By William Opalka

ISO-NE’s average real-time prices rose 13% to $63.32/MWh in 2014, the RTO’s Market Monitor reported Wednesday.

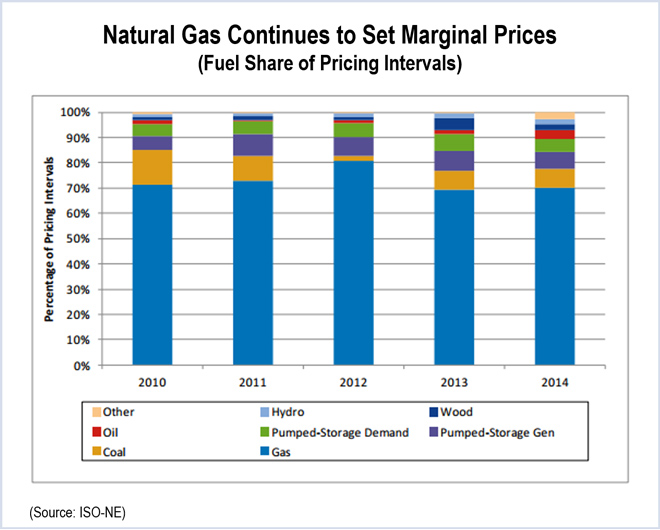

The 2014 Annual Markets Report said the increase was largely driven by higher fuel costs in the first quarter. Prices of natural gas, which was the marginal fuel for the RTO in 70% of the hours in 2014, rose 15% last year, to $7.99/MMBtu from $6.97/MMBtu in 2013. Electricity usage dropped 2% to 127,138 GWh.

“Overall, 2014 weather was milder compared with 2013, but the extreme cold in January, February and March and the resulting high natural gas and power prices were the main reason for 2014’s higher annual average power price,” Jeffrey McDonald, ISO-NE’s vice president of market monitoring, said in a statement. “Lower oil and natural gas prices, combined with mild summer weather that contributed to lower energy usage, and the implementation of several ISO market enhancements that helped improve both reliability and market efficiency, brought generally lower wholesale electricity prices during the rest of the year.”

The Monitor repeated a recommendation it has made since its 2010 report: that the RTO relieve virtual transactions from energy market payments — also known as real-time net commitment-period compensation (NCPC) charges — that it said is preventing virtuals from improving day-ahead market liquidity.

Last year, the RTO proposed a partial solution that would have excluded positive load deviations from real-time first contingency NCPC charges. The Monitor said the change would strengthen incentives for load-serving entities, exporters and virtual demand bidders to buy energy in the day-ahead market.

The proposal was unable to win stakeholder support and was not submitted to the Federal Energy Regulatory Commission. The RTO plans to start a new stakeholder process to reconsider the issue this year.

Total reliability payments, including NCPC charges, increased 10% to $173.7 million in 2014. About 62% of the payments stemmed from the need to operate more expensive generation during extreme cold weather in the first quarter.

The total value of the region’s wholesale electricity markets, including electric energy, capacity and ancillary services markets, rose about 12%, from about $8.8 billion in 2013 to about $9.9 billion in 2014. Electric energy comprised $8.4 billion of the total in 2014, up from $7.5 billion a year earlier. The cost of ancillary services jumped 50% to about $410 million.