By Tom Kleckner

ERCOT’s electricity demand continues to grow more rapidly than expected, and while reserve margins are projected to shrink slightly, the Texas ISO says it still has sufficient capacity to support system reliability.

“Based on the information we have today and current planning criteria, we continue to see sufficient planning reserve margins through most of the 10-year planning horizon,” ERCOT’s senior director of system planning, Warren Lasher, said Thursday.

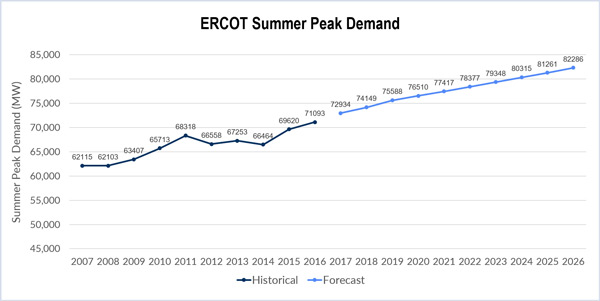

The Texas grid operator’s latest Capacity, Demand and Reserves (CDR) report, released last week, indicates next summer’s peak demand will reach nearly 73,000 MW, growing to more than 77,000 MW by summer 2021. ERCOT set a new system peak this summer when it reached 71,110 MW on Aug. 11.

The ISO expects to have more than 82,000 MW of capacity available for next summer and more than 88,000 MW by summer 2021.

The increased load growth will cut the ISO’s reserve margin to 16.9%, down from the May 2016 forecast of 18.2%. The CDR sees the reserve margin climbing to 10.2% in 2018 but dropping to 19% in 2021 — still well above ERCOT’s 13.75% target.

ERCOT attributes the load growth to the state’s strong economy, fueled by a rebounding petroleum market and high-tech jobs in Central Texas.

“We’re seeing stronger growth than Moody’s projected a year ago,” said ERCOT Manager of Load Forecasting and Analysis Calvin Opheim. “Texas growth used to be tied to oil and gas and drilling. Those [industries] appear to be coming back alive, but when you come into Central Texas and San Antonio, a lot of people are moving here for well-paying jobs” in other industries.

Opheim said Moody’s forecast for Central Texas, which ERCOT incorporates in its planning models, projects employment growth rates of more than 3% in 2021.

The Federal Reserve Bank of Texas is also optimistic, saying a stabilized energy sector, recent improvements in the manufacturing sector and increased optimism by Texas businesses will likely lead to a “moderately” improved economy in 2017.

ERCOT’s demand in November 2016 was already up 11.2% compared to November 2015.

The new CDR shows almost 2,700 MW of new capacity since the May report, including 1,188 MW of wind and 262 MW of solar. ERCOT surpassed 500 MW of installed solar resources when a 160-MW project in West Texas was synched to the grid in November.

By next summer, the ISO expects to add nearly 3,000 MW of wind, more than 450 MW of solar and 2,660 MW of gas resources — more than 2,150 MW coming from two units near Houston and Fort Worth.

Planned resources reflect more than 10,000 MW of additional capacity by 2021.

The ISO’s long-term forecast, which is updated annually, includes the addition of a new LNG facility being developed on the Gulf Coast, but it doesn’t take into account Lubbock Power and Light’s proposed migration of 430 MW of load from SPP to ERCOT.