By William Opalka

If you want to see the value of dual-fuel capability, look no further than New York, where 47% of the generation can run on oil or natural gas.

That flexibility helped NYISO meet its winter load — including a new winter peak of 25,738 MW — without resorting to voltage reductions or other emergency operating procedures.

On the Jan. 7 record-setter, NYISO imported power from ISO-NE and Ontario over the evening peak, issued public calls for conservation and deployed demand response for the first time in winter.

“The primary operational issues during the first three winter 2014 cold snaps were cold-weather equipment issues and gas-only generator outages,” according to a NYISO review.

The ISO said the extreme cold reduced pressure in high-voltage circuit breakers, caused icing in rivers serving hydroelectric plants and froze pipes and valves.

Although the ISO reported no outages from fuel supply shortages, gas price spikes sent wholesale electricity prices skyward. On 18 days in January, gas prices exceeded oil generation. Like PJM, the ISO obtained a waiver from the Federal Energy Regulatory Commission to pay suppliers costs exceeding $1,000/MWh.

Most oil-fired plants were replenished by barge or truck deliveries at rates close to their burn rates. In late January, however, concerns about oil depletion led to increased NYISO efforts to manage projected unit capability on alternate fuels.

Despite the challenges, ISO officials express confidence heading into winter 2014/15.

“The combination of approximately 18,000 MW of dual-fuel generation in the fleet and our continuing work to enhance communications and operational coordination between the electric and gas industries has us well prepared for the coming winter,” NYISO spokesman David Flanagan told RTO Insider.

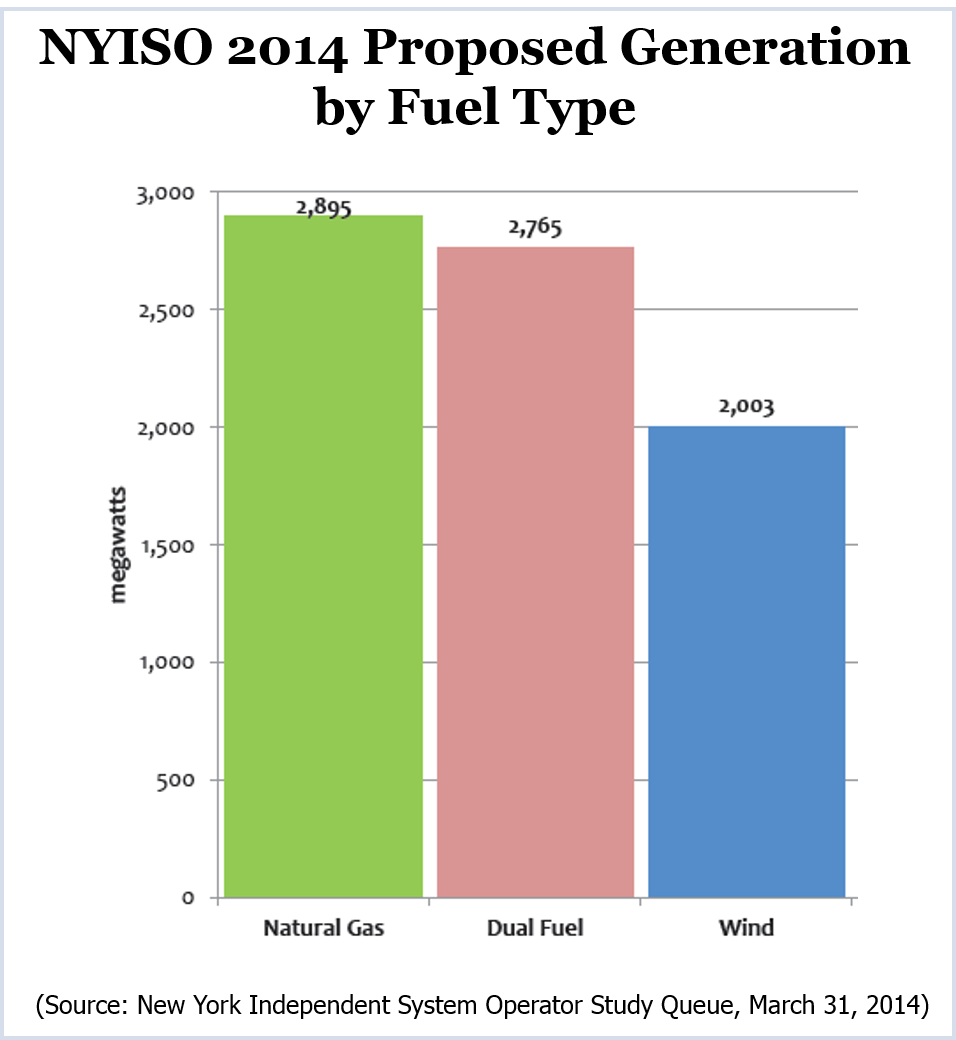

The ISO cannot afford to be sanguine, however. Its gas-fired production nearly doubled between 2004 and 2012, and natural gas and dual-fuel generators represent more than 70% of proposed capacity in the ISO’s interconnection study queue.

The ISO established the Electric and Gas Coordination Working Group in January 2012, and in October 2013 it released a study comparing the cost of dual-fuel capability to firm pipeline transportation under several scenarios.

In August the ISO outlined its Fuel Assurance Initiative, a stakeholder process to ensure sufficient generation on days with “a high risk for a reduction in real-time resource availability due to factors such as interchange and fuel supply uncertainty.”

The initiative is expected to consider energy, ancillary service and capacity market changes. Possible energy and ancillary market changes include the creation of “critical” operating days and two recommendations in the Market Monitor’s 2013 State of the Market Report: allowing suppliers to submit day-ahead offers that more accurately reflect fuel supply constraints, and requiring generators to provide information on a daily basis regarding fuel availability.

Leading up to this winter, the ISO said it completed a fuel survey of all gas, oil and dual-fuel-capable generators and is coordinating with pipelines on outages and maintenance.

The ISO said it will begin discussing possible capacity market changes — including incentives tied to performance on critical operating days and the possibility of using separate forced outage rate estimates for summer and winter — this fall.

In 2015, the ISO hopes to complete development of shortage pricing rules.

Increased gas pipeline capacity, relatively mild weather this summer and increased supplies of gas from the Marcellus Shale fields have eased pricing pressures.

The Federal Energy Regulatory Commission’s Division of Energy Market Oversight (DEMO) expects about 1.1 Bcfd of pipeline capacity to begin operation this winter to serve the New York market. The additional capacity could reduce pipeline utilization in New York from peaking at nearly 100% of capacity last winter to about 60% during the coming one, FERC staff said in a presentation to the commission last week.

Prices at the Algonquin citygate near Boston and the Transco Zone 6 New York City pricing point have been below Henry Hub since April, with Transco at $2.34/MMBtu as of Sept. 30, a 38% drop from a year ago. The unusual negative basis was caused by a 38% annual growth in Northeast production and low natural gas demand over the summer.

Long Term

Concerns about a potential “generation gap” that arose more a decade ago have receded somewhat as the state added more than 10,000 MW, mostly wind and gas, between 2001 and 2014. Retirements over the period totaled almost 6,000 MW.

Since 2012, however, the state’s surplus generation versus peak demand and reserve requirements has dropped from more than 5,000 MW to about 1,900 MW.