By Tom Kleckner

DALLAS — SPP stakeholders last week endorsed $201.5 million in transmission projects as part of the RTO’s Integrated Transmission Planning process, despite objections from several entities.

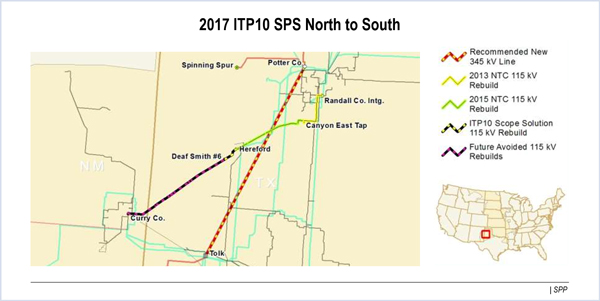

The ITP’s final 2017 10-Year Assessment recommended 14 projects in the southern part of SPP’s footprint, clustered in the Texas-Oklahoma Panhandle and along its eastern seam. Staff said the projects have an annual production cost benefit of $59 million and will solve long-standing congestion issues in West Texas.

Bill Grant, director of strategic planning for Southwestern Public Service, pushed back against the Transmission and Economic Studies working groups’ recommendation to the Markets and Operations Policy Committee, saying a 90-mile, 345-kV line in SPS’s service territory is “the right project but the wrong time.”

The proposed $144 million project would run southwest of Amarillo to SPS’s Tolk Generating Station near Muleshoe. Tolk consists of two 350-MW coal-fired units that date back to the early 1980s. SPS is currently evaluating whether to keep the plant operating.

“We think it’s a good project, but it’s not a good economic project at this time,” Grant told RTO Insider. “We think it’s best as a long-term project. If we do shut the plant down, restudying the project makes sense.”

Grant said SPS will be making some “major resource decisions” over the next few years. He said one of his company’s customers will begin buying power from one of its own affiliates, an unnamed SPP member, leaving SPS in a “resource flux.” Grant said he expects the resource plan to “clarify the need for this line in time.”

Tolk was one of seven Texas coal plants targeted by EPA for affecting air quality in the Big Bend and Guadalupe Mountains national parks along the Mexican border. The agency in November withdrew a requirement that the plants reduce their emissions, but Tolk is still facing potential future water-supply shortages.

“The concern we have is the removal of [the] regional haze [rule] changes the outlook,” Grant said. “I’m not questioning the analysis, but I am questioning the timing of the recommendation, because there’s so much unknown at this time.”

The company sees a long-term need for a 345-kV line in that area but would “feel better” about a decision in the future, he said.

SPP staff said the project would ease congestion in the corridor but could also avoid potential costs of up to $120 million from incremental upgrades in future studies. Staff also said the Potter-Tolk line improves voltage stability limits in SPS’s south load pocket and would ease a generation interconnection queue filled with wind projects.

“There is a significant price difference between resources in the southern end and SPS resources in the north,” said Antoine Lucas, SPP’s director of transmission planning. “Cheaper energy is looking to flow south, but a lack of transmission is causing a constraint and driving costs up in the SPS zone.”

Grant cast one of seven opposing votes against the recommendation. Eight other members abstained.

“I’m just trying to caution [everyone],” Grant said. “I don’t want to go through another Walkemeyer, but that may be exactly where we’re headed.”

Grant was referring to SPP’s first competitive project under FERC Order 1000, which was awarded to the incumbent transmission owner but then pulled when changing load projections rendered the project moot. SPP staff will determine whether any of the 14 projects will be deemed competitive projects. (See SPP Cancels First Competitive Tx Project, Citing Falling Demand Projections.)

The Potter-Tolk line was one of two projects staff identified through an “alternative project analysis” to evaluate needs in support of SPP initiatives along the seams or solving congestion and operational problems.

