Energy Secretary Jennifer Granholm opened the Department of Energy’s two-day Floating Offshore Wind (FOSW) Shot Summit with the first of the event’s long list of offshore wind metaphors and puns — and announcements of DOE’s latest initiatives to advance FOSW technology, supply chains and infrastructure.

Pointing to the ongoing impacts of Russia’s year-old invasion of Ukraine, Granholm said Wednesday, “When the winds of change blow, some build walls, others build wind turbines.”

Announced in September, the Floating Offshore Wind Shot is aimed at cutting the cost of FOSW by more than 70% to a target price of $45/MWh, which Granholm said “would make floating offshore wind competitive across the nation, across the globe.”

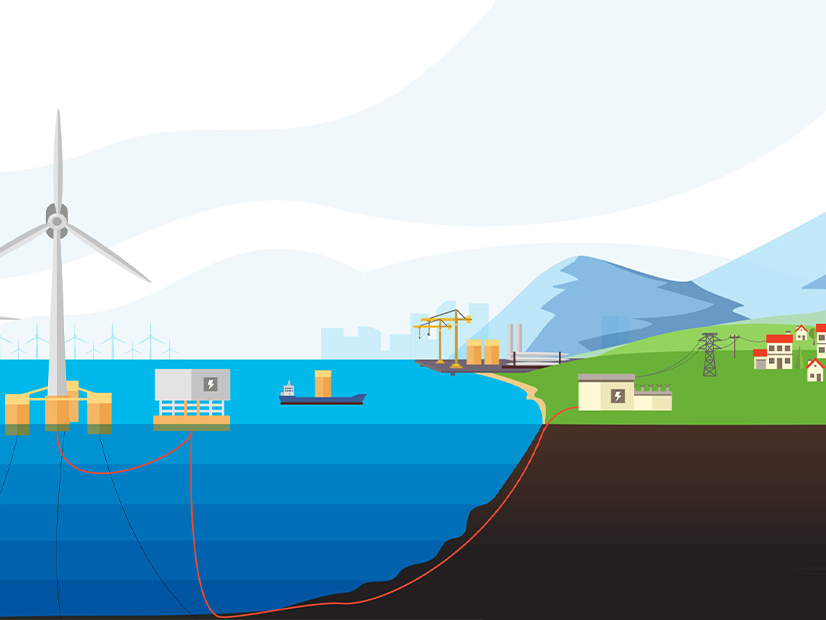

Two-thirds of U.S. offshore wind potential is located in waters deeper than the 60-meter maximum for fixed-bottom turbines, she said, which is why floating turbines, mounted on floating platforms, are now a major focus of White House and DOE initiatives. In addition to the 30 GW of offshore wind development President Joe Biden has targeted for 2030, the Bureau of Ocean Energy Management has added an additional 15 GW of FOSW by 2035.

BOEM’s first West Coast auction in December brought in $757.1 million for five sites, but other potential areas for floating offshore wind development include Hawaii, the Gulf of Maine, and parts of the Gulf of Mexico. (See First West Coast Offshore Wind Auction Fetches $757M.)

Still, California figured heavily in the day’s announcements. Granholm started with the launch of a new West Coast Offshore Wind Transmission Study, supported by funds from the Inflation Reduction Act. “That study is going to examine how the West Coast can expand transmission to support offshore wind development,” Granholm said.

“The study will use its findings to develop practical plans through 2050 to address transmission constraints that currently limit offshore wind development along the nation’s West Coast,” a DOE press release said. “It is also expected to evaluate multiple pathways to reaching offshore wind goals while supporting grid reliability, resilience and ocean co-use.”

Other announcements focused on new research partnerships and initiatives:

- California has become the first West Coast state to join the DOE-funded National Offshore Wind Research and Development Consortium. “The consortium works across the public and private sectors to invest in research and development projects that slash the cost of offshore wind for ratepayers across the country,” Granholm said. “The California addition is going to bring a whole new focus on floating offshore wind technology.”

- Both California and Louisiana also joined the White House Federal-State Offshore Wind Implementation Partnership, launched last year to “maximize the benefits” of offshore wind development for workers and communities, according to a White House fact sheet.

- DOE, along with the Sandia National Laboratory and the National Renewable Energy Laboratory, also announced “the development of an industry-informed roadmap for new operations and maintenance technologies and processes to enhance cost-effectiveness, efficiency and reliability at offshore sites,” according to the DOE press release.

- With Hawaii still another potential site for floating offshore wind, DOE’s Pacific Northwest National Laboratory and the Bureau of Ocean Energy Management have deployed a floating scientific research buoy about 15 miles east of the island of Oahu “to collect offshore wind resource, meteorological and oceanographic data,” DOE said.

Not Business-as-usual

Granholm and other speakers at the summit were also eager to frame FOSW as a job generator and a vital technology for unleashing U.S. clean energy independence and energy security.

The Floating Offshore Wind Shot “is about bringing supply chains home; it’s about creating jobs from sea to shining sea, from welders and deckhands assembling platforms at our ports … to steelworkers hundreds of miles inland who are making towers or other components, to electricians and construction workers to connect those communities to the energy,” Granholm said.

It will also show “the world that we’ve got to build a global energy system that can never be manipulated again by one leader, by one autocrat or even one country,” she said.

But behind the sweeping, turbine-charged rhetoric of the summit lie real challenges. In its 2023 Offshore Wind Market Report, the Business Network for Offshore Wind sees both major growth drivers and potential headwinds, including ongoing debates over streamlining and accelerating permitting processes and rising concerns over the impact of expensive OSW construction on consumer electric bills. The report also notes the ongoing drag of inflation, which has some offtakers seeking to renegotiate contracts for East Coast projects,

“Building out the floating industry will require a substantially different supply chain than the one being developed for fixed-bottom turbines, necessitating more and new government research and support,” the report says.

Jocelyn Brown-Saracino, DOE’s offshore wind energy lead, agreed, saying the 70% cost reduction goal of the Floating Offshore Wind Shot “is not meant to represent a business-as-usual case. It will require [an] expanded, concerted R&D push from all of us, and more, it will require future leasing actions, transmission infrastructure, supply chain maturation, and the readiness of U.S. infrastructure, including ports.”

While the shot’s primary goal is to drive down costs and increase deployment, Brown-Saracino said, “R&D alone is not going to be enough to reach the cost targets.” Other priorities are being incorporated, such as ensuring just and sustainable deployment of FOSW, supporting the development of a “robust domestic supply chain,” transmission development, and advancing co-generation opportunities between FOSW and, for example, clean hydrogen.

As reeled off by Brown-Saracino, the supply chain challenges will be daunting. “We’re going to need to expand port capabilities. We’re going to need to ensure that we have a fleet of vessels for construction and operations, and we’re going to need to build manufacturing facilities,” she said. “We’re going to need to ensure that we have a set of trained domestic workers ready to step into jobs as the industry grows. And we’re going to need foresight into the timing and the geography of that growing demand. And we’re going to need to look for opportunities to ensure that that workforce is diverse, equitable and inclusive.”

Resolving transmission challenges will also be critical to “ensure that electrons can come to shore at a cost-effective manner,” she said. “We’re going to need solutions that help grid operators and system planners meet our goals to decarbonize the electric system, while not just protecting but enhancing the resilience and reliability of the grid.”