PJM will increase performance penalties and incentives and seek ways to incorporate firm gas transportation in energy prices under an initiative announced last week to reduce generator outage rates.

PJM CEO Terry Boston announced the initiative, which he said resulted from a three-day meeting of the Board of Managers and discussions with present and former leaders of the Members Committee and stakeholder sectors.

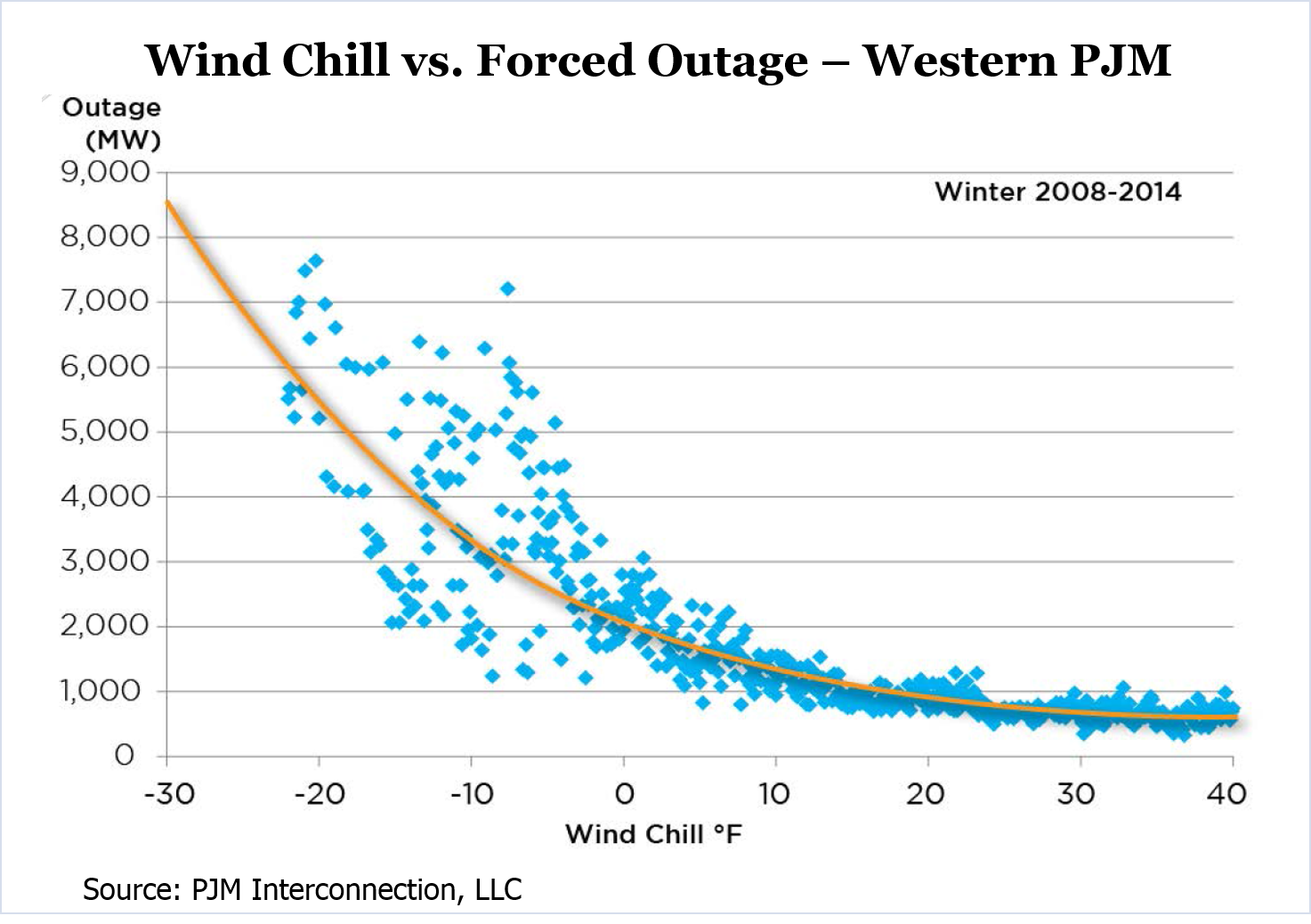

The action was prompted by January’s extreme cold, when as much as 22% of PJM’s generation suffered forced outages, three times the normal winter rate.

