By Suzanne Herel

VALLEY FORGE, Pa. — After PJM’s Craig Glazer started with the food analogies, speakers at Thursday’s Grid 20/20 symposium couldn’t resist serving up a smorgasbord of edible metaphors.

Glazer, vice president of federal government policy, kicked off the conference, “Focus on Public Policy Goals and Market Efficiency,” talking about apples as a stand-in for power. To the laughter of the overflow audience, a slide depicted a grocery store display pricing the fruit to reflect subsidies (49 cents), subject to partial FRR adjustments (58 cents), MOPR’D per PJM rules (60 cents) and cleansed of all subsidies (65 cents).

Currently, the recipe for competitive markets doesn’t call for carbon reduction, the preservation of jobs and tax bases, or the retention of uneconomic plants, he said. But these are among the public policy goals that some states are looking to achieve.

“A state could say, ‘Just add my one little ingredient,’” Glazer said. “The result isn’t just the most efficient solution for state A. Everybody gets it. How do we not force it on states B and C, who haven’t authorized us to put that ingredient into the blender?”

Symposium Follows PJM Study

The topic for the confab grew out of a controversial white paper PJM published in May, “Resource Investment in Competitive Markets.” (See PJM Study Defends Markets, Warns State Policies can Harm Competition.)

Penned amid efforts by money-losing coal-fired generators in Ohio and nuclear generators in Illinois to win state-backed subsidies, the report concluded that PJM’s markets efficiently manage the entry and exit of capacity resources, but they could be hamstrung by policies to protect social, economic or political interests.

The study drew a volley of critical correspondence to the Board of Managers from generators who said it presented a skewed view of the risks and benefits associated with competitive markets as compared with the traditional regulated model. (See Generators Rebut PJM Study on Investment in Competitive Markets.)

The subject incited just as lively of a debate at last week’s forum, which consisted of three panels: defining the problem, discussing traditional responses and studying alternative solutions.

Tony Clark: ‘A Real Challenge’

FERC Commissioner Tony Clark, who will be leaving his post next month, delivered the opening remarks. Clark said that integrating public policies into competitive markets has become an increasing challenge for regulators.

“It’s going to be at the core and heart of what FERC is doing over the next several years and what states are going to be doing,” he said. “It’s going to last long past the next six weeks of my tenure, I can guarantee that.”

Although FERC’s job is not “passing philosophical judgement” on state policies, he said, those policies impact the commission’s jurisdiction over wholesale markets.

“We have the responsibility for just and reasonable rates,” he said. “There may be an iterative process where we try to set the boundaries and bumpers around what is permissible and what is not. But it’s not going to be an easy process.”

Even states that share a goal — such as the nine in the Regional Greenhouse Gas Initiative — can have differing ideas of how to reach the objective, said Marc Montalvo, president of Daymark Energy Advisors, who spoke with Glazer on the first panel.

State policies also can have unintended consequences, he said, citing the challenges faced by California and Hawaii, which are chasing ambitious renewable power goals.

“Every last region inside of the country is wrestling with the same issues. We want to make sure we’re doing smart investments, protecting consumers, respecting competitiveness,” he said. “All of us who are working in the markets are trying to figure a way to mix that batter up to make a delicious pancake.”

How Can PJM Markets Change?

The second panel was led by Hung-po Chao, senior director of economics for PJM. Panelists were Independent Market Monitor Joe Bowring; Steve Schleimer, senior vice president of government and regulatory affairs for Calpine; Susan Bruce, an attorney representing the PJM Industrial Customer Coalition; Jim Wilson of Wilson Energy Economics; and Lisa McAlister, deputy general counsel for American Municipal Power.

“The competitive wholesale market was designed to address and ensure reliable supply and an efficient market that includes resource adequacy issues,” Chao started off. “It was not designed to accommodate many other social objectives, like a clean environment. Here the question is: As these policy challenges are upon us, are there things that the PJM electricity markets can change to accommodate positive externalities?”

Playing off of one of Glazer’s analogies, McAlister said that just one kitchen tool — a blender — can’t make every dish.

“Unlike a real competitive market, the current PJM capacity construct is not sufficiently robust to accommodate unforeseen events,” McAlister said. “Adding another tweak to the 24 major adjustments since 2010 will only add another layer of complexity and uncertainty. It is time to look at simpler constructs that would be more resilient in the face of constant change.”

At Thursday’s Markets and Reliability Committee meeting, AMP’s Ed Tatum will be seeking support for an initiative to consider an overhaul of the capacity market. (See related story, Co-ops, Munis Call for Reset of PJM Capacity Model.)

Wilson agreed that changes to the capacity market are needed.

PJM’s changing resource mix is creating a need for flexible capacity, he said. “All of that is valued properly in the energy and ancillary services markets” he said, but not in the capacity market.

Schleimer took a different view, saying that without the capacity market, there would be no independent power producers, and consumers would be shouldering the risk of building generation under state integrated resource plans.

