By William Opalka, Chris O’Malley and Rich Heidorn Jr.

PJM is considering changing its day-ahead market schedule in response to the Federal Energy Regulatory Commission’s April 16 ruling revising the interstate gas nomination timeline.

Other RTOs’ reactions varied, with ISO-NE saying it has no plans to change its schedule and NYISO looking to respond to its neighbors. MISO stakeholders will discuss the issue Friday, while an SPP task force is expected to make recommendations on any changes by July.

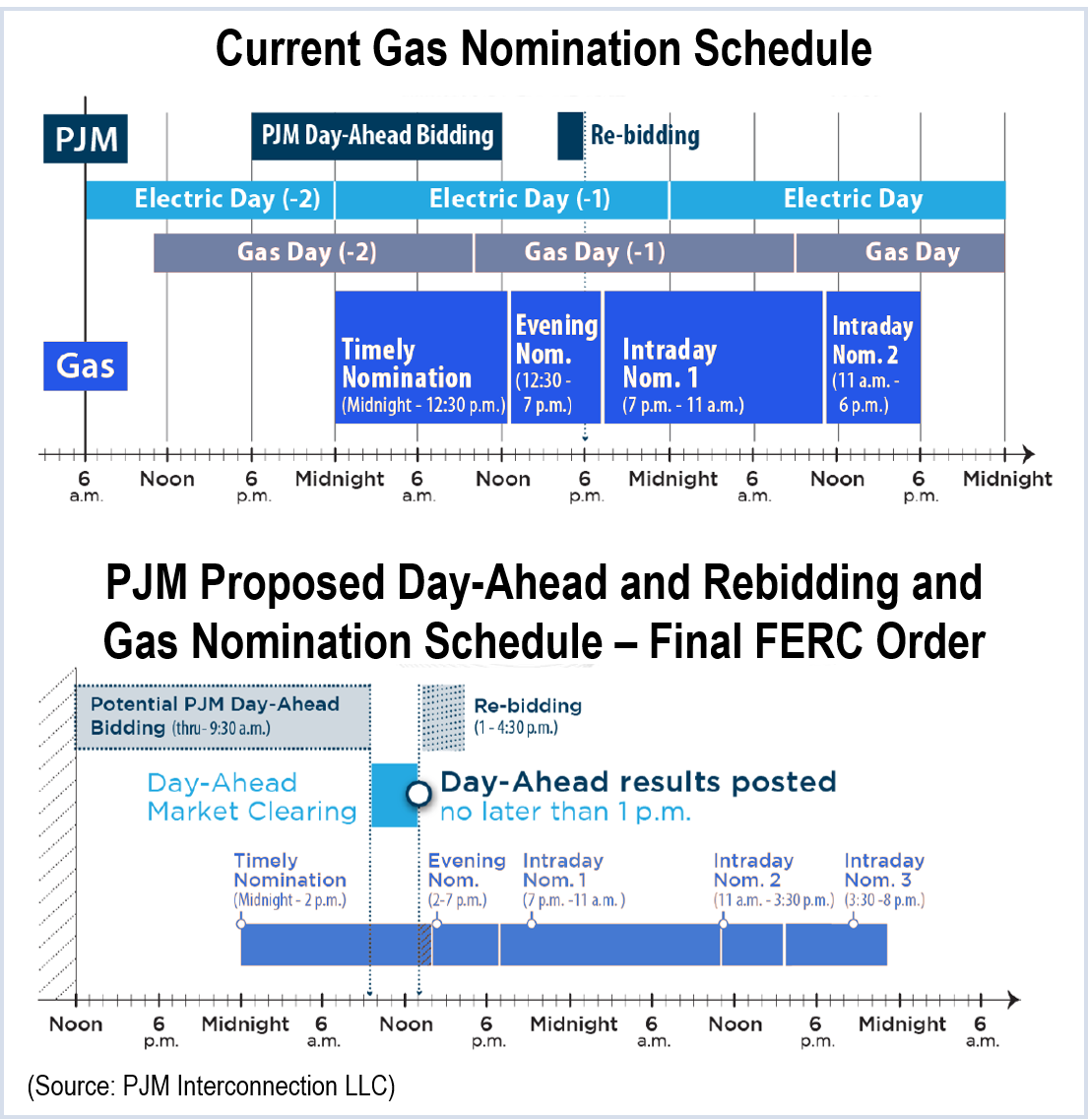

FERC moved the timely nomination cycle deadline for scheduling gas transportation from 11:30 a.m. to 1 p.m. CT (12:30 p.m. to 2 p.m. ET). It also added a third intraday nomination cycle (RM14-2). (See FERC Approves Final Rule on Gas-Electric Coordination.)