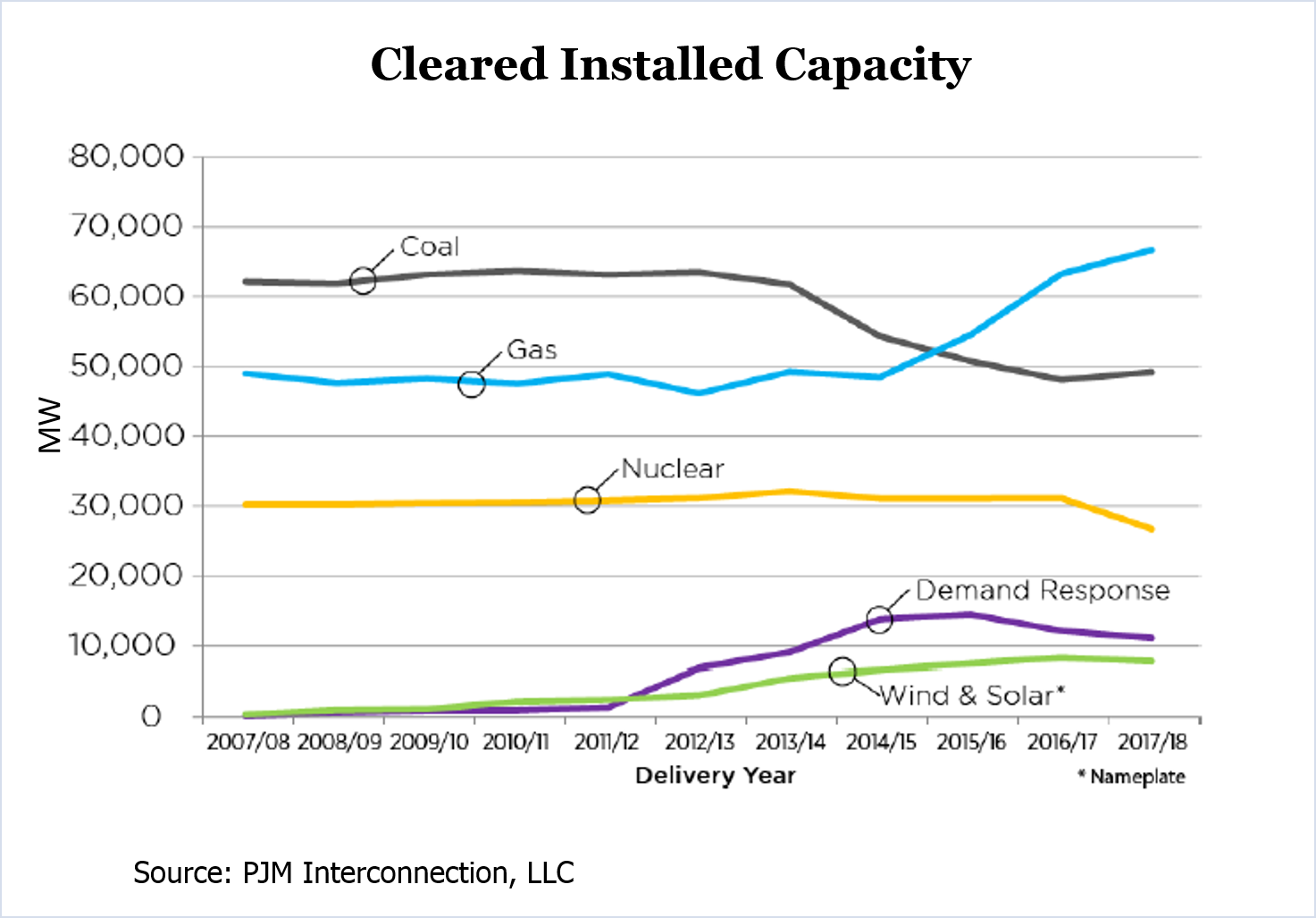

“We would have to interrupt load if this happened in [future] winters,” Boston told the Markets and Reliability Committee Thursday, noting that the RTO will lose about 8,500 MW of generation to retirements by the winter of 2015/16. “We feel [changing capacity rules] has to be one of our highest priorities.”

Officials said the changes may increase capacity costs but should also reduce volatility during tight supply/demand conditions.

Redefinition of Capacity

“You should think of this as a holistic redefinition of what capacity is,” said Andy Ott, executive vice president for markets.

Members’ initial response to the initiative — which PJM said would be conducted under expedited procedures outside the normal stakeholder process — was muted.

David “Scarp” Scarpignato of Direct Energy questioned whether PJM would bring proposed changes to “advisory” votes before the MRC or Members Committee.

Gregory Carmean, executive director of the Organization of PJM States (OPSI), expressed concern that additional costs would be largely for winter performance while capacity cost allocation is based on summer loads.

Carl Johnson, representing the PJM Public Power Coalition, expressed misgivings over the initiative during a later MRC discussion regarding the Triennial Review of capacity auction parameters.

Johnson said stakeholders haven’t received enough information on the cost impact of the parameter changes, which include a potential increase in the Installed Reserve Margin. Referring to PJM’s plans to “redefine” capacity Johnson said, “When we don’t understand what we’re buying when we buy capacity, to say we’re going to be buying more of it, we cannot support.”

The Consumer Advocates of PJM States discussed the initiative yesterday and was expected to issue a statement later this week.

Fuel Security

A key part of the new definition will be fuel security, meaning incentives are likely to encourage nuclear generators, dual-fuel units and firm gas contracts.

“At 20 mph [the speed at which gas flows], there’s not a lot of difference between just-in-time delivery and too dang late,” Boston said.

He also referred to two coal plants that were unable to operate in January because they lacked natural gas needed to start up. “Twenty thousand dollars’ worth of fuel oil could have brought those units up,” Boston said. “I would pay that now.”

More Flexible Operations

Ott said limits on unit flexibility must be a function of operational limits, not financial concerns. “We’ve seen units with three starts per day reduced to one; units with very short minimum run times became very long minimum run times,” he said.

The effort will also seek to boost operations and maintenance spending to improve generator availability on “low probability peak events” such as January’s polar vortex or last September’s unexpected heat wave.

“Generation owners may choose to cut O&M costs or choose not to make investments that enhance availability as a means to manage costs,” the report noted. “In making such a decision, the generation owner has implicitly or explicitly made a calculation that the benefits of such measures [increased net revenues] do not cover these ‘additional’ costs.”

Generator owners also have complained that there is no way to reflect such costs in supply offers.

“Competitive pressure to clear in the RPM capacity market may push generation owners to not make these investments if they feel other competitors are taking a similar strategy due to the risk of pricing themselves out of the market,” the report said.

Insufficient Penalties

PJM said current penalties for capacity resources that are unavailable during the 500 “peak” hours per year are insufficient.

The Tariff defines summer peak hours as Hour Ending 1500 to HE 1900 on non-holiday weekdays from June through August. Winter peak hours are HE 800 to HE 900 and HE 1900 to HE 2000 on non-holiday weekdays in January and February.

Penalties are assessed only if the forced outage rate during peak hours (EFORp) is more than the five-year average forced outage rate (EFORd5) of the resource.

Generators are often able to avoid even these penalties because the Tariff forgives outages related to a lack of gas as “Out of Management Control (OMC).”

“The penalties for being unavailable during the pre-defined peak hours … provides no incentive to make investments in O&M or infrastructure to enhance availability since there is little risk of incurring a capacity market penalty for being unavailable during reliability critical events,” the report said.

The current structure “provides an incentive for generation owners to hide the real cause behind an outage, or to shift the cause of an outage to a third party such as a gas pipeline” and claim it as OMC, the report said. However fuel delivery contracts and installation of dual-fuel capacity “are business decisions well within the control of the generation owner.”

‘Enhanced’ Liaison Committee Process

PJM officials said they will invoke a never-used “Enhanced Liaison Committee” process so that the new rules can be filed with the Federal Energy Regulatory Commission in time for the winter of 2015/16.

“If Polar Vortex conditions occurred in 2015/16 and outage rates were as high as PJM experienced in January 2014 … PJM would almost certainly experience a loss-of-load event,” the report said. PJM hopes to reduce outages this winter by resuming winter generation testing.

The process — developed by the Governance Assessment Special Team (GAST) in 2011 and documented in Manual 34 — was created to allow members to provide input on issues for which consensus is unlikely and the board acts independently.

“There will be a lot of opportunity in the next two months for dialogue,” promised Dave Anders, director of stakeholder affairs.

PJM has scheduled two meetings — 1-4 p.m. Aug. 12 and 18 — to discuss the initiative and the problem statement white paper.

On Aug. 20, PJM plans to release a draft white paper detailing proposed solutions; it will be the subject of a third meeting from 9 a.m. to noon Aug. 22. Stakeholders’ written comments on the second paper will be due Sept. 12, followed by a fourth meeting to receive additional comments Sept. 24.

The enhanced liaison process will begin Oct. 7 when PJM issues the final version of its solutions whitepaper. Additional input from stakeholders will come through coalitions, which will be required to submit briefing papers by Oct. 28.

The board will meet with the Enhanced Liaison Committee Nov. 4.

The proposed solutions may incorporate cold-weather initiatives being conducted by other committees, including energy storage participation in RPM (Planning Committee); qualifying transmission upgrade (QTU) credits and unit market offers (Market Implementation Committee); and cold weather resource performance improvements and gas unit commitment coordination (Operating Committee).

Arbitrage Technical Conference

General Counsel Vince Duane said PJM will ask FERC to delay scheduling of a technical conference the commission ordered in May, when it rejected the RTO’s plan to curb speculation in capacity market auctions. The conference is to develop solutions to eliminate arbitrage opportunities between the base residual auction (BRA) and incremental auctions (IAs).

“Any conversations with FERC thus far I would characterize as very preliminary,” Ott said in response to a stakeholder question.