New York said Friday that its latest offshore wind solicitation drew a record level of response for an East Coast state: more than 100 proposals from six developers for eight new projects.

The New York State Energy Research and Development Authority, which is shepherding the state’s offshore wind buildout, said it would post summaries of the proposals after reviewing them. After the solicitation closed at 3 p.m. Thursday, five of the developers publicly announced their intentions.

“The high volume of quality proposals from leading global energy developers is a testament to the state’s ability to attract strong competition and significant investments in New York’s clean energy economy, ports and the development of long-term domestic supply chain,” NYSERDA said in an email. “Following a rigorous evaluation period, NYSERDA expects to announce the awards in spring 2023.”

Among the state’s priorities in this third solicitation was development of an in-state supply chain. One of the oldest names in the power industry, General Electric (NYSE:GE), will potentially help make that happen.

GE said Thursday that if there were enough orders for projects in New York waters, it would build two factories in Coeymans, 130 miles up the Hudson River from New York Harbor: one for nacelles, and one for blades for the next generation of GE’s Haliade-X offshore turbine.

Ørsted and Eversource Energy (NYSE:ES) already have contracted with Riggs Distler to build foundation components at the Port of Coeymans for their Sunrise Wind project.

At the nearby Port of Albany, a manufacturing plant for turbine towers is planned by a partnership that includes Equinor.

The move would be a reversal of sorts for GE, which was born in 1892 in Schenectady, not far from Coeymans. The conglomerate, which is now dissolving, long ago moved its headquarters out of Schenectady and has been shrinking its footprint there and elsewhere in upstate New York for decades through cutbacks, closures, spinoffs and business sales.

“As a leading manufacturer and innovator in developing renewable energy technology, GE is ideally positioned to help New York secure its vision of becoming a leading manufacturing hub for offshore wind technology,” Scott Strazik, CEO of the new GE Vernova, the company’s portfolio of energy businesses, said in a statement. “Our proposal leverages GE’s unique and unparalleled expertise, resources and track record — including a 130-year legacy of manufacturing in New York — to make this vision a reality in a durable and sustainable way.”

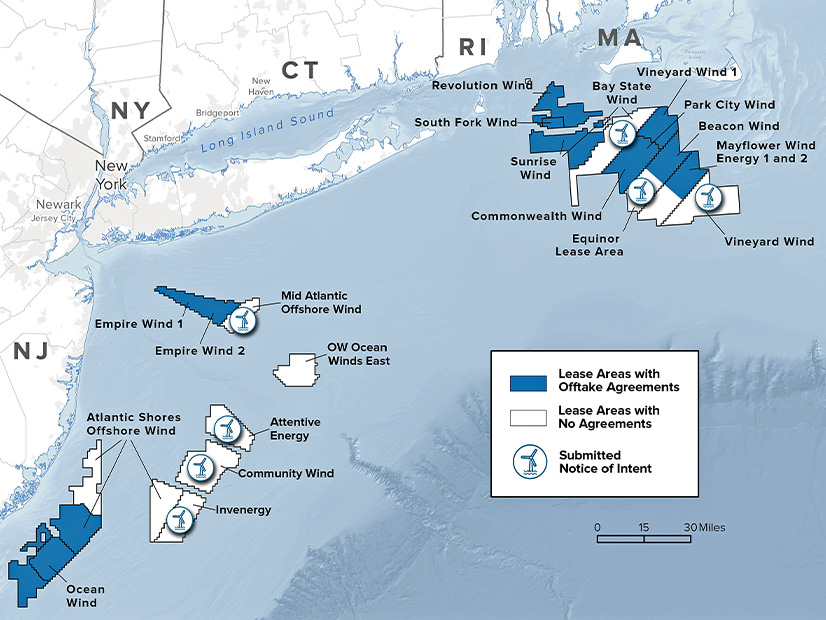

Notices of intent to submit proposals in this third solicitation were due Dec. 1. NYSERDA said it received notices from Attentive Energy, Bay State Wind, Beacon Wind, Community Offshore Wind, Invenergy Wind Offshore and Vineyard Offshore Wind.

Publicly announcing their intentions Thursday and Friday were:

- Vineyard Offshore, which proposed two projects — Excelsior and Liberty Wind — with a combined capacity of 2.6 GW. They would entail the largest investment to date in the U.S. supply chain infrastructure for the young offshore wind industry and provide more than $15 billion in direct economic benefits, Vineyard said. The proposal is backed by Copenhagen Infrastructure Partners, with is building Vineyard Wind I off Massachusetts in a 50/50 venture with Avangrid.

- Community Offshore Wind, a joint venture of RWE and National Grid Ventures, which said it would create more than 4,600 jobs, deliver more than $3 billion in economic benefits and collaborate with GE on the factories as it developed a 1.3-GW wind farm.

- Leading Light Wind, a partnership between Invenergy and energyRE, which proposed a wind farm generating up to 2.1 GW of power and offering up to $13.3 billion in economic benefits to the state. Leading Light noted that it is the only American-led wind developer in the New York Bight, and that the two partner firms are developing the $11 billion Clean Path NY transmission project with the New York Power Authority.

- Equinor and BP, already partners on Beacon Wind 1 and Empire Wind 1 and 2 off the New York coast, which submitted a proposal for a 1,360-MW installation in the Beacon Wind 2 lease area. In a news release Thursday, Equinor and BP said their plan would complement the 3.3-GW combined output of the three other wind farms and generate more than $11 billion in new economic activity statewide.

- Ørsted and Eversource, already partners on South Fork Wind and Sunrise Wind off the New York coast, which submitted multiple bids with different configurations. The common factor, according to the companies, would be billions of dollars in economic activity, strides for economic justice, prioritization of disadvantaged communities and minority- and women-owned businesses, and furtherance of the state’s climate goals. Ørsted and Eversource are also partners in Bay State Wind.