Low-Cost Nuclear Power Reduces Electricity System Costs by $1.1B | Climate Action Council

Low-Cost Nuclear Power Reduces Electricity System Costs by $1.1B | Climate Action Council

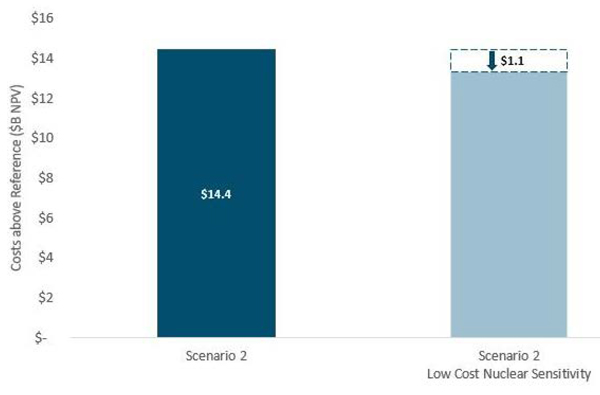

ALBANY, N.Y. — New York could reduce its decarbonization costs by $1.1 billion, an 8% cut, if forecasts of lower cost advanced nuclear reactors are realized, the New York State Energy Research and Development Authority told the Climate Action Council last week.

Carl Mas, director of NYSERDA’s Energy and Environmental Analysis Department, shared a sensitivity analysis during the Nov. 7 meeting that found that deploying 4 GW of small modular nuclear reactors in upstate zones A-F by 2050 could displace 12 GW of intermittent renewables and 5 GW of firm resources or battery storage under a low-cost nuclear scenario aided by new federal funding.

The low-cost scenario assumes 2030 capital costs of about $6,000/kW (2020 $) versus more than $9,000/kW under the high-cost scenario based on recent nuclear projects.

Proponents of advanced nuclear designs — such as the NuScale small modular reactor recently certified by the Nuclear Regulatory Commission — cite their passive safety features and potential economies of scale compared with traditional custom designs that have been prone to cost overruns. In addition to producing zero-emission electricity, such designs could be used in industrial process heat and hydrogen production.

New York’s four current reactors — Nine Mile Point units 1 and 2, James A. FitzPatrick and R. E. Ginna — total 3,358 MW of capacity and produced about one-quarter of the state’s in-state generation in 2021. Each of the plants has received license extensions from the NRC allowing them to run for a 60-year lifespan.

Prior analysis found the state’s electric system costs would increase by $9 billion on a net present value basis if the plants shut down after only 40 years. Their current license terms expire between 2029 and 2046.

Current installed nuclear capacity & contribution in New York State | Climate Action Council / 2022 Go

Current installed nuclear capacity & contribution in New York State | Climate Action Council / 2022 Go

Adding 4 GW of new nuclear capacity would more than double nuclear’s share of energy production from the current 31 terawatt hours. No new nuclear would be added under the high-cost scenario.

In both scenarios, Mas said, “a majority of the energy and installed capacity is from wind and solar in 2050.”

Nuclear’s competitiveness would be dependent on new lower-cost designs — aided by more than $2 billion in funding from the CHIPS and Science Act — and tax credits under the Inflation Reduction Act. The two bills represent a “significant ramp up” in federal investment in the technology, Mas said. (See A Nuclear Renaissance in the Making?)

Mas said transmission costs and a lack of operational flexibility could limit nuclear’s future role. “We could hypothesize that with more flexible new reactor designs, we might see nuclear playing a larger role,” he added. “If more transmission gets built for the whole system than what we modeled, you could see more energy flowing from upstate to downstate, and that could put a put additional economic value on upstate nuclear.”

The scenario assumes the technologies would not come online until at least 2040. The findings “reinforce the benefits of a more flexible policy framework that can adapt over time,” Mas said.

Low-Cost Nuclear Scenarios Adds 4GW by 2050 | Climate Action Council

Low-Cost Nuclear Scenarios Adds 4GW by 2050 | Climate Action Council

“We’re looking at least a decade for when these types of projects can get up and going,” he added. “Frankly, we just don’t know yet … since some of these new modules are only now being authorized.”

Bob Howarth, a professor at Cornell University, questioned the assumption that New York’s nuclear fleet possessed a 90% capacity accreditation factor (CAF), saying that Europe’s fleet average is “closer to 72 or 74% CAF.”

Mas responded that market signals under deregulation had led to a “substantial uptick in the utilization and CAFs of the nuclear fleet.”

Gavin Donohue, CEO of the Independent Power Producers of New York, commended the presentation, saying it highlighted how the state needs to be flexible and “keep the door open” to new technologies.

Paul Shepson, dean at Stony Brook University, asked whether nuclear waste disposal was incorporated into the cost estimates.

Mas responded that “there is an end-of-life assumption in terms of cost” and that, in the absence of national plan to manage spent fuel, the waste will be stored “in-place” at reactor sites.

Next Steps

Sarah Osgood, executive director of the CAC, said that remaining redlines of the council’s scoping plan will be circulated for consideration throughout the month ahead of a planned vote on the document on Dec. 19.

Climate protesters attending climate action council meets in Albany, N.Y. | © RTO Insider LLC

Climate protesters attending climate action council meets in Albany, N.Y. | © RTO Insider LLC

NYSERDA CEO Doreen Harris, the CAC’s co-chair, said the remaining meetings would be extended to four hours to accommodate the longer discussions that are expected as the council completes work on the plan.

The meeting on Dec. 5 would be used to reach final resolutions on outstanding items before the Dec. 19 vote.

Registration is open for the next Climate Justice Working Group meeting on Nov. 16.