By Robert Mullin

California will require improved transmission access to a diverse set of renewable resources throughout the state and the broader West to cost-effectively meet its renewable energy and greenhouse gas reduction targets, according to a report released by the state’s Energy Commission.

Increasing solar generation will lead to rising costs stemming from the need to curtail surpluses during periods of high output and shore up system, and flexible, capacity during other times of the day, the report found.

A technologically and geographically balanced portfolio of resources would help offset the technical risks of California’s growing reliance on in-state solar generation, while the upgraded transmission required to access those resources could enable the state to export surplus solar outside the state.

The study was conducted on behalf of the multiagency Renewable Energy Transmission Initiative (RETI), a collaboration that includes CAISO, the state’s major municipal and investor-owned utilities, the Western Area Power Administration and the California Natural Resources Agency.

The outcome of a yearlong effort, the RETI report provided a “high-level visioning process about what it might take” for California to meet its 2030 mandates for generating 50% of the state’s electricity from renewable resources and reducing GHG emissions to 40% below 1990 levels, RETI project director Brian Turner said during a Jan. 4 call to discuss the report.

Turner was careful to point out that the report did not represent “a projection or goal for any total quantity of renewable energy statewide or in any specific areas” or advocate for any specific transmission or generation projects.

And while the study focuses on the potential for utility-scale renewable development in California and the rest of the West, Turner noted that it is not intended to express a preference for utility-scale energy over other strategies to help the state meet its goals.

“The overall flavor — objective — here is really one big, ‘What if?’” Turner told RTO Insider.

The RETI project poses a set of interrelated questions: “To meet [the state mandates], what might it require in terms of renewables? And, if it requires [a certain] level of renewables, what transmission might be required? And if that transmission were required, what cost, environmental and land-use implications might it entail?”

The report is the most comprehensive effort to date to draw on available information to scope out the most cost-effective transmission solutions for meeting California’s goals. It relies on information about the most promising areas for renewable development, environmental and local land-use policies within California and the potential for collaboration with the wider West.

“One of the questions to ask is: ‘Did we get the synthesis right?’” Turner said during the Jan. 4 CEC call, soliciting feedback from industry participants.

The study assumes that for California to meet its 50% renewable portfolio standard, the state will need to tap an additional 25 to 53 TWh of renewable energy between 2020 and 2030. Based on a 30% capacity factor, that translates into a need for 9.4 to 20.3 GW of new renewable capacity. That figure spikes to 76 TWh (29 GW) under a scenario of accelerated vehicle electrification in the state.

While low-cost utility-scale solar is already cost-competitive throughout California, its continued growth will become costly without the integration of other types of renewable resources to balance out the generation profile for solar.

“Without integration solutions, continued growth in solar PV resources will lead to increased costs from a surplus of generation during high solar periods and a shortage of system and flexible capacity at other times,” the report said. CAISO late last year incorporated into its real-time market a mechanism for procuring upward and downward flexible ramping capability in order to respond to variability from renewable sources, the costs for which are borne by load-serving entities and ultimately ratepayers. (See FERC OKs Ramping Product for CAISO, EIM.)

To counter that effect, California will require access to low-cost renewable resources both inside and outside the state, “especially wind and geothermal resources with generation profiles complementary to California solar generation.” The state’s power producers will also need access to energy markets outside California to offload excess generation and reduce ratepayer costs, the study said.

While California has a “substantial amount” of non-firm capacity to interconnect new generators as “energy-only” resources subject to curtailment, the state falls short in the availability of full-capacity interconnections equipped to ensure that output is “fully deliverable” — capable of reaching its load sink without hitting potential constraints.

That distinction is important because under California Public Utilities Commission rules, only fully deliverable resources can be counted toward a utility’s resource adequacy requirements.

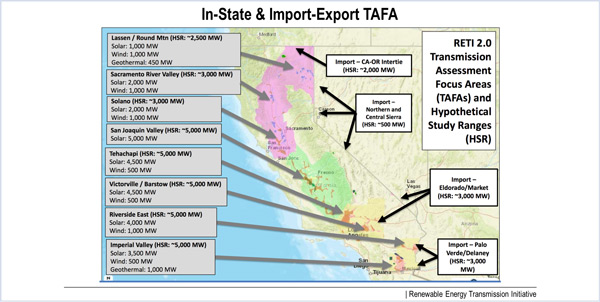

The distinction also underlies the RETI report’s assumptions about the hypothetical potential for development of wind, solar and geothermal development in eight transmission assessment focus areas (TAFAs) where large quantities of resources could be constructed to meet the state’s goals.

In most of the TAFAs, full deliverability of new resources would require a significant investment in transmission upgrades in order to relieve constraints. (See Price Tag on Tx Needed to Meet California 50% RPS: $5B?) Development in other TAFAs could be constrained by environmental restrictions or land-use rules.

The Imperial Valley TAFA shows some of the strongest potential for development based on a “hypothetical study range” (HSR) of an additional 3,500 MW of solar and 1,000 MW of geothermal and the existence of favorable land-use planning. New transmission would be necessary to achieve full deliverability.

Development of 4,000 MW of new solar in the Riverside East TAFA would be feasible because of extensive planning on U.S. Bureau of Land Management land through the Desert Renewable Energy Conservation Plan. (See Interior Dept. Approves First Phase of California Desert Renewable Plan.) Constructing 500 to 1,000 MW of wind would be less likely because of environmental and land-use restrictions.

While existing transmission in both the Imperial Valley and Riverside East areas could accommodate the lower end of new renewable development estimates, build-out at the high end of the HSR could require up to $1 billion in transmission upgrades to relieve the so-called “Desert Area Constraint” east of the Miguel substation.

The sprawling San Joaquin Valley TAFA shows potential for 5,000 MW of new solar development, in part through the reuse of “degraded” — or disused industrial — land, but development could require “substantial” investment in upgrading the region’s low-voltage network.

Full development of Northern California’s renewable potential is considered less likely because of a lack of environmental and land-use planning, as well as limited transmission availability. Tapping an estimated 5,450 MW of wind, solar and geothermal resources could cost between $2 billion and $4 billion in new transmission.

The possibilities for development along import-export paths is a mixed bag, according to the report.

Importing an additional 2,000 MW via the California-Oregon Intertie (COI), a major import point from the Pacific Northwest, is not considered feasible without construction of a new 500-kV line from the Oregon border to Tracy, Calif. Still, new transmission built elsewhere in the West and the possibility of dynamic line ratings could result in increased capacity on the line.

Also, the largely underutilized northbound segment of the COI could transmit 3,000 MW worth of solar exports from California.

“Being in the Northwest, we’re very interested in what are the implications for us,” said Fred Heutte, senior policy associate with the Northwest Energy Coalition, an alliance including environmental organizations, utilities and businesses in Oregon, Washington, Idaho, Montana and British Columbia.

Path 46 out of Arizona has the capacity to accommodate an additional 3,000 MW of imports, although substantial resource development could eventually trigger the Desert Area Constraint, the report said.

“This is quite an impressive bit of work in quite a compressed timeline,” Carl Zichella, director of western transmission for the Natural Resources Defense Council, said of the RETI report. “This is very, very useful work.”

The CEC is seeking comments on the draft final report by Jan. 10. A final study is expected to be issued by the end of this month.