By William Opalka

WESTBOROUGH, Mass. — ISO-NE’s latest briefing on its ongoing economic study focused on the shortfall of energy market revenues, prospects for storage and the ability to meet increased renewable portfolio standards.

Planners told the Planning Advisory Committee on Wednesday that uplift and capacity revenues will become increasingly important because energy market revenues will be insufficient to support any form of new generation in 2025 or 2030, the two time horizons in the draft study.

“Additional revenue from other sources will be needed to support new resources, as the energy market contribution isn’t sufficient to cover fixed costs,” said Michael Henderson, director of regional planning and coordination at ISO-NE.

The economic study is simulating five scenarios related to the changing mix of the New England power fleet as the states move to decarbonize the power sector. (See 5 Resource Scenarios Presented to ISO-NE Planning Advisory Committee.)

In the simulations, energy market revenues are below annual carrying charges for all new generation resources, including wind, solar photovoltaic, natural gas combined cycle and combustion turbines. Units would recover some costs through energy market revenues plus uplift, the study says. Resources also would need “significant revenues” from the capacity market, Henderson added.

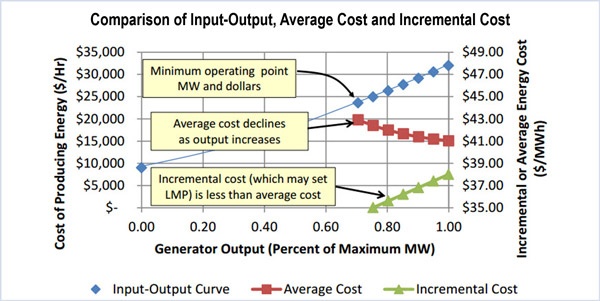

The study says the shortfall results because cheap gas-fired units typically set LMPs and higher-cost resources are rarely on the margin.

Another factor is low- or no-cost resources. The region is experiencing little or no load growth as the states have made significant commitments to behind-the-meter solar resources and energy efficiency. Wind and PV that aren’t behind the meter are price takers.

Uplift would be highest in 2025 under scenario 2 — in which all additional capacity needs, including retirements, are met with new renewable and clean energy resources, including nuclear power — hitting almost $179 million assuming no transmission constraints.

The lowest uplift — $88 million — is under scenario 5, in which RPS requirements are met by resources interconnected to the system, under construction or approved as of April 1, 2016, with alternative compliance payments used to meet any remaining RPS requirements. Retired units would be replaced with combined cycle plants to meet installed capacity requirements.

In 2015, uplift payments to resources operated out of merit — typically to ensure power system reliability — totaled $119 million, 2% of the total energy payments of $5.9 billion, according to Internal Market Monitor’s 2015 Annual Markets Report.

Energy Storage

The study found that net revenues for energy storage increase along with more production by renewable resources.

Net revenues would be highest under the “RPS-plus scenario,” which assumes additional renewable and clean energy resources above existing RPS requirements. Annual net revenues — revenue from generation minus the cost of storing energy — are projected to total more than $12 million in 2025 under the scenario, assuming no transmission constraints.

By contrast, storage would show negative net revenues of $1.5 million under scenario 5.

Increasing RPS

The study finds that scenarios 1, 2 and 3 all can meet the projected growth in the new RPS target for 2025 (8,069 GWh) and 2030 (10,806 GWh), although scenario 1 barely meets the 2030 target under a constrained transmission system.

Meeting the RPS targets under scenarios 4 and 5 would require the addition of more renewable resources, imports, alternative compliance payments or reducing RPS targets by adding energy efficiency and behind-the-meter solar.