By Rich Heidorn Jr.

DALLAS — The Markets & Operations Policy Committee approved the following measures at its two-day meeting last week. The issues will next be considered by the Board of Directors.

MARKET WORKING GROUP

Transitional ARR Allocation Process OK’d

The MOPC approved without opposition a rule that will allow transmission owners that are new to the Integrated Marketplace to participate in an auction revenue rights allocation prior to the monthly allocation if they are unable to participate in the annual one (MPRR 221).

Revised LTCR Process Approved

Members approved a response to an Oct. 28 FERC order finding SPP not in compliance with guidelines 3 and 5 of Order 681, which set the rules for long-term firm transmission rights (MPRR 227).

FERC ordered SPP to create a process for offering long-term congestion rights (LTCRs) for transmission upgrades to “any party” and to allow load-serving entities to nominate candidate LTCRs prior to a simultaneous feasibility test to determine the availability of the nominated LTCR.

SPP’s response proposes a transmission planning study process that would grant candidates incremental LTCRs in lieu of Tariff Attachment Z2 credits for sponsored transmission upgrades. It also would allow LTCRs and incremental LTCRs to be nominated prior to the simultaneous feasibility test instead of selecting them after the test.

Bill Dowling of Midwest Energy, a customer-owned utility in western Kansas, was among several members who voted no. He said it is unfair for entities that make relatively inexpensive transmission upgrades, such as replacing a wave trap, to be entitled to LTCRs, “competing with those who have invested hundreds of thousands or millions” on bigger improvements.

“We just flat-out think FERC got it wrong,” he said.

American Electric Power’s Richard Ross said he shared Dowling’s concerns but that the proposal was a “reasonable response” to the FERC order.

“We’re not going to convince FERC they got it wrong,” Ross said. “We have to do something.”

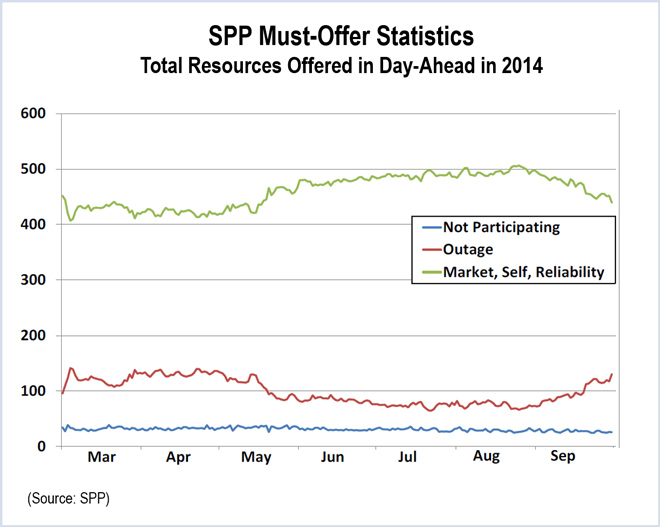

Action on Day-Ahead Must-Offer Rule Deferred

The committee approved a Market Working Group recommendation that it defer action on changes to the current limited day-ahead must-offer rule.

In November, the working group voted to recommend that no action be taken on the rule until the deadline for reporting to FERC on how it is working. The vote followed a presentation by SPP staff in October on results of a six-month evaluation of the rule’s impact. The analysis found that almost $362,000 in penalties were issued for shortages in 128 hours between March 1 and Sept. 30.

The majority of the working group said having no day-ahead must-offer rule was preferable to the current limited one and that there was no need to address changes to the current rules now.

The report to FERC is due 15 months after the Integrated Marketplace went live last March 1 and will incorporate 12 months of market data.

Resource Hubs Process Revised; New Hub Created

The committee endorsed an initiative to eliminate discrepancies between the market hubs establishment process in the Marketplace Protocols and that in the Tariff, approving without opposition a compliance filing in response to a 2013 FERC order (ER13-1173).

The vote included approvals of six current resource hubs that have not been previously made official — GRDA_HUB; GRDA_HUBSA; UCUHUB; GSPR2014HUB; OMPA_GENHUB; and KCPLHUB — and one new hub, GSPR2015HUB.

Before SPP created the hubs process in 2012 (Marketplace Protocol Revision Request 90), the Tariff had general “placeholder” language about market hubs, but the Protocols were silent. The MPRR made modifications to the Tariff and added several sections to the Protocols, with market hubs split into two categories — trading hubs and resource hubs — with separate approval processes.

The filed Tariff language referenced the approval process in the Protocols: the SPP Market Monitoring Unit reviews proposed resource hubs for consistency with the market hub criteria while the Markets Working Group and MOPC must approve trading hubs.

The FERC order rejected all changes to the hubs establishment section of the Tariff, leaving in place the original language, which requires all market hubs be recommended by MOPC and approved by the Board of Directors.