That analysis also recommended a 345/161-kV transformer and 161-kV line upgrade in southwestern Missouri near Springfield. The line connects to an Associated Electric Cooperative Inc. substation in Morgan and could qualify as a seams project pending negotiations with AECI. (See “SPP-AECI Joint Study Recommends Two Projects,” SPP Seams Steering Committee Briefs.)

SPP staff also performed additional analysis to ensure that transmission model updates and the 2016 near-term projects were included in its recommendations.

The 2017 ITP10 considered three futures: regional and state approaches to carbon reductions as a result of the now-endangered Clean Power Plan, and a business-as-usual reference case.

Supplemental Analysis Incorporated into 2017 ITPNT

The MOPC unanimously endorsed the TWG’s supplemental analysis incorporating newly issued and withdrawn notices-to-construct (NTC) from the 2016 ITP Near-Term Assessment into the 2017 ITPNT. The additional analysis helped better inform the ITPNT decisions because the NTCs and withdrawals occurred after the 2017 ITP10 models had been completed.

Lucas said the supplemental analysis was done to help bridge the gap between the ITP’s new and old processes. A final near-term assessment will be conducted for 2018.

MOPC Chair Paul Malone asked Lucas whether SPP also analyzes the transmission systems of new members coming into the RTO.

“We look at the existing systems based on SPP criteria and ensure the necessary upgrades have been completed before they roll into the network,” Lucas said.

As part of its analysis, staff evaluated 420 detailed project proposals — down “significantly” from years past, Lucas said — and made 131 model corrections.

A draft 2017 ITPNT portfolio was issued Jan. 6. Transmission owners and interested competitive developers will have until Feb. 3 to provide study cost estimates to SPP. An updated project portfolio will be shared during a Feb. 23 planning summit, and a draft report and recommendations will be made for the April MOPC and Board of Directors meetings.

MOPC Approves Change to Renewables Modeling

The MOPC also endorsed a revision to the Transmission Process Improvement Task Force’s (TPITF) white paper that the committee approved last July. The TPITF has been charged with combining SPP’s various planning efforts into one annual cycle, set to begin in 2018.

In recommending a common planning model, the task force has first suggested modeling renewable facilities with firm service at their highest summer output over a three-year period, with off-peak and light load modeled at 100% of firm service.

The new language recommends those resources with firm service “be modeled in the summer peak base scenario model at each facility’s latest five-year average for the SPP coincident summer peak, not to exceed each facility’s firm service.” Non-firm service will be modeled at zero.

The measure passed with four abstentions.

Brian Gedrich, the group’s chair and executive director of development for NextEra Energy Transmission, said the change was necessary because SPP’s wind output has been approaching 100% firm transmission-service levels during summer peak conditions.

However, several MOPC members expressed their concern with their inability to use SPP’s financial hedging instruments to pay for congestion costs.

“We build to the specifics of firm transmission … but [financial transmission rights] are not happening. We have an obligation to manage that,” Grant said. “This proposal is a compromise — a good compromise — but our concern is not being financially hedged against projects where we’ve paid for an upgrade, and then [do] not get the hedge.”

“This impacts our customers,” said Oklahoma Gas & Electric’s Greg McAuley. “They’ve had to pay for firm service, and now they’re paying congestion charges and new transmission charges. As we’ve discussed here, we really don’t have a hedge. All this planning, yet customers are paying for all this congestion. We’re asking ourselves, how did we end up like this?”

“We’re on a journey. This is a first step,” Gedrich said. “We may find over time this five-year average is too generous, it’s too optimistic.”

Nearly $2B in Projects Completed, Approved in 2016

SPP staff reported that members completed 78 upgrades totaling $939 million in 2016, while NTCs were issued for another 138 projects worth an additional $992 million.

ITP projects accounted for $1.4 billion of the total: $582.3 million for 44 completed projects and $859.5 million in NTCs.

The projects are part of SPP’s Transmission Expansion Plan. The MOPC unanimously endorsed staff’s recommendation that the board accept the 2017 STEP report as documenting completion of the Tariff’s Attachment O transmission planning process.