By Tom Kleckner

AUSTIN, Texas — NextEra Energy CEO Jim Robo made a last-minute appearance before Texas regulators Thursday —leaving nothing to chance in the company’s pursuit of Oncor, the Lone Star State’s largest utility.

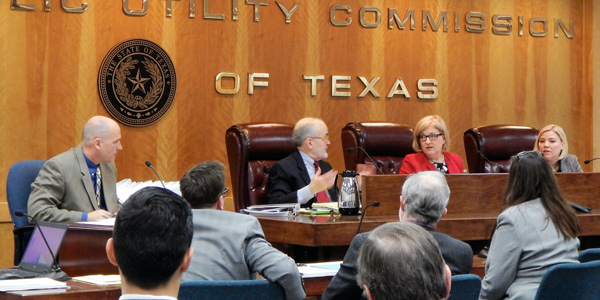

NextEra offered up Robo to the Public Utility Commission after the first two days of hearings on NextEra’s proposed $18.7 billion deal, which the CEO told the commissioners he had watched online (Docket 46238).

Texas Ties

Having heard concerns from the commissioners over Oncor’s out-of-state ownership, he was quick to play up his Texas ties, noting his wife is from Dallas, their marriage took place in Dallas and he has in-laws in Waco.

“There’s been a lot of talk and discussion about how Oncor is a gem, and I couldn’t agree more,” Robo said. “I’ve been very clear … I love the Oncor management team. I’ve asked every one of them to stay. I do know this: As good as Oncor is, as terrific a company as NextEra is, we will be a better utility together. That’s my vision.”

Robo said Oncor and NextEra’s utility, Florida Power & Light, will be able to share best practices, benefiting both utilities. Oncor CEO Bob Shapard’s “team will teach us things; we’ll teach Bob’s team things. We’ll be a better company going forward,” he said.

Robo addressed the commissioners’ concerns over NextEra’s unregulated businesses, citing his “very clear business strategy of de-risking” them, and whether NextEra would try to pass on affiliate costs from its subsidiaries in Oncor’s upcoming rate case. “Our intention is not to layer costs on Texas customers,” he said.

Robo then reviewed a list of 68 regulatory commitments NextEra had made to the PUC, some of which have been revised by PUC staff. Mark Hickson, the company’s executive vice president of corporate development, strategy and integration, had answered questions from the commissioners on the same commitments the day before. (See NextEra Still Faces Skepticism over Oncor Acquisition.)

Dealbreakers?

Staff expressed concerns over NextEra’s commitments dealing with existing legacy debt, credit ratings, the makeup of Oncor’s board of directors, budgets, dividend policies and ring-fencing measures to protect Oncor customers. “NextEra Energy proposes transactions funded with high levels of debt that would significantly increase NextEra Energy’s debt as a percentage of total capitalization, while removing the protective ring fencing currently protecting Oncor,” staff wrote.

Staff and intervenors have called for stronger ring-fence measures than those proposed by NextEra, with staff saying the deal “would expose Oncor to the substantial risks of NextEra Energy’s nonregulated businesses, which carry much more risk than that of a [transmission and distribution] utility.” A strong ring fence insulated Oncor from the Chapter 11 bankruptcy that took down Energy Future Holdings, the company formed by private equity investors following a leveraged buyout of TXU Corp. in 2007. (See NextEra Energy Talks Up its Oncor Acquisition.)

Robo said several of staff’s revisions to NextEra’s commitments would qualify as “burdensome conditions” or “deal-killers.” He said a number of staff’s proposed changes would affect how credit-rating agencies viewed the deal.

“I appreciate you coming in and being so frank,” Commissioner Brandy Marty Marquez said.

“I feel very strongly that when we make commitments, we’ll do what we say,” Robo responded.

NextEra’s legal staff will submit a new document in the record Friday morning, when the hearings will conclude, reflecting Robo and Hickson’s comments on the regulatory commitments.

Not on the Record

Robo did not testify on the record and was not made available for comment afterward. He answered the commissioners’ questions in what was an emergency open meeting of the PUC — framed as an opportunity to visit with the commissioners and get to know them better.

“We envision [Robo’s] discussion as a statement of opportunity and to discuss the company’s position,” said NextEra’s lead legal counsel, Anne Coffin. “This would be a duly noticed open meeting. It’s no different than calling people up before regular open meetings. It’s not evidence, it’s simply dialogue.”

Attorneys for the intervenors declined an opportunity to put Robo under oath, agreeing to expedite the hearings by having their witnesses respond to Robo’s comments following the open meeting.

The PUC has an April 29 deadline to issue a decision on NextEra’s bid.