By Tom Kleckner

The Public Utility Commission of Texas unanimously agreed Thursday that NextEra Energy’s proposed $18.7 billion acquisition of Texas utility Oncor is not “at this point” in the public interest.

“The tangible benefits to this transaction are few,” Nelson said. “In order to find this in the public interest, I would need to keep those ring-fencing provisions in place.”

“Bottom line, I do not find the tangible and quantifiable benefits are an improvement over the status quo to justify approval” of the deal, Anderson said, reading from a memo he later filed (Docket 46238). “To be honest, it has to do with their deal-killers.”

Commissioner Brandy Marty Marquez agreed with Anderson, saying she took NextEra “at its word” and complimented the company on its candor in the proceeding.

“I don’t believe they were posturing,” she said. “They were telling us quite clearly what they could and could not live with. I’m not happy to say that those were, unfortunately, the things I feel like we should not bend on.”

PUC staff will now draft a preliminary order that the commissioners can adopt during their April 13 open meeting.

Next Step Unclear

Whether this ends NextEra’s bid to acquire Oncor — which the Florida-based company has eyed for several years — remains to be seen. NextEra and Oncor representatives were not given an opportunity to appear before the PUC on Thursday, and both companies declined to comment on the commissioners’ remarks or next steps.

A previous attempt to acquire Oncor, by Dallas-based Hunt Consolidated, ended last May when Hunt withdrew its yearlong application over PUC requirements it found too onerous. (See Texas PUC Denies Rehearing on Oncor Sale, Ends Hunt Bid.)

Hunt officials would not say Thursday whether they hope to make another bid.

“We have a long-standing policy of not commenting on other parties’ regulatory proceedings,” said Hunt spokesperson Jeanne Phillips in a written statement. “We are watching these events with interest and will wait for the commission’s final vote.”

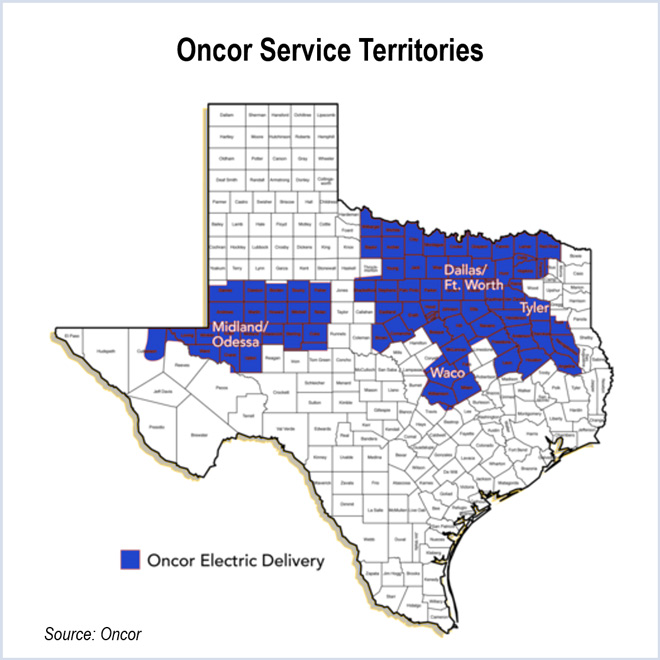

Oncor has long been considered the crown jewel of Energy Future Holdings’ assets. EFH — previously TXU Corp. before being acquired by private-equity firms in a leveraged buyout — declared Chapter 11 bankruptcy in 2014 and has since spun off its generation and retail electric service providers as part of Vistra Energy.

Board Independence Issue

The utility has been ring-fenced since the 2007 buyout. That helped insulate Oncor from much of the $45 billion in debt EFH had incurred when it declared bankruptcy.

“The lack of a truly independent disinterested board and the lack of independent board control over the dividends are what worry me the most,” Nelson said. “And unfortunately, those are the issues on which it seems NextEra Energy is not willing to budge.”

During a public hearing in February, NextEra told the PUC it needs to maintain control over Oncor’s board to ensure its ability to appoint or remove the utility’s directors. The company said that is a fair trade-off for lending its A- credit rating and $59.2 billion market capitalization to help Oncor eliminate debt left by EFH. (See Hearings Over, PUCT, NextEra Ponder Oncor ‘Deal-Killers’.)

In its most recent filing, NextEra said its proposed ring fence retains virtually all of the 2007 conditions, while adding additional protections “that would not impede consolidation of NextEra Energy’s and Oncor’s credit profiles.”

The company noted it is proposing “a comprehensive suite of 73 regulatory commitments,” some in response to staff and intervenor concerns.

“These regulatory commitments offer substantial protections and benefits for Oncor and its customers and are more than sufficient to protect Oncor and its customers from any perceived risks associated with NextEra Energy’s ownership of Oncor,” NextEra said.

Nelson also referenced a July 2016 ratings report from Moody’s Investor Service. She quoted the report as saying “the acquisition-related debt without a material amount of deleveraging would exhaust NextEra Energy’s debt capacity at its current rating” and “makes the company more vulnerable to unforeseen events or margin shortfalls.”

NextEra told the PUC in February it has $12.2 billion reserved for funding the transaction — $9.8 billion for an 80% interest in Oncor and $2.4 billion for a 20% interest in various holding companies. It would assume the remaining $6.5 billion in debt, in line with its 60/40 debt-to-equity ratio.

“I worry about removing the ring-fence protections in this situation, where the debt above Oncor isn’t being extinguished, but is instead being refinanced with new debt at NextEra Capital Holdings,” Nelson said. “The parent company will remain substantially leveraged in order to make the purchase happen.”

“I see as much downside as upside to linking Oncor’s credit rating to NextEra Energy,” Anderson said. “I would require staff’s version of the condition de-linking the respective credit ratings … but given that they are all also NextEra Energy deal-killers, it seems to me that we would be wasting time and resources to proceed further down the road of appearing to approve the transactions with such conditions.”