By Rory D. Sweeney

A financial trading firm accused PJM of unfairly discounting the interests of up-to-congestion traders in recent rule changes that it says would shift hundreds of millions in uplift charges to them from load.

“PJM is required to act as a neutral body without giving priority to one sector over others. XO is concerned that the packages promulgated by PJM and its [Independent Market Monitor] … benefits load while producing great harm to the Other Supplier Sector, including the financial community,” XO Energy President Shawn Sheehan wrote in a Feb. 24 letter to the Board of Managers.

The letter follows a phased set of rule changes that was overwhelmingly endorsed by the Markets and Reliability Committee in January and the Members Committee in February. (See “Work on Uplift Moves Forward Despite NOPR,” PJM Markets and Reliability and Members Committees Briefs.)

Phase 1 includes in the determination of balancing operating reserve credits only the day-ahead revenues from the hours the resource operated in real-time, not all day-ahead revenues. Phase 2 includes UTC transactions in the allocation of day-ahead and balancing operating reserves in the same way as incremental offers and decremental bids. It would also remove the ability for internal bilateral transactions to offset deviation charges.

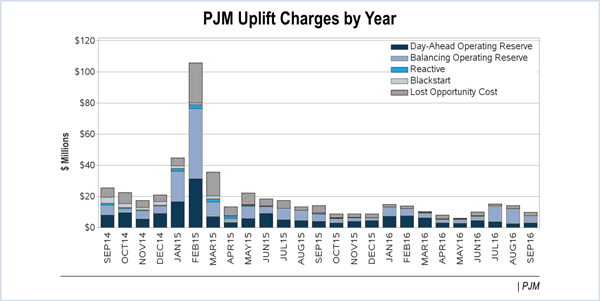

XO argues in its letter that the changes create a “triple capacity deviation,” although UTCs are intrinsically transmission products that don’t impact capacity. According to XO’s calculations, the changes will shift as much as 79% of the total real-time uplift charges and 25% of day-ahead uplift to UTCs — a total of more than $388.5 million.

The letter argues that PJM actively worked to force the changes through the stakeholder process and didn’t offer XO and its allies due process.

“XO is concerned that equitable, stakeholder-centric initiatives, which do not comport with fundamental market design principles, such as best practices and causation, are taking precedence” to sound market design, the letter reads. “In the past year or more, XO has witnessed an unwarranted negativity from PJM and its staff towards both financial products and the financial trading community. … Financial market participants feel bulldozed by PJM’s perceived priority in advancing its own proposals through the voting process and its favoritism of other [stakeholder] sectors. These actions are strongly affecting market participants’ confidence in PJM’s ‘neutral’ administration of its duties and its operation of a fair and efficient market.”

PJM did not immediately respond to a request for comment.

The complaint is the latest chapter in a long-running battle among PJM stakeholders over the value of financial products such as UTCs and whether they are paying their fair share of costs.

FERC weighed in on the issue in its Jan. 19 Notice of Proposed Rulemaking on uplift and UTCs. (See FERC Proposes More Transparency, Cost Causation on Uplift.)

XO contends that PJM ignored FERC’s direction in its proposed Phase 3 package that would limit UTCs to zones, hubs and aggregates. Such changes “would effectively remove the products’ ability to mitigate local market power and converge nodal congestion,” the company said. “FERC has repeatedly held that convergence of the day-ahead and real-time markets is a key measure of market efficiency.”