By Rich Heidorn Jr.

ATLANTIC CITY, N.J. — To shake or not to shake the Money Tree?

That was the question Independent Market Monitor Joe Bowring posed during his Year in Review presentation at PJM’s Annual Meeting last week, setting off a lively debate with one of the consultants that Richard and Kevin Gates, enlisted in their high profile defense against market manipulation allegations.

“If the rules are imperfect, is it OK to do anything not explicitly prohibited?” Bowring asked.

He quickly provided his own answer. “It is not permissible,” he said, citing what he called the “duty” of market participants to inform RTO officials and federal regulators of such “money trees.”

Bowring referred to PJM’s poorly designed rules on rebating excess line losses, which allowed the Gates brothers’ Powhatan Energy Fund and a handful of other traders to profit through what the Federal Energy Regulatory Commission later called riskless, back-to-back up-to-congestion trades. The rules were later changed. The Gates brothers and their associates — despite stopping the practice after being warned by Bowring — are now facing up to $29.8 million in fines. (See FERC Staff Seeks $30 Million Fine in Powhatan Case.)

“Almost all of the market knew these opportunities existed and chose not to take advantage of them,” Bowring said. “That raises the question: Who’s the smartest guy in the room? The guy who took advantage or the guy who didn’t?”

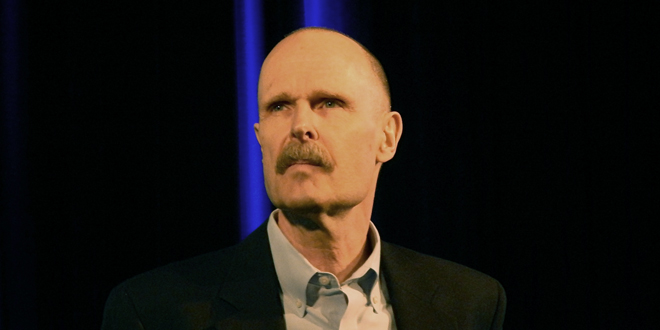

That brought a response from consultant Roy Shanker, who is quoted on the Gates’ brothers’ website criticizing FERC’s case. “It’s really unfair to have an ill-defined affirmative obligation to do something,” Shanker said.

On the website, Shanker says he believes the Gates and their associates “were simply engaging in rational economic decision making.” He rejected FERC’s contention that the trades were riskless “wash trades.”

In response to Bowring, Shanker cited traders that schedule power deliveries through the IMO interface with Ontario’s Independent Electricity System Operator. Bowring has identified the interface as a location where traders can manipulate PJM’s pricing rules by breaking transactions into multiple “back-to-back” transactions, a practice he has called “sham scheduling.” (See Monitor Gives Lukewarm Review to PJM ‘Sham Scheduling’ Fix.)

“It may be a money tree or there just may be [ambiguity] about the rules,” Shanker said. “We know that ambiguity is out there. It sits like a heavy stone on everyone.”

“When you find something, [the RTOs should] identify it, post it and try to change the rules,” Shanker said. “Because you can’t hit every [possibility] that doesn’t mean that you do not try to address some.”

“Would you be supportive if we proposed such [an affirmative obligation] rule?” Bowring asked.

“Yes,” Shanker responded.

He later explained that he would support “the coupling of an affirmative obligation on market participants” with a “safe harbor” that would protect traders from manipulation charges as long as they stop activity of concern after being specifically warned. “Then it is up to RTO or IMM to act to clarify or change rules,” he said, adding that he was speaking for himself and not the Gates brothers.

Andy Ott, senior vice president for markets, said he, too, would support such a rule. As long, he said, as it was not seen as an “inoculation” for traders that have done something not explicitly listed.