Wind energy and other renewable resources are providing so much of ERCOT’s generation mix that not even the ISO can keep up.

Delivering his CEO report to the Board of Directors, Bill Magness said ERCOT on March 23 had finally reached the 50% wind penetration mark — a percentage he said would have reached 55% had another 1,500 MW of wind energy not been curtailed. (See ERCOT Reaches 50% Wind Penetration Mark.)

Not included on the slide, which was produced to meet an earlier board deadline for the April 4 meeting, was ERCOT’s latest record for wind generation. That came March 31, when the ISO reported 16,141 MW of wind generation at 8:56 p.m., almost 40% of the total load.

The previous record came last Christmas, when ERCOT saw 16,022 MW of wind generation.

ERCOT has 18,064 MW of installed wind capacity, with just more than 10,000 additional megawatts that have interconnection agreements, according to its latest generator interconnection status report.

The ISO has also seen a rapid increase in solar energy, Magness said, though not at the scale of wind resources. He said ERCOT’s solar capacity nearly doubled in 2016; it currently has 556 MW of capacity and another 2,009 MW have interconnection agreements.

To help address the continued increase in variable generation, ERCOT has added a sixth desk in its operations center that is focused on reliability risk. The new desk went live in January and will respond to wind and solar forecasts errors, net load ramps, low inertia and variable ancillary service needs.

“Because of our changing resources, certain things have grown over time to be much bigger issues than they traditionally have been,” ERCOT Senior Director of System Operations Dan Woodfin told the board in a separate presentation.

Woodfin was recently honored by the Utility Variable-Generation Integration Group with an award for “sustained leadership” in integrating variable generation. He said reliability risk increases as more renewables are added to the Texas grid.

“We have the same percentage of forecasting error, but the number of [renewable] megawatts in any given hour will be higher,” Woodfin said. “We want to assess them in real time, not just quarterly or at the beginning of the year.”

“The things we’re doing and the investments we’re making are just part of the day-to-day business as we adjust to these changes,” Magness said.

He said training staff would be a “big priority” the next couple of years. “We’re training our operators and giving them as much simulation of the conditions they’re seeing on the grid they’ve never seen before. We’re taking as much advantage as we can of our operational expertise to prepare for the future.”

Higher Capacity Factors Increase Wind Energy’s Output

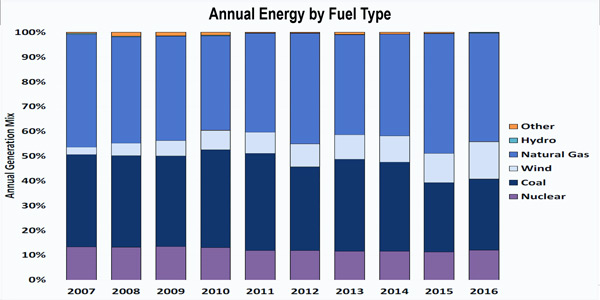

The Independent Market Monitor’s report picked up on the renewables discussion, with Director Beth Garza highlighting wind energy’s growing share of ERCOT’s fuel mix. Wind produced 15% of ERCOT’s power last year, up from 3% in 2007. Coal has seen its fuel share drop from a high of 40% in 2010 to a low of 28% in 2015, while gas has ranged from 38 to 48%.

“More wind is displacing some of the fossil fuels as the price disparities between gas and coal change through time,” Garza said.

She attributed much of the growth to wind energy’s higher capacity factors, a “reflection of improving and increasing technology.” Garza said the Monitor is also seeing an increase in installations on the Gulf of Mexico because the “wind output coincides more with load requirements” peaking in the afternoon.

Raising the question as to whether coal is “on the way out,” Garza pointed out that ERCOT’s coal fleet is “vintage.”

“What we see with our coal fleet,” she said, “is that the bulk of it was installed in the 70s and 80s. It’s achieving the end of its economic life as we speak.”

Ending Greens Bayou RMR to Save $21.9M

Magness told the board that terminating NRG Texas Power’s Greens Bayou Unit 5 reliability-must-run contract early will save the ERCOT market $21.9 million. He credited efforts made by staff and stakeholders to change protocols and criteria for reviewing RMR contracts, saying they “clearly had a big impact and allowed us to make this change.”

He also pointed to the Public Utility Commission of Texas’ RMR rulemaking, which is currently open to comments. The rule changes include requiring board approval of RMR contracts and adjusting the notice requirements and complaint timeline applicable to suspending a resource’s operation. (See “PUC Approves ERS, RMR Rulemakings,” Texas PUC Briefs.)

The Greens Bayou RMR contract was approved last June and scheduled to last through June 2018. It was expected to cost the market more than $58 million, but that number was revised down to $43.9 million in February. Instead, the early termination means ERCOT will only have made $22.1 million in standby payments to NRG at $3,185/hour during on-peak hours for the Houston-area plant.

ERCOT announced the contract’s termination in February. It said studies using new criteria indicated the unit would not be needed for transmission system reliability after Exelon’s 1,148-MW Colorado Bend II Generating Station in nearby Wharton County becomes operational in June. (See ERCOT Ending Greens Bayou RMR May 29.)

Magness also told the board that ERCOT now declares level 3 energy emergency alerts (EEA3) when operating reserves hit 1,375 MW, as required by NERC reliability standard EOP-011-1.

