MISO said last week that it is ready to begin introducing improved modeling of its combined cycle generating fleet.

The RTO will use a configuration-based combined cycle model that can mimic different combinations of combined cycle units and their dependencies, Yonghong Chen, MISO principal advisor of market development and analysis, said during a Nov. 1 Market Subcommittee conference call.

Currently, MISO’s roughly 40 combined cycle unit “groups” are subject to an aggregate model in which they must either bid as a single generator or bid as separate combustion or steam turbines; dependencies between the units are not modeled. A generator with two combustion turbines and one steam turbine would constitute a “group.”

MISO said the new modeling will increase bid accuracy and prevent infeasible scheduling. Chen said the RTO performed a rough analysis using eight sample cases and found the new model could have saved $47 million in annual production costs in 2014 and $16 million in 2015. The analysis studied MISO’s 20 combined cycle groups with reliable configuration data and assumed other combined cycles would stick to the aggregated model.

Chen said the modeling can be used with the current 40 combined cycle generator groups in MISO’s system, but doubling or tripling the number of groups under the model would create computational challenges.

She also said MISO will look for further improvements and continue to study the benefits of the new modeling throughout 2017 using more updated offer data from resource owners and optimization software from programming firm Gurobi Optimization.

Jeff Bladen, executive director of MISO market services, said the RTO “expects to spend meaningful resources on combined cycle generators” in 2017 given the potential benefits.

MISO May Tweak Emergency Pricing Floors

Following a summertime emergency pricing event that resulted in depressed prices, MISO is considering changing its emergency offer floor calculations to expand the pricing logic to more emergency power.

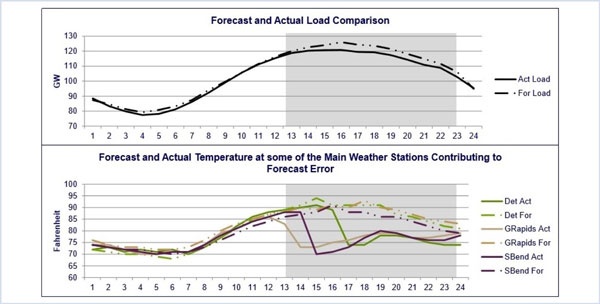

MISO had been monitoring performance of its two emergency pricing floors since July 21, the first maximum generation event since the 2014 polar vortex. Based on a forecast that average temperatures in the footprint would hit a record of 91, load on July 21 was predicted to hit 130 GW. But the load didn’t materialize because of thunderstorms that lowered temperatures. (See “New Emergency Pricing Floors Undergoing Monitoring,” MISO Market Subcommittee Briefs.)

Michael Robinson, principal adviser of market design, said MISO is mulling five possible approaches, all of which require Tariff changes:

- Implementing an offer cap to the emergency offer floors, which unlike the other solutions would not require a software change;

- Allocating the commitment costs of offline fast-start units into the minimum run time when calculating the offer floor;

- Expanding the emergency pricing logic to allow emergency-committed units dispatched at their economic minimum prices to set emergency prices, similar to how fast-start resources can set prices under extended locational marginal pricing;

- Applying emergency pricing to non-firm export curtailments; and

- Evaluating the need to further compensate deployed emergency resources when LMPs, make-whole uplift and capacity credits are not sufficient.

Robinson said MISO could consider further changes as well. MISO is asking for stakeholder input through Nov. 18.

“We want to make sure we’re sending the right prices to as many generators called up as we can,” Bladen told stakeholders.

— Amanda Durish Cook