make it cheaper to achieve those environmental goals,” he said.

“The only resources left to rely on the existing wholesale markets in New England are natural gas generators and old nukes,” said Susan Tierney, senior adviser with The Analysis Group. “Policymakers in the states are making a big bet that those markets will remain sustainable.”