In response, PJM is considering moving up its day-ahead schedule by three hours, Adam Keech, senior director of market operations, told the Markets and Reliability Committee on Thursday.

PJM’s day-ahead market results currently are published at 4 p.m. ET, which would not provide enough time for selected generators to purchase gas, Keech said.

PJM is proposing that day-ahead offers close at 9:30 a.m. ET, with results published no later than 1 p.m. That would allow at least one hour for gas generators selected to run the next day to purchase fuel before the timely nomination cycle deadline.

The rebid period and reliability unit commitment (RUC) also would be moved up, running from 1 p.m. to 4:30 p.m., with results published by 6 p.m., allowing at least one hour for gas nominations before the evening nomination cycle deadline, which FERC left unchanged.

The changes would condense the day-ahead market solution window to 3.5 hours.

Joe Wadsworth of Vitol asked if PJM would be coordinating its changes with neighboring regions. He said moving PJM’s day-ahead deadline to 9:30 a.m. could inhibit trading with NYISO, which publishes its day-ahead results at about 9:30 a.m. That could hurt day-ahead convergence along the NYISO-PJM seam, he said.

Wadsworth said PJM also needs to consider that liquidity in the next-day gas markets sometimes doesn’t occur until after 10 a.m. on high gas-demand days. In such circumstances, there may be little or no natural gas price transparency prior to PJM’s day-ahead market bid deadline, he said.

Ed Tatum of Old Dominion Electric Cooperative suggested PJM coordinate the changes through the ISO/RTO Council and consider changing the start of the electric day.

Keech said FERC’s order neither mandates nor precludes changes to the electric day.

Keech’s comments came during a first read of a proposed problem statement to respond to the FERC order. Although the initiative won’t come up for a vote until the May 28 MRC meeting, PJM will conduct an educational session following the May 6 Market Implementation Committee meeting.

PJM and other regions must make compliance filings — adjusting their tariffs to comply with the final rule or explaining how their current rules are compliant — by July 23.

NYISO

“Because electricity markets are interdependent, the NYISO’s response to FERC’s order will need to account for its neighbors’ compliance efforts,” NYISO spokesman David Flanagan said. “If no changes are determined to be necessary, FERC’s decision will provide New York generators an additional hour-and-a-half to nominate the gas they require following the posting of the NYISO’s day-ahead market. FERC’s order also will increase the gas procurement flexibility available to New York generators that participate in the NYISO’s real-time market.”

MISO

MISO spokesman Andy Schonert said the RTO is “working internally and with stakeholders to figure out how we will respond to FERC’s order.” The Electric and Natural Gas Coordination Task Force will discuss the issue in a meeting May 1.

SPP

SPP spokesman Tom Kleckner said the RTO’s Gas Electric Coordination Task Force discussed the FERC ruling at a meeting Thursday and will be making a recommendation to SPP’s Board of Directors at the board’s July meeting.

“The [task force] is evaluating what changes can be made to the day-ahead and reliability unit commitment timelines,” Kleckner said. “It will be up to our stakeholders to make any changes to our timeline that are presented to the board.”

ISO-NE

ISO-NE, which shifted its day-ahead market schedule two years ago to align with the natural gas trading day, believes it is already in compliance with the FERC rule, spokeswoman Marcia Blomberg said.

“However, we are very disappointed at the decision not to change the gas day,” Blomberg said. “We continue to believe it would have been a material improvement to reliability. Without the change, obtaining fuel in order to meet their obligations will be more challenging for generators during upcoming winters. We are supportive of the change to the timely nomination cycle, which will help owners of gas-fired generators incrementally by improving their ability to timely nominate and schedule gas.”