But the proposed changes had already been incorporated into the Protocols, and were not removed after the FERC order, resulting in the discrepancies between the Protocols and Tariff.

The filed Tariff language said that approved market hubs won’t take effect until they have been posted for 45 days, while the original Tariff language set a six-month posting requirement. The compliance filing will seek a waiver from the six-month posting requirement for the newly-created hubs.

Kansas City, NW Kansas No Longer Constrained Areas

MOPC approved the Market Monitoring Unit’s recommendation (TRR 149) to eliminate the Kansas City area and the Northwest Kansas area as frequently constrained areas (FCAs).

SPP’s Tariff defines FCAs as areas with one or more binding transmission or reserve zone constraints that are expected to be binding for at least 500 hours annually and within which one or more suppliers are pivotal.

As a result of transmission expansions, the MMU said, the two regions no longer experience high levels of congestion that left them vulnerable to market power by a dominant supplier.

SPP’s third FCA, the Texas Panhandle, is unaffected by the change.

The three FCAs were recommended by Potomac Economics, under contract with the MMU, before the Integrated Marketplace was launched.

REGIONAL TARIFF WORKING GROUP

Regional Cost Allocation Review Remedies Added

Members approved remedies for addressing problems identified in regional cost allocation reviews (TRR 131).

SPP’s Tariff requires the RTO to review the reasonableness of its regional and zonal allocation methodologies at least once every three years.

The revision adds to the Tariff potential remedies for correcting imbalances in cost allocations:

- Acceleration of planned upgrades;

- Issuance of Notifications to Construct (NTCs) for selected new upgrades;

- Apply regional allocation to all, or a portion, of the cost of any project that otherwise would not qualify for regional allocation;

- Recommend potential seams transmission projects;

- Transfer zonal annual transmission revenue requirements (ATRRs) to the region-wide ATRR;

- Exemptions from allocated costs associated with future transmission projects; and

- Change cost allocation percentages as defined under Section III of the revision’s Attachment J.

Jeff Knottek, of the City Utilities of Springfield, Mo., said he was supportive of the changes but was concerned they don’t do enough to correct inequities.

Tariff Revised to Eliminate ‘Windfall’ Point-to-Point Revenues

The MOPC approved Tariff revisions to eliminate ambiguity in the application of credits for point-to-point (PTP) revenues (TRR 143). The revisions are intended to make the Tariff consistent with the incorporation of multi-owner zones that have both formula-rate and stated-rate ATRRs.

The changes clarify the transmission owner’s obligation to account for all point-to-point revenues beyond the TO’s allowed ATRR. If the TO’s formula rate template does not account for adjustments to the zonal ATRRs and Schedule 11 ATRRs for PTP revenue, the proposed Tariff revisions will allow SPP to reduce the charges in the settlement process.

“This is making sure there isn’t either a windfall” or a shortfall, said Regional Tariff Working Group Chairman Dennis Reed of Westar Energy. “This ensures that the target that SPP will try and hit [for PTP and other transmission revenue] is correct.”

Rules for Seams Transmission Projects Approved

MOPC approved additional Tariff language governing the rules for seams transmission projects, as outlined by the policy paper released by the Seams Steering Committee in September (TRR 144).

AEP’s Ross expressed misgivings about the changes, saying the Regional State Committee should know that “they may not be getting all they expected.”

OTHER MATTERS

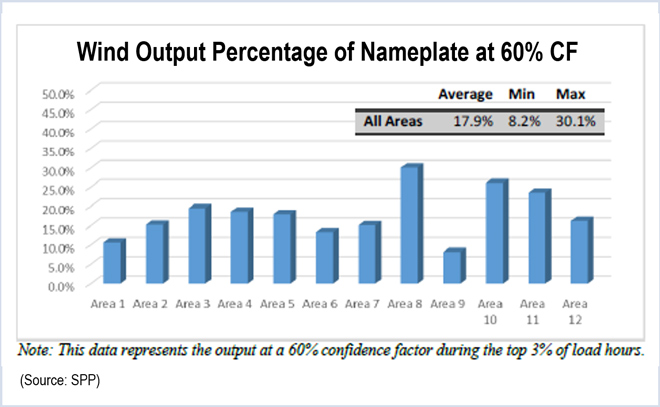

Staff to Update Wind Integration Study

SPP operations staff will update a 2010 study to evaluate the impact of increasing wind generation on the SPP system.

The original Wind Integration Task Force study, which was completed in January 2010, focused on balancing, forecast needs, tool development and transmission adequacy. Results were incorporated into the design of the Integrated Marketplace.

In the five years since, installed wind capacity in the RTO is approaching or has passed the levels forecast in the study.

“There’s a lot higher penetration of wind. There are more operational concerns and issues that we have to be aware of,” said Operating Reliability Working Group Chairman Jim Useldinger of Kansas City Power and Light.

“Just this week we went from 7,000 MW to 700 MW [of wind generation] in a short period of time,” one SPP staffer said.

