By William Opalka

The U.S. electric industry will face reliability concerns in four years if the interim goals of the Environmental Protection Agency’s Clean Power Plan aren’t relaxed, the North American Electric Reliability Corp. said last week.

NERC released a reliability assessment of the CPP Tuesday that concludes EPA’s proposed 2020 targets — 80% of the total CO2 emission reductions the agency seeks — can’t be reached in several regions.

The 69-page report provides additional ammunition for critics who have called for changes to the interim goals and the provision of a reliability “safety valve.” The report is NERC’s second on the impact of the EPA plan. Its initial review, released in November, examined EPA’s assumptions and provided a broad view of potential reliability risks. (See MISO, SPP: EPA Clean Power Plan Threatens Reliability, Needs Longer Compliance Schedule.)

Scenarios Analyzed

NERC concludes the plan will accelerate the transition in the generation mix as natural gas, wind and solar power replace coal. The report predicts about 60 GW of natural gas-fired generation will be added by 2020, rising to 80 GW by 2030. Coal retirements are projected to total at least 18 GW by 2020 and an additional 18 GW by 2030.

Much of the remaining coal fleet will have to change from baseload to seasonal and peaking use, making the plants less economic, NERC said. Between 14 GW and 22 GW of coal plants remaining in service after 2020 will be at risk because they would be operating at capacity factors of only 11% to 19%.

The report warns that new generators will be needed before the transmission and pipeline infrastructure to support them can be built. While most combined-cycle gas turbine plants go from conception to operation in an average of 64 months, transmission infrastructure can take from five to 15 years. Local and regional pipeline infrastructure will also need to be in place to deliver gas to the new plants.

“More time is needed to develop coordinated plans for this shift in generation and corresponding transmission reinforcement,” said John Moura, director of reliability assessments.

NERC noted there are regions where compliance will be easier, but says New York and the New England states in the Northeast Power Coordinating Council will need more than 7 GW of new capacity by 2020, with ERCOT in need of 11 GW over the same time frame.

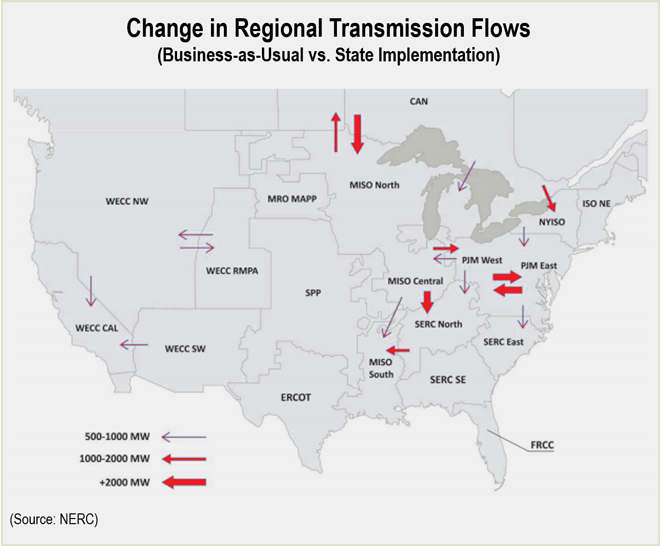

The report also predicts major changes in transmission flows, with Canada tripling its exports to the U.S. and PJM-East shifting from being a net importer to a net exporter as generating units in Regional Greenhouse Gas Initiative states become more competitive with the imposition of carbon pricing nationwide.

MISO Central would reduce its exports to MISO North due to cheaper imports from Canada while increasing its exports to MISO South.

EDF Challenges Report

The Environmental Defense Fund disputed the report’s conclusions.

“NERC’s modeling uses unrealistic assumptions that are contradicted by what’s happening on the ground today,” Cheryl Roberto, EDF’s associate vice president of clean energy said in a statement.

NERC “fails to capture the great innovation happening now – with major investments in renewables, efficiency, natural gas and transmission infrastructure,” Roberto said. “NERC’s report also assumes flat-footed regulators, when the truth is regional and state-level regulators have repeatedly demonstrated they are up to the task of planning for future power needs. In short, NERC’s assessment does not take into account the transformation unmistakably underway in our electric system.”