The ISO’s normal operating procedure had been to declare an EEA3 and load shed when reserves fall to 1,000 MW. It has revised its procedures to still go into load shed at 1,000 MW but declare the EEA3 earlier. Staff is drafting a revision request to change the EEA3 trigger in the protocols.

“Our studies have indicated as long as we have sufficient responsive reserves, we’re able to maintain and not need to go into load shed until 1,000 MW,” Magness said.

Dallas Fed: Texas Surviving an Oil Bust

Mine Yücel, senior vice president and research director for the Federal Reserve Bank of Dallas, once again delivered an annual report on the Texas economy, saying the state has survived the recent energy bust “with few deep scars.”

Yücel pointed to a 2.7% employment growth rate and 54,500 jobs created in the first two months of 2017, this after a 1.7% growth rate and 203,000 new jobs last year. The Fed is projecting a 2.3% growth rate and 280,000 new jobs in Texas this year.

“The worst may be behind us, but of course, we have quite a few risks,” Yücel said, alluding to oil prices and the dollar’s strength.

Despite a slowdown in the Permian Basin and the rest of the oil patch, Texas still saw more than 210,000 people migrate to the state from July 2015 to July 2016. That was a drop from about 260,000 the year prior and trails Florida nationally, but still outpaces California, New York and Illinois.

Multi-Interval

ERCOT Commercial Operations Vice President Kenan Ögelman shared staff’s Multi-Interval Real-Time Market (MIRTM) feasibility study with the board, getting little pushback with his recommendation that now is not the right time to implement the market.

Ögelman said the estimated $20 million cost of the market’s software would not produce sufficient production cost savings. The Technical Advisory Committee reached the same conclusion last month. (See ERCOT Technical Advisory Committee Briefs.)

“The study found there were production cost savings, but that was in the environment of $2 to $3 gas,” he said. “Unless you see gas prices driving up, I’m trying to create savings off a very low baseline price.”

ERCOT dispatches its market in five-minute intervals. Staff and stakeholders have been discussing potential alternatives under different names (look-ahead security-constrained economic dispatch, multi-interval SCED, etc.) since 2011.

“The question has been, can we improve the market’s efficiency and functionality by looking ahead longer than five minutes. At 15 minutes, we were more accurate with the forecast, but we left a lot of resources behind,” Ögelman said, referring to fast-responding resources and load resources that currently participate in the real-time market through voluntary self-commitment.

Ögelman said the TAC had assigned the Wholesale Marketing Subcommittee to consider whether real-time co-optimization might be a better solution to pursue. The subcommittee held a preliminary discussion April 5.

“It’s been dormant for a while,” Ögelman said of the optimization discussions. “There’s a need to get everyone up to speed on how it works.”

Board Approves 16 Revision Requests

The board’s consent agenda, approved unanimously, included 10 nodal protocol revision requests (NPRRs) and three revisions to the Planning Guide (PGRRs).

- NPRR776: Aligns protocol language with currently used verbal communication practices between transmission service providers (TSPs), qualified scheduling entities (QSEs) and generation resources. Also identifies new requirements for data that TSPs provide to ERCOT, QSEs and generators. The committee tabled NOGRR167, which aligns the Nodal Operating Guide with NPRR776.

- NPRR799: Requires that TSPs and resource entities — generation and load that can reduce electricity usage or provide ancillary services — submit updates to the outage scheduler within one hour of the facility’s outage start or completion.

- NPRR802: Clarifies current settlement practices and protocol language, including how reliability unit commitment resources opting out of RUC settlement are treated in calculating real-time online reserve capacity.

- NPRR804: Clarifies that ERCOT should post both a systemwide network model and a set of station one-line diagrams, and that the model posting does not disclose data about private-use networks.

- NPRR808: Extends the congestion revenue right (CRR) auction process into the third year forward, revises the percentages sold in the auction’s long-term sequence and aligns modifying load zones to the timetable.

- NPRR809: Defines the terms “initial energization” and “initial synchronization;” adds a reference to a quarterly stability assessment for interconnecting generation resources when evaluating the need for a generic transmission constraint; and clarifies a resource’s requirements prior to initial synchronization.

- NPRR810: Removes the applicability of an RMR’s incentive factor to reservation and transportation costs associated with firm-fuel supplies, and accordingly separates costs in the RMR standby payment equation.

- NPRR812: Clarifies short-term system adequacy report language; aligns protocol language with current ERCOT practices and Texas PUC rules for posting resource and load information; and modifies the requirement for posting a RUC initial-conditions report to only include the process as originally intended in NPRR314.

- NPRR813: Requires references to service organization controls for the annual ERCOT market settlement audits.

- NPRR818: Clarifies that the ISO can curtail DC tie loads during a watch, before declaring an emergency condition. (See ERCOT Stakeholders OK Change to DC Tie Curtailments.)

- PGRR052: Ensures a new generating unit’s operating limits are established by setting a timeline for stability studies following a full interconnection study (FIS), incorporating model data or transmission system changes, not known during the FIS, before a new unit is brought online.

- PGRR054: Clarifies the content, review period and process for posting an FIS’ results, and establishes a process for identifying, proposing and implementing solutions to stability issues identified during the FIS.

- PGRR055: Defines the process for revising the Planning Guide to first consider PGRRs at the subcommittee level.

— Tom Kleckner