By Amanda Durish Cook

MISO is recommending the addition of a fourth future to its 2018 transmission planning to reflect localized carbon reduction efforts and battery storage.

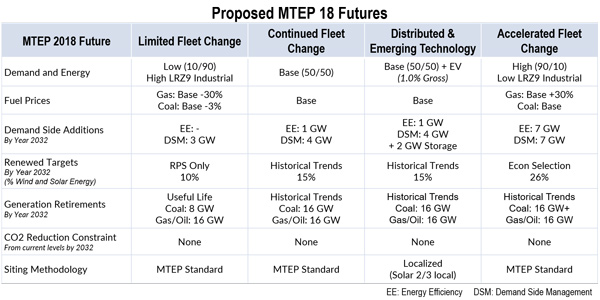

In addition to futures for “limited,” “continued” and “accelerated” fleet change, the RTO is proposing a distributed and emerging technologies scenario to inform its 2018 Transmission Expansion Plan.

Under the new distributed and emerging technology future, fleet evolution is driven by local and state policies and the adoption of emerging technology. Renewable additions are economically propelled by technological advancements and state renewable portfolio standards. Renewables, which are expected to provide 15% of total MISO energy by 2032, are sited within state jurisdictions for local energy use.

The future also predicts commercial mass production of energy storage devices. MISO envisions that natural gas reliance increases with more electric vehicles on the road, the need to support intermittent renewables and to replace retiring capacity. Natural gas prices stay consistent with long-term forecasts, with the RTO using the NYMEX for the first two years to forecast prices and an average of the U.S. Energy Information Administration and Wood Mackenzie forecasts for the remaining years. MISO also expects a surge in demand-side management programs.

MISO’s 2017 futures include an existing fleet future, policy regulations future and an accelerated alternative technologies future. (See MISO Stakeholders Seek Review of MTEP Futures Under Trump.) Using stakeholder feedback, the RTO will now use MTEP 17 definitions as “outlines” for MTEP 18, “but completely refresh forecasts.”

“Given trends, low gas price forecasts, member-stated plans and renewable potential, MISO feels it is necessary to consider fleet changes beyond those in the MTEP 17 policy regulation future,” the RTO said.

In addition to distributed technology scenario, the 15-year futures for 2018 are:

- A limited fleet change future assumes 8 GW of age-driven coal fleet retirements by 2032. Low demand and low prices for both natural gas and energy curb new energy generation technologies and keep renewable additions limited to current renewable portfolio standards, making up 10% of MISO resources by 2032. The low natural gas prices, however, drive an increase in industrial production along the Gulf Coast in MISO Zone 9.

- A continued fleet change future presumes the rate of fleet evolution remains as it has since about 2005. The assumed 16 GW of coal retirements is based on plant shutdowns at age 55-60, with natural gas additions largely replacing them. New renewable resources continue to exceed RPS requirements and serve 15% of MISO energy by 2032 because of continuing public interest, economics and future policy regulation.

- An accelerated fleet change hinges on a “robust” economy that drives demand and energy production. Natural gas prices rise as a result of demand, and carbon regulations aiming for a 20% reduction from current emissions levels are introduced. Coal retirements would surpass the “continued” future’s 16 GW, with natural gas sources stepping up to replace the lost capacity and provide a steady backup to renewable resources, which exceed RPS targets and make up 26% of MISO resources. High gas prices hinder industrial production along the Gulf Coast.

“It’s still very early” in the planning process, MISO engineer Stuart Hansen reminded stakeholders at an April 4 special workshop. “I think we’ve incorporated what makes sense, but we want to hear your ideas.”

Hansen said MISO will still model a future federal carbon emissions policy for the 2018 batch of transmission projects in the accelerated fleet change future by modeling 20% additional emissions reductions by 2030. “We know that the [Clean Power Plan] is no longer a hot topic, but to provide an adequate bookend … we’ll continue to model federal policy in the accelerated fleet change future.”

Some stakeholders expressed appreciation for the fourth future, saying even with the CPP no longer relevant in the near term, MISO will still need to capture a decreasing carbon trend led by economics, local efforts, state policy and corporate initiatives rather than federal policy.

Richard Seide of Apex Clean Energy asked if MISO planned to model utilities’ green tariffs and corporate purchasing of renewable power. Ann Benson, of MISO’s policy studies group, said the RTO could include renewable types and prices into the futures’ expected renewable portfolios.

Sean Brady of Wind on the Wires asked MISO to consider modeling future nuclear plant closings, especially in Illinois. In all MTEP 18 futures, nuclear units are assumed to remain online through their current operating licenses. The RTO also assumes 16 GW of natural gas and oil unit retirements by 2032 across all four futures.

More discussion on MTEP 18 futures development will take place at MISO’s monthly Planning Advisory Committee meetings through August.