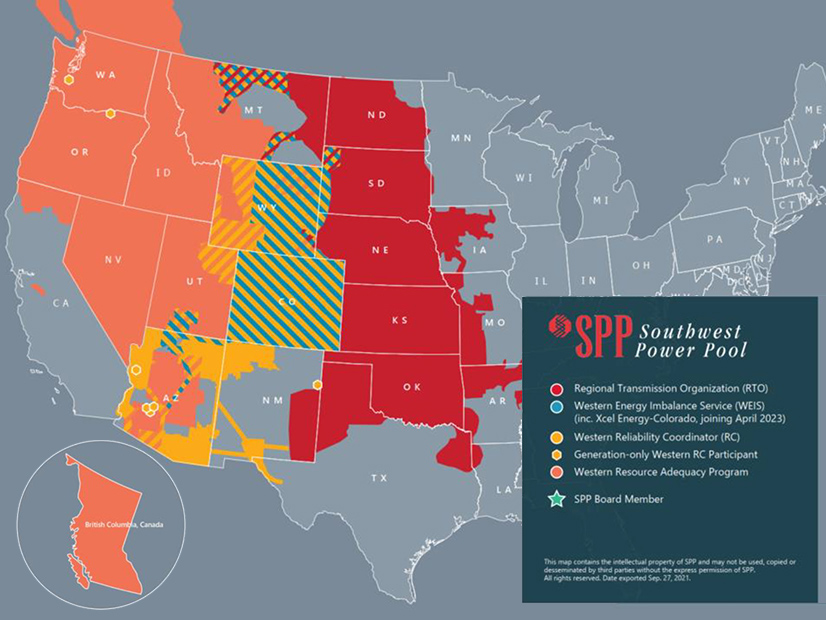

SPP continues to make a misnomer out of the "Southwest" portion of its name, expanding its beachhead in the Western Interconnection along several fronts.

SPP continues to make a misnomer out of its name. The Southwest Power Pool? Really?

In October, it added Canadian utility SaskPower as its first international member.

And this July, SPP’s board, state regulators and members will gather in St. Paul, Minn., for their quarterly meetings. After all, who wants to meet in Minnesota in January?

And of course, the grid operator continues to expand its beachhead in the Western Interconnection along several different fronts.

Focusing on the RTO’s stakeholder-driven culture as a counterweight to CAISO’s market buildout efforts, staff worked closely with potential Western stakeholders to finalize its Markets+ service offering. The document lays out the market’s governance structure and resource adequacy requirements that will, as SPP says, “ensure Western customers get the products and services they need at affordable rates they help control.” (See Governance, Resource Adequacy Key to SPP’s Markets+.)

“Without you at the table, we simply cannot develop the market the West wants: one that will serve Western needs with the governance that you value so much,” CEO Barbara Sugg told Western stakeholders in a holiday email.

The grid operator says Markets+ is a conceptual bundle of services that would centralize day-ahead and real-time unit commitment and dispatch, deploy hurdle-free transmission service across its footprint and reliably integrate renewable generation for utilities that aren’t yet ready to pursue full RTO membership.

Several Western organizations have already committed to funding the first development phase of Markets+ that establishes market rules and tariff language. SPP will engage through March with those utilities that have committed to funding Phase 1; staff have projected that will cost $9.7 million and take about 21 months.

Phase 2 will include the day-ahead market’s development. Based on SPP’s experience in building the Integrated Marketplace, staff has estimated the second phase will take three years and about $130 million to complete. Staff is assuming the market will be about a 50-GW system with up to 30 balancing authorities and 90 market participants.

Sugg said SPP has also seen a “growing interest” in full-scale RTO services. Seven participants in SPP’s Western Energy Imbalance Service (WEIS) market, which the grid operator has been administering on a contract basis since February 2021, have signed onto a plan to form a Western RTO — dubbed RTO West.

Western stakeholders are currently developing the RTO’s terms, with a review scheduled to wrap up by March. It would then take another two or three years to integrate those utilities into the system. The WEIS market will also welcome Xcel Energy-Colorado, among others, in April.

A Brattle Group study for the grid operator found that a Western RTO would produce approximately $49 million in savings annually for SPP’s current and new members. The Western utilities would receive $25 million a year in adjusted production cost savings and revenue from off-system sales, and SPP’s Eastern Interconnection members would benefit from $24 million in savings resulting from the expansion of the RTO’s market, transmission network and generation fleet.

SPP is also exploring a Markets+ transitional real-time balancing market, similar to the WEIS, that would launch in June 2024. A day-ahead balancing market would be developed at the same time and launch as soon as possible.

“Markets+ won’t exist in isolation,” Sugg said. “We certainly see opportunities to improve energy coordination within the East today, and we know California is a valuable trade partner in the West. Markets+ can optimize and improve the value of energy trading through carefully negotiated terms of coordination between peers across these seams.”

SPP will form a Markets+ seams committee early this year and will work closely with stakeholders to facilitate and advocate for seams coordination “that results in fair, equitable and value-added outcomes, Sugg said.

Already a NERC-certified reliability coordinator for 16 Western utilities, SPP will also provide program operator services for the Western Power Pool’s Western Resource Adequacy Program when it receives FERC approval. (See FERC IDs Deficiencies in Western RA Program.)

Meanwhile, in the East…

Sugg said SPP is well on its way to achieving many of its Aspire 2026 Strategic Plan initiatives, beyond expanding its service offerings in the West. It continues to improve and consolidate its transmission planning process, reduce the backlog in its interconnection queue, and define the grid of the future.

What the RTO was unable to do was find mutually beneficial interregional projects on its MISO seams. The grid operators’ staffs said in December they will not pursue any small projects that will relieve constrained flowgates. It was the fifth time the RTOs have come up empty after four fruitless joint studies last decade. (See MISO, SPP Unable to Find Smaller Joint Tx Projects.)

In the meantime, demand continues to grow. Staff said increased load assumptions could result in an almost $7 million over-recovery for the year. As it was, SPP set new records for summer and winter peak demand (53.2 GW on July 19 and 47.1 GW on Dec. 22). The highs were 4.2% and 7.9% increases over previous records.

Non-standard loads such as crypto miners, data centers, biofuel and alternative fuel manufacturers, and cannabis grow houses account for much of the growth. SPP said that, since June, it had received more than 7 GW of interconnection requests for the firm and non-firm load, some of which would be behind the meter.

Staff will begin the year attempting to secure approval of a mitigation strategy for load-responsible entities unable to meet the new 15% planning reserve margin (PRM). They could reduce the deficiency payment charge, extend the timeline to cure deficiencies or add mechanisms to assure capacity and make failure to meet the requirements “less costly or less punitive.”

The SPP board raised the PRM from 12% to 15%, effective Jan. 1. That left some members complaining they wouldn’t have enough time to meet the requirements. (See SPP Board, Regulators Side with Staff over Reserve Margin.)