“When you have more apples on hand than you will ever need, costs are always going to be low. You can either have an energy market with scarcity pricing, or you can have a capacity market to allow investors a reasonable opportunity to recover their capital,” he said. “Where do we want to end up 10, 20 years from now? In a world where new investment is only made from rate base?”

“I don’t know if we have a strong view decided on this because it’s such a difficult question and the history of this issue is so important to it,” responded Bruce.

She recalled 1997, when Pennsylvania’s Electricity Generation Choice and Competition Act went into effect. “The ideas of markets and shifting the risk away from customers was something attractive to industrial customers,” she said. “The driver was to reduce cost, reduce risk for customers.”

The Origin of the Markets

Bowring agreed. “The markets have worked very well. You have to remember where restructured markets came from — they’re an alternative to a regime in which public utilities commissions made decisions, many opaque, various policies of many kinds,” he said. “It was a conscious decision to move to markets.”

He said there exist ways aside from subsidies to achieve public policy goals. For example, he said, “If you want to deal with carbon, have a carbon price; don’t subsidize nuclear, have a carbon price.”

He was referring to New York’s recent adoption of the Clean Energy Standard, which includes a zero-emission credit for struggling nuclear power plants. (See New York Adopts Clean Energy Standard, Nuclear Subsidy.)

“Markets can’t handle the recent attempts to intervene in the market in Ohio on behalf of companies that wanted subsidies in their favor,” Bowring said. “That’s fallen by the wayside for various reasons, but we do need tools to address that type of intervention. We need to continue to react to change. The market has to be flexible, and the market designers have to be flexible.

“The reason we have markets is to provide power to customers at the lowest possible [cost]. We have to be careful not to let other aspects of the debate interfere with that or undermine them. Markets are more fragile than we all think, and they could go away fairly easily.”

Capacity Market at Risk?

The third panel, moderated by Vince Duane, PJM’s senior vice president for law, compliance and external relations, hosted William Berg, vice president of wholesale market development for Exelon; Peter Fuller, vice president of market and regulatory affairs for NRG Energy; Stu Bresler, PJM’s senior vice president of operations and markets; Raymond DePillo, senior director of market development for PSEG Energy Resources and Trade; and John Moore, senior attorney for the Sustainable FERC Project.

Asked if the capacity market is at risk, Bresler said, “I certainly think a do-nothing approach going forward puts the goals of the markets in general at risk. The risk of a do-nothing approach is a detrimental effect on the long-term price signal.”

“Yes, I do think we are putting the capacity market at risk,” DePillo said. “We’re going through what is effectively a fleet transformation. How do we do that in the most effective way possible? We are going to need uneconomic retention,” he said, referring to state initiatives such as New York’s nuclear subsidies.

“The more we attempt to use the capacity market, particularly in isolation, to solve all the blender issues we are facing today, the more distorted it gets,” Berg said.

He advocated a holistic approach. “That starts with an honest conversation about what constitutes a subsidy so onerous it needs to be subject to mitigation,” he said.

For his part, Moore said the Sustainable FERC Project supports a goal of 80% carbon reduction by 2050.

“There are a lot of good state policies that get us a long way that we should protect,” he said. “I wonder if we’re going down the wrong fork in the road adding complexities to the capacity market.”

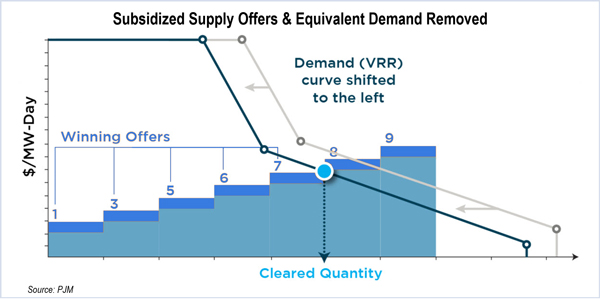

Bresler introduced an idea for a two-stage capacity auction that would integrate subsidized resources but prevent them from impacting the prices of other generators. Fuller welcomed PJM’s effort to respond to out-of-market state policies but expressed concern that the model would place all of the risk of state policy implementation on resources at the margin, which could defeat the goal of protecting price formation.

The concern, which PJM’s proposal acknowledges, is that resources will bid zero to ensure they clear in stage 1; those that don’t won’t receive any capacity revenue through the second, higher-priced stage, clearing after subsidized units are removed. “It is unclear whether this potential would have any significant impacts on resource offer behavior in the capacity auctions,” PJM said.

Berg wasn’t so sure. “My first thought is if there was ever any doubt that … resources will bid zero, this is it amped up on steroids,” he said.

PJM CEO Andy Ott closed out the session, saying, “I see this issue as fairly large for us.” He added, “It’s no secret that PJM feels strongly about its competitive markets.”

Stakeholders can expect the dialogue to continue, he said.

“Don’t worry,” he reassured the audience. “We’re not going to make a filing tomorrow.”