Steve Huntoon | Steve Huntoon

Steve Huntoon | Steve Huntoon

Six years ago, I explained how regulators across the country were allowing electric utilities about 50% more return on equity than their actual cost of capital — amounting to roughly $17 billion in annual excessive costs to consumers. No more EEI cocktail parties for me.

I won’t repeat here the basis for that $17 billion, but if you’re interested, the excruciating detail is in that 2016 piece.[1] By the way, with the big increase in electric utility common equity over the last six years, that $17 billion would now be more like $25 billion today.[2] A mere bagatelle.

This being a subject that is not just dry but bone dry, no one seemed to care one way or the other. The band has just played on.

It’s Even Worse

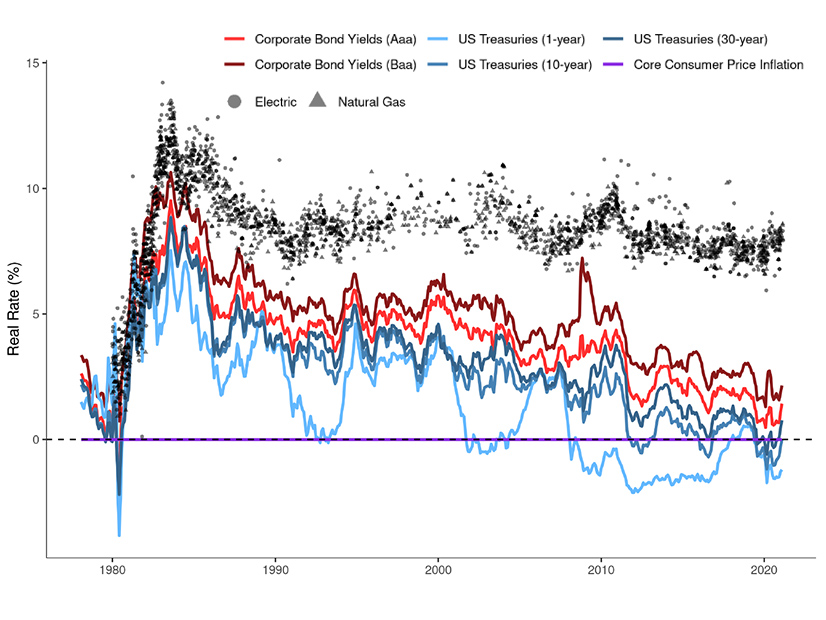

Now the Energy Institute at Haas has released a working paper by Karl Dunkle Werner and Stephen Jarvis showing that equity returns charged to consumers have remained the same while various measures of capital cost have declined.[3] Severin Borenstein’s excellent blog about the paper is here.[4] A killer chart from the paper is reprinted nearby.

In other words, as bad as the overcharging was when I wrote that piece six years ago, and as much as the overcharging has grown with more utility common equity, it’s even worse than that.

Wait, There’s More

Excess returns not only cause excess charges to consumers but have two other pernicious consequences. When utilities get a return on equity above their cost of equity, they have incentive to fight like cats and dogs to keep and expand their monopoly on rate base assets like transmission. Which they are doing at the state and federal levels — frustrating the competition that is an unalloyed good thing.[5]

And when utilities can get a return on equity above their cost of equity, they have incentive to construct the most expensive solution to address a given reliability violation (or other driver).[6] The Haas study actually found evidence of this: “The paper finds that every extra percentage point of allowed return on equity causes a utility’s capital rate base to expand by an extra 5% on average.”

If allowed equity return is set equal to the cost of equity capital then the utility should be indifferent to whether it or a competitor adds a given increment of transmission, and it would not have incentive to gold-plate the system. Don’t take my word for it; just ask your neighborhood economist.[7]

FERC, historically the most sophisticated utility regulator in the country, seems unaware of all this. Instead of reducing the cost of equity being charged to consumers and reducing pernicious incentives to frustrate competition and inflate rate base, FERC seems intent on increasing the future transmission infrastructure to be monopolized by incumbent transmission owners.[8] No competition from lower cost providers or incentive for lower cost solutions.

In my humble opinion, climate change won’t get fixed by throwing money at monopolies.

[2] My calculation was based on electric utility common equity of $356 billion then, which has now grown to $526 billion, https://www.eei.org/-/media/Project/EEI/Documents/Issues-and-Policy/Finance-And-Tax/Financial_Review/FinancialReview_2021.pdf, page 63.

[6] There are many potential solutions to a given reliability violation, as I’ve discussed before, https://energy-counsel.com/wp-content/uploads/2022/06/Transmission-and-Technology.pdf; https://www.energy-counsel.com/docs/waste-not-what-not.pdf.

[7] Or the Haas authors: “To the extent a utility’s approved ROE is higher than their actual cost of equity, they will have a too-strong incentive to have capital on their books.” https://haas.berkeley.edu/wp-content/uploads/WP329.pdf, page 21.

[8] Proposing a federal right of first refusal for transmission upgrades is Exhibit A. https://energy-counsel.com/wp-content/uploads/2022/07/Say-It-Ain-t-So-Joe.pdf. Eliminating generators’ right to pay for interconnection upgrade costs is Exhibit B. https://www.energy-counsel.com/docs/new-ball-and-chain-for-renewable-energy.pdf.