A year ago, the working group presented a proposal to update the study to reevaluate transmission adequacy based on new wind capacity forecasts.

The MOPC asked the task force to revise the study scope based on what the RTO’s staff can provide without employing external analysts.

(Click to Zoom)

The task force’s revised proposal recommends staff use current and forecast wind installations to review the transmission adequacy assumptions from the 2010 study.

It also will look at operating characteristics and impacts including frequency response (Consolidated Balancing Authority needs vs. wind capability), reactive capabilities under low-wind and high-wind-low-load scenarios and the likelihood of wind events becoming contingency events.

The goal will be to determine the need for any new operational requirements on wind farms and provide inputs into transmission planning studies.

The study, which is expected to take about one year, will be split to provide initial results regarding operational concerns sooner because the transmission review could take longer.

Meanwhile, the Generation Working Group released its biannual report, which recommended no changes to SPP’s methodology for establishing net capability for wind and solar facilities.

Effort to Streamline Aggregate Study Procedures Wins OK

Members approved a measure to revise the Aggregate Study process in an effort to make it more efficient (TRR146). The revisions also consolidate the process into Attachment Z1. Members also approved BPR051, which documents the procedures for the new process.

Order 1000 Task Force Gets New Boss, More Members

The Competitive Transmission Process Task Force will expand its membership and report to the MOPC under a charter change outlined to the committee.

The task force will have at least at least six and as many as 15 members with experience and knowledge in electric transmission engineering design, project management and construction, operations and maintenance, rate design and analysis, and finance.

Larry Holloway of the Kansas Power Pool expressed concern that the charter didn’t list policy experience among the requirements for task force members. Holloway also said it needed diversity with viewpoints of those other than incumbent transmission owners.

Terri Gallup of AEP responded that “a lot of [current task force members] have policy titles within our companies” in addition to experience in the fields listed in the charter.

MOPC Chairman Noman Williams, of South Central MCN, said no committee vote was required on the charter change.

Minimum Design Standards for Competitive Upgrades Approved

Members approved without opposition minimum design standards for competitive transmission upgrades (MDS) with a correction noting that 230-kV circuits should have ratings of at least 1,200 amps, not 2,000 as shown in the MDS.

SPP Announces ‘One-Stop Shop’ for Tracking Document Changes

SPP is creating a Web page as a “one-stop shop” for finding the latest version of the Tariff, Marketplace Protocols, business practices and other documents subject to the RTO’s revision request process.

“You won’t have to go to four different Web pages to find them,” explained Debbie James, manager of market design.

The primary working groups will review all changes to the revision request process prior to MOPC approval of the changes.

SPP, MISO Agree on Revised Flowgate Process

SPP and MISO have agreed on a new process for coordinating tie-line flowgates. The two RTOs have agreed to begin using the new process even before filing it with FERC early this year as an addition to their Joint Operating Agreement.

The party with functional control over the most limiting equipment for the flowgate will be the managing entity and is responsible for available flowgate capability (AFC) calculations. New tie-line flowgates will initially be created as temporary and will not become permanent for 60 days after notification is posted.

The initiative began when SPP staff was assigned to research whether MISO had followed procedures in creating a new flowgate on a line between it and the Empire District Electric. [MISO FG #6257: Ozark 161 kV (EDE) to Omaha 161 kV (EES) for the loss of Osage 161 kV (EES) to Eureka 161 kV (CSWS)].

Empire officials were “surprised” by the flowgate, said David Kelley, SPP’s director of interregional relations.

“I think we’ve identified maybe a gap in our process,” Empire District’s Bary Warren said. There should be explicit criteria for establishing permanent flowgates, including a dispute resolution process, he said.

SPP staff will propose the new coordination process to Associated Electric Cooperative, Kelley said.

Project Pinnacle ‘Close to the Finish Line’

Barbara Sugg, vice president of information technology, told members SPP is “very, very close to the finish line” for Project Pinnacle, implementing Phase 2 of the Integrated Marketplace, including market-to-market rules, long-term congestion rights and regulation compensation.

CONSENT AGENDA

MOPC also approved the following items on the consent agenda with no discussion:

- BPWG-BPR 065 BP 7250 Modification: Generator Interconnection Service

- MWG-MPRR 209 Change Start-Up Offer from Daily to Hourly

- MWG-MPRR 215 Product Substitution Cost Calculation

- MWG-MPRR 216 Regulation Qualification

- MWG-MPRR 222 Allow Max of Zero for VERS

- MWG-MPRR 223 SPP Conservative Operations during Multi-Day RUCs

- MWG-MPRR 226 Settlement Area Definition Change

- RTWG-TRR 142 Attachment C Update

- RTWG-TRR 145 Attachment P Revisions

- GECTF-Request to extend another year

- PCWG-Charter Changes

- SPCWG-Charter Changes