Stored fuel levels appear unlikely to be a source of concern for the North American electric grid this winter, according to a member of the team developing NERC’s Winter Reliability Assessment.

Supplies of coal and natural gas are likely to be less of a concern for the North American electric grid this winter, according to a member of the team developing NERC’s 2023-2024 Winter Reliability Assessment (WRA).

Speaking at the ERO’s Preparation for Severe Cold Weather webinar on Thursday, Stephen Coterillo, an engineer with NERC’s Reliability Assessment department, previewed findings from this year’s WRA. The team has been working on the report since July.

NERC’s WRAs cover the months of December through February and typically are based on demand and generation availability forecasts provided by regional entities, utilities and other stakeholders. This year’s assessment also will include information gathered as part of the ERO’s first-ever Level 3 alert, which was issued this year after NERC’s Board of Directors approved it at its meeting in May. (See “ERO to Issue First Level 3 Alert May 15,” NERC Board of Trustees/MRC Briefs: May 10-11, 2023.)

Coterillo cautioned the team has not finished processing the data, but he told webinar attendees he could share some preliminary findings. These include the rising stockpiles of coal, which are “trending toward an adequate level,” and natural gas storage levels, which are above the five-year average for this point in the year. According to data from the Energy Information Administration, natural gas underground storage in the lower 48 states was more than 3,000 Bcf, higher than any year since 2017 except for 2019.

“This is definitely a welcome change from prior years, where supply chain issues, coupled with global supply concerns, caused lower inventory levels of stored coal and natural gas headed into the winter season,” Coterillo said.

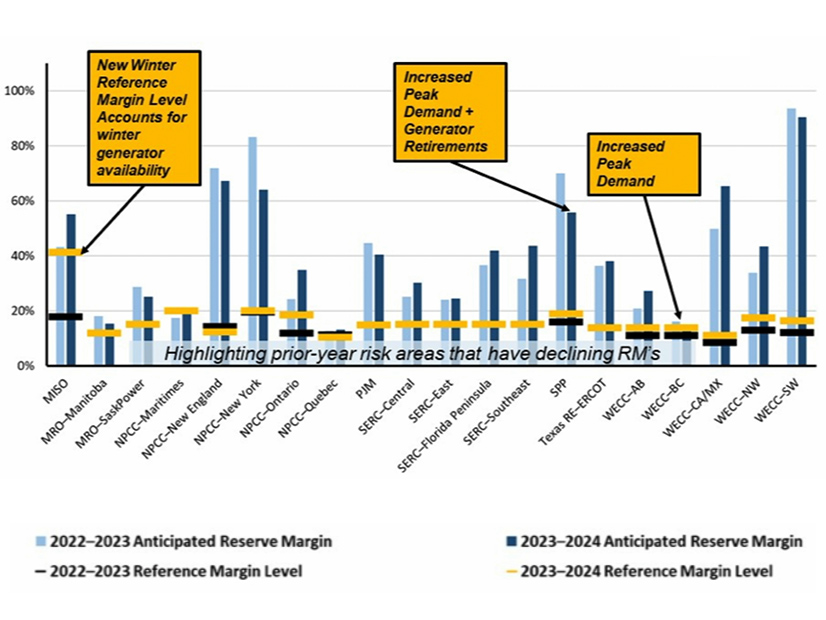

However, while the fuel levels are a welcome sign for the ERO overall, Coterillo also highlighted several areas of concern that will be featured in the upcoming report. First, several assessment areas — including Manitoba, SPP and British Columbia — reported their anticipated reserve margins have fallen from the previous year’s assessment.

In the case of British Columbia, the reduced reserve margin risks dropping below the area’s reference margin level, which, as in many assessment areas, is higher than last year’s. Coterillo attributed the declining reserve margins in SPP and other areas to increases in peak demand and generator retirements.

Coterillo also singled out MISO, which is projecting a significantly higher reference margin compared to last year, for comment. Noting the RTO has “recently re-evaluated the reference margin for cold weather operations,” Coterillo said MISO “opted for a higher [reference] margin to cover this impact for winters going forward.”

Finally, the team previewed its extreme condition risk analysis for the upcoming winter. The risk analysis is based on data provided by each assessment area, including their anticipated resources for the winter and projected maintenance outages and forced outages. The analysis then factors in a potential extreme low-generation scenario, as well as projected peak demand under both normal and extreme conditions, to identify any areas where resources may not be sufficient at some point during the season.

NERC plans to publish this year’s WRA in the